Xcel Energy 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155

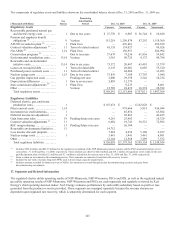

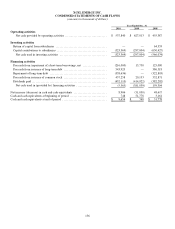

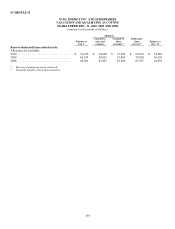

SCHEDULE I

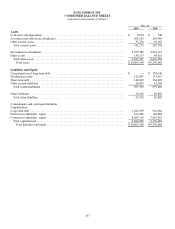

XCEL ENERGY INC.

CONDENSED STATEMENTS OF INCOME

(amounts in thousands, except per share data)

Year Ended Dec. 31

2010 2009 2008

Income

Equity earnings of subsidiaries ............................................ $ 818,212 $ 743,798 $ 708,943

Total income .......................................................... 818,212 743,798 708,943

Expenses and other deductions

Operating expenses ...................................................... 11,849 9,116 10,481

Other income ............................................................ (681) (1,295) (6,327)

Interest charges and financing costs ........................................ 112,510 101,118 114,341

Total expenses and other deductions ..................................... 123,678 108,939 118,495

Income from continuing operations before income taxes ....................... 694,534 634,859 590,448

Income tax benefit ......................................................... (57,422) (50,665) (55,272)

Income from continuing operations ........................................ 751,956 685,524 645,720

Income (loss) from discontinued operations, net of tax ........................ 3,878 (4,637) (166)

Net income ............................................................... 755,834 680,887 645,554

Dividend requirements on preferred stock .................................... 4,241 4,241 4,241

Earnings available to common shareholders .................................. $ 751,593 $ 676,646 $ 641,313

Weighted average common shares outstanding:

Basic ................................................................... 462,052 456,433 437,054

Diluted .................................................................. 463,391 457,139 441,813

Earnings per average common share — basic:

Income from continuing operations ........................................ $ 1.62 $ 1.49 $ 1.47

Income (loss) from discontinued operations ................................ 0.01 (0.01)

—

Earnings per share ..................................................... $ 1.63 $ 1.48 $ 1.47

Earnings per average common share — diluted:

Income from continuing operations ........................................ $ 1.61 $ 1.49 $ 1.46

Income (loss) from discontinued operations ................................ 0.01 (0.01)

—

Earnings per share ..................................................... $ 1.62 $ 1.48 $ 1.46

Cash dividends declared per common share ............................... $ 1.00 $ 0.97 $ 0.94