Xcel Energy 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

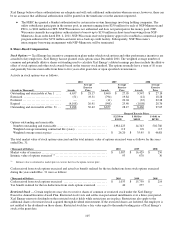

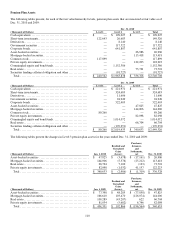

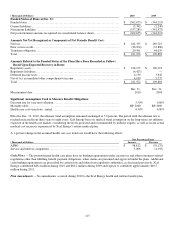

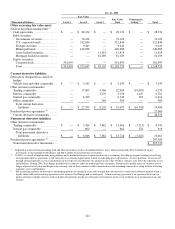

(Thousands of Dollars) 2010 2009

Funded Status of Plans at Dec. 31:

Funded status ........................................................................ $ (362,675) $ (344,213)

Current liabilities ..................................................................... (5,392) (2,240)

N

oncurrent liabilities ................................................................. (357,283) (341,973)

N

et postretirement amounts recognized on consolidated balance sheets.................... $ (362,675) $ (344,213)

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

N

et loss .............................................................................. $ 221,335 $ 189,743

Prior service credit .................................................................... (28,954) (33,886)

Transition obligation .................................................................. 29,591 44,035

Total ................................................................................ $ 221,972 $ 199,892

Amounts Related to the Funded Status of the Plans Have Been Recorded as Follows

Based Upon Expected Recovery in Rates:

Regulatory assets ..................................................................... $ 218,177 $ 190,172

Regulatory liabilities .................................................................. (6,423)

—

Deferred income taxes ................................................................ 4,159 3,943

N

e

t

-of-tax accumulated other comprehensive income.................................... 6,059 5,777

Total ................................................................................ $ 221,972 $ 199,892

Measurement date .................................................................... Dec. 31,

2010 Dec. 31,

2009

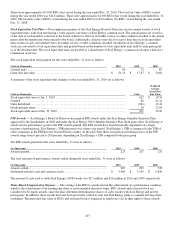

Significant Assumptions Used to Measure Benefit Obligations:

Discount rate for year-end valuation.................................................... 5.50% 6.00

%

Mortality table ....................................................................... RP 2000 RP 2000

Health care costs trend rate - initial..................................................... 6.50% 6.80

%

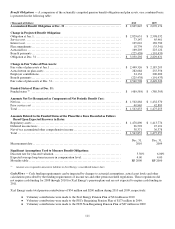

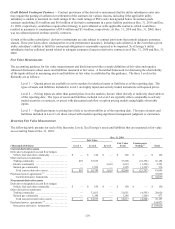

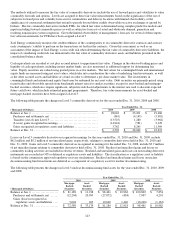

Effective Dec. 31, 2010, the ultimate trend assumption remained unchanged at 5.0 percent. The period until the ultimate rate is

reached increased from three years to eight years. Xcel Energy bases its medical trend assumption on the long-term cost inflation

expected in the health care market, considering the levels projected and recommended by industry experts, as well as recent actual

medical cost increases experienced by Xcel Energy’s retiree medical plan.

A 1-percent change in the assumed health care cost trend rate would have the following effects:

One Percentage Point

(Thousands of Dollars) Increase Decrease

APBO ..............................................................................

.

$ 98,812 $ (76,175)

Service and interest components ......................................................

.

5,006 (4,193)

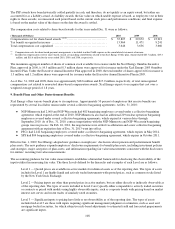

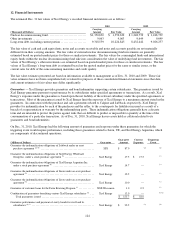

Cash Flows — The postretirement health care plans have no funding requirements under income tax and other retirement-related

regulations other than fulfilling benefit payment obligations, when claims are presented and approved under the plans. Additional

cash funding requirements are prescribed by certain state and federal rate regulatory authorities, as discussed previously. Xcel

Energy contributed $48.4 million during 2010 and $62.2 million during 2009 and expects to contribute approximately $40.5

million during 2011.

Plan Amendments — No amendments occurred during 2010 to the Xcel Energy health and welfare benefit plan.