Xcel Energy 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

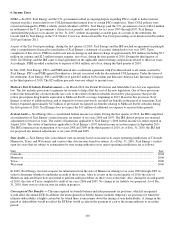

7. Preferred and Common Stock

Preferred Stock — Xcel Energy has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31, 2010 and

2009, Xcel Energy had six series of preferred stock outstanding, redeemable at its option at prices ranging from $102 to $103.75

per share plus accrued dividends. The holders of the $3.60 series preferred stock are entitled to three votes per each share held.

The holders of the other series of preferred stock are entitled to one vote per share. In the event dividends payable on the preferred

stock of any series outstanding is in arrears in an amount equal to four quarterly dividends, the holders of preferred stocks, voting

as a class, are entitled to elect the smallest number of directors necessary to constitute a majority of the Board of Directors. The

holders of common stock, voting as a class, are entitled to elect the remaining directors.

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31, 2010 and

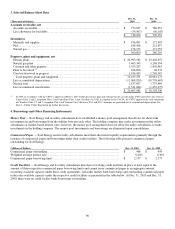

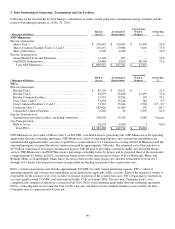

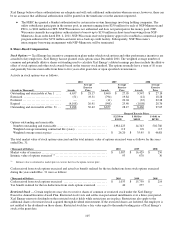

2009, there were no preferred shares of subsidiaries outstanding. The following table lists preferred shares by subsidiary:

Preferred

Shares

Authorized Par Value

Preferred

Shares

Outstanding

SPS .......................................................................... 10,000,000 $ 1.00 None

PSCo ......................................................................... 10,000,000 0.01 None

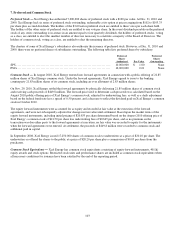

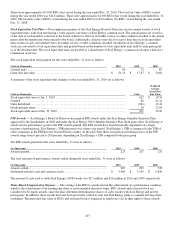

Common Stock — In August 2010, Xcel Energy entered into forward agreements in connection with a public offering of 21.85

million shares of Xcel Energy common stock. Under the forward agreements, Xcel Energy agreed to issue to the banking

counterparty 21.85 million shares of its common stock, including an over allotment of 2.85 million shares.

On Nov. 29, 2010, Xcel Energy settled the forward agreements by physically delivering 21.85 million shares of common stock

and receiving cash proceeds of $449.8 million. The forward price used to determine cash proceeds was calculated based on the

August 2010 public offering price of Xcel Energy’s common stock, adjusted for underwriting fees, as well as a daily adjustment

based on the federal funds rate less a spread of 0.50 percent, and a decrease to reflect the dividend paid on Xcel Energy’s common

stock in October 2010.

The equity forward instruments were accounted for as equity and recorded at fair value at the execution of the forward

agreements, and were not subsequently adjusted for changes in fair value until settlement. Based upon the market terms of the

equity forward instruments, including initial pricing of $20.855 per share determined based on the August 2010 offering price of

Xcel Energy’s common stock of $21.50 per share less underwriting fees of $0.645 per share, and as no premium on the

transaction was due either party to the forward agreements at execution, no fair value was recorded to equity for the instruments

when the forward agreements were entered. At settlement, the proceeds of $449.8 million were recorded to common stock and

additional paid in capital.

In September 2008, Xcel Energy issued 17,250,000 shares of common stock to underwriters at a price of $20.10 per share. The

underwriters re-offered the shares to the public at a price of $20.20 per share plus a commission of $0.05 per share from the

purchasers.

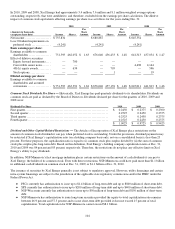

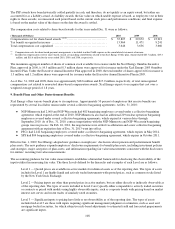

Common Stock Equivalents — Xcel Energy has common stock equivalents consisting of equity forward instruments, 401(k)

equity awards and stock options. Restricted stock units and performance shares are included as common stock equivalents when

all necessary conditions for issuance have been satisfied by the end of the reporting period.