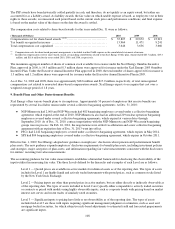

Xcel Energy 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

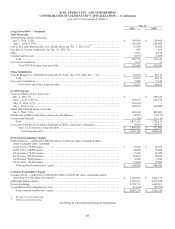

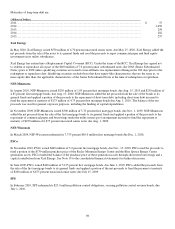

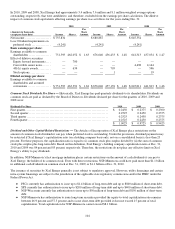

Maturities of long-term debt are:

(Millions of Dollars)

2011 .................................................................................................

.

$55

2012 .................................................................................................

.

1,059

2013 .................................................................................................

.

259

2014 .................................................................................................

.

282

2015 .................................................................................................

.

257

Xcel Energy

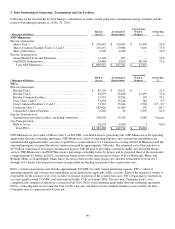

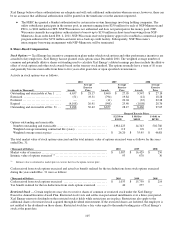

In May 2010, Xcel Energy issued $550 million of 4.70 percent unsecured senior notes, due May 15, 2020. Xcel Energy added the

net proceeds from the sale of the notes to its general funds and used the proceeds to repay commercial paper and fund equity

investments in its utility subsidiaries.

Xcel Energy has entered into a Replacement Capital Covenant (RCC). Under the terms of the RCC, Xcel Energy has agreed not

to redeem or repurchase all or part of the $400 million of 7.6 percent junior subordinated notes due 2068 (Junior Subordinated

Notes) prior to 2038 unless qualifying securities are issued to non-affiliates in a replacement offering in the 180 days prior to the

redemption or repurchase date. Qualifying securities include those that have equity-like characteristics that are the same as, or

more equity-like than, the applicable characteristics of the Junior Subordinated Notes at the time of redemption or repurchase.

NSP-Minnesota

In August 2010, NSP-Minnesota issued $250 million of 1.95 percent first mortgage bonds, due Aug. 15, 2015 and $250 million of

4.85 percent first mortgage bonds, due Aug. 15, 2040. NSP-Minnesota added the net proceeds from the sale of the bonds to its

general funds and applied a portion of the proceeds to the repayment of short-term debt, including short-term debt incurred to

fund the repayment at maturity of $175 million of 4.75 percent first mortgage bonds due Aug. 1, 2010. The balance of the net

proceeds was used for general corporate purposes, including the funding of capital expenditures.

In November 2009, NSP-Minnesota issued $300 million of 5.35 percent first mortgage bonds, due Nov. 1, 2039. NSP-Minnesota

added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a portion of the proceeds to the

repayment of commercial paper and borrowings under the utility money pool arrangement incurred to fund the repayment at

maturity of $250 million of 6.875 percent unsecured senior notes due Aug. 1, 2009.

NSP-Wisconsin

In March 2009, NSP-Wisconsin redeemed its 7.375 percent $65.0 million first mortgage bonds due Dec. 1, 2026.

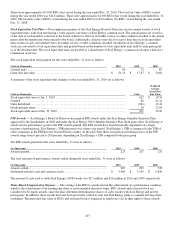

PSCo

In November 2010, PSCo issued $400 million of 3.2 percent first mortgage bonds, due Nov. 15, 2020. PSCo used the proceeds to

fund a portion of the $739 million purchase price of the Rocky Mountain Energy Center and the Blue Spruce Energy Center

generation assets. PSCo funded the balance of the purchase price of these generation assets through short-term borrowings and a

capital contribution from Xcel Energy. See Note 19 to the consolidated financial statements for further discussion.

In June 2009, PSCo issued $400 million of 5.125 percent first mortgage bonds, due June 1, 2019. PSCo added the proceeds from

the sale of the first mortgage bonds to its general funds and applied a portion of the net proceeds to fund the payment at maturity

of $200 million of 6.875 percent unsecured senior notes due July 15, 2009.

SPS

In February 2010, SPS redeemed its $25.0 million pollution control obligations, securing pollution control revenue bonds, due

July 1, 2016.