Xcel Energy 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

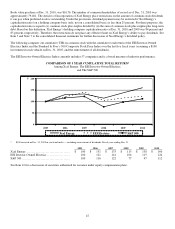

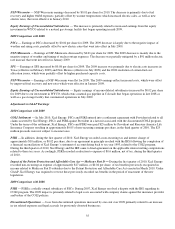

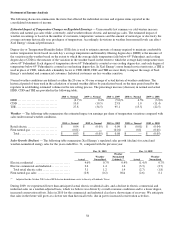

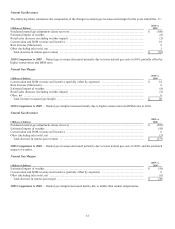

NSP-Wisconsin — NSP-Wisconsin earnings decreased by $0.01 per share for 2010. The decrease is primarily due to fuel

recovery and higher O&M expenses, partially offset by warmer temperatures which increased electric sales, as well as new

electric rates, that were effective in January 2010.

Equity Earnings of Unconsolidated Subsidiaries — The increase is primarily related to increased earnings from the equity

investment in WYCO related to a natural gas storage facility that began operating in mid-2009.

2009 Comparison with 2008

PSCo — Earnings at PSCo decreased by $0.04 per share for 2009. The 2009 decrease is largely due to the negative impact of

weather and rising costs, partially offset by new electric rates that went into effect in July 2009.

NSP-Minnesota — Earnings at NSP-Minnesota decreased by $0.01 per share for 2009. The 2009 decrease is mainly due to the

negative impact of weather and timing of nuclear outage expenses. The decrease was partially mitigated by a $91 million electric

rate increase that went into effect in January 2009.

SPS — Earnings at SPS increased by $0.08 per share for 2009. The 2009 increase was primarily due to electric rate increases in

Texas (effective in February 2009) and New Mexico (effective in July 2009) and the 2008 resolution of certain fuel cost

allocation issues, which were partially offset by higher purchased capacity costs.

NSP-Wisconsin — Earnings at NSP-Wisconsin were flat for 2009. The 2009 earnings reflect increased costs, which were offset

by improved fuel recovery and new rates which were effective in January 2009.

Equity Earnings of Unconsolidated Subsidiaries — Equity earnings of unconsolidated subsidiaries increased by $0.02 per share

for 2009 due to our investment in WYCO, which owns a natural gas pipeline in Colorado that began operations in late 2008 as

well as a gas storage facility that commenced operations in July 2009.

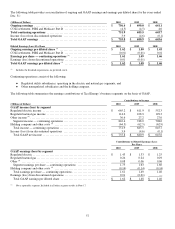

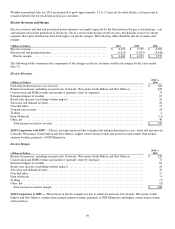

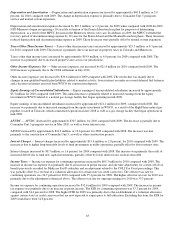

Adjustments to GAAP Earnings

2010 Comparison with 2009

COLI Settlement — In July 2010, Xcel Energy, PSCo and PSRI entered into a settlement agreement with Provident related to all

claims asserted by Xcel Energy, PSCo and PSRI against Provident in a lawsuit associated with the discontinued COLI program.

Under the terms of the settlement, Xcel Energy, PSCo and PSRI were paid $25 million by Provident and Reassure America Life

Insurance Company resulting in approximately $0.05 of non-recurring earnings per share, in the third quarter of 2010. The $25

million proceeds were not subject to income taxes.

PSRI — In addition, during the first quarter of 2010, Xcel Energy recorded a non-recurring tax and interest charge of

approximately $10 million, or $0.02 per share, due to an agreement in principle reached with the IRS following the completion of

a financial reconciliation of Xcel Energy’s statement of account dating back to tax year 1993, related to the COLI program.

During the third quarter of 2010, Xcel Energy and the IRS came to final agreement on the applicable interest netting computations

related to these tax years. Accordingly, PSRI recorded a reduction to expense of $0.6 million, net of tax, during the third quarter

of 2010.

Impact of the Patient Protection and Affordable Care Act — Medicare Part D — During the first quarter of 2010, Xcel Energy

recorded non-recurring tax expense of approximately $17 million, or $0.04 per share, of tax benefits previously recognized in

income related to Medicare Part D subsidies due to the Patient Protection and Affordable Care Act enacted in March 2010. Under

GAAP, Xcel Energy was required to reverse these previously recorded tax benefits in the period of enactment of the new

legislation.

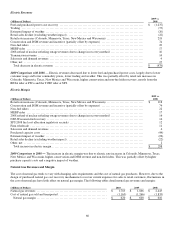

2009 Comparison with 2008

PSRI — PSRI is a wholly owned subsidiary of PSCo. During 2007, Xcel Energy resolved a dispute with the IRS regarding its

COLI program. The 2009 impact is primarily related to legal costs associated with company claims against the insurance provider

and broker of the COLI policies.

Discontinued Operations — Loss from discontinued operations increased by one cent over 2009 primarily related to an increase

in tax related expenses and legal accruals for previously divested businesses.