Xcel Energy 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

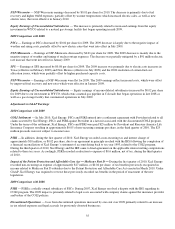

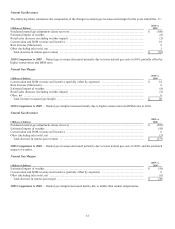

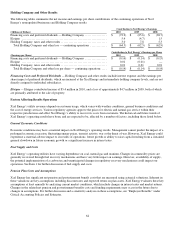

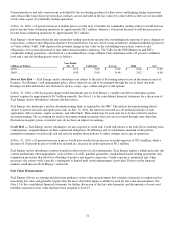

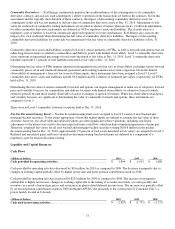

Depreciation and Amortization — Depreciation and amortization expenses increased by approximately $40.8 million, or 5.0

percent, for 2010 compared with 2009. The change in depreciation expense is primarily due to Comanche Unit 3 going into

service and normal system expansion.

Depreciation and amortization expenses decreased by $10.3 million, or 1.2 percent, for 2009 when compared with 2008. In 2009,

NSP-Minnesota began recognizing a 10-year life extension of the Prairie Island nuclear plant for purposes of determining

depreciation, as a result of the MPUC decision in the Minnesota electric rate case. In addition, in 2009, the MPUC extended the

recovery period of decommissioning expense by 10 years for the Prairie Island and the Monticello nuclear plants. These decisions

reduced depreciation and decommissioning expense in 2009. These decreases were partially offset by normal system expansion.

Taxes (Other Than Income Taxes) — Taxes (other than income taxes) increased by approximately $25.5 million, or 8.3 percent,

for 2010 compared with 2009. The increase is primarily due to an increase in property taxes in Colorado and Minnesota.

Taxes (other than income taxes) increased by approximately $19.9 million, or 6.9 percent, for 2009 compared with 2008. The

increase was primarily due to increased property taxes across our jurisdictions.

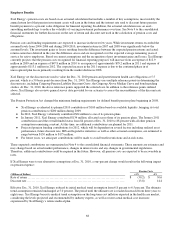

Other Income (Expense), Net — Other income (expense), net increased by $21.4 million for 2010 compared with 2009. The

2010 increase is primarily due to the COLI settlement in July 2010.

Other income (expense), net decreased by $30.6 million for 2009 compared with 2008. The net decline was mainly due to

changes in non-qualified benefit plan liabilities related to market activity, lower interest on under recovered deferred fuel balances

and a decrease in interest received from WYCO for construction deposits.

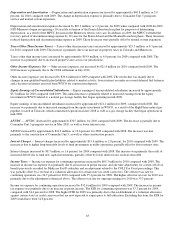

Equity Earnings of Unconsolidated Subsidiaries — Equity earnings of unconsolidated subsidiaries increased by approximately

$5.3 million for 2010 compared with 2009. The annual increase is primarily related to increased earnings from the equity

investment in WYCO related to a natural gas storage facility that began operating in mid-2009.

Equity earnings of unconsolidated subsidiaries increased by approximately $21.1 million for 2009, compared with 2008. The

increase was primarily due to increased earnings from the equity investment in WYCO, as a result of the High Plains natural gas

pipeline, located in Colorado, which commenced operations in late 2008 as well as a gas storage facility that began operations in

mid-2009.

AFUDC — AFUDC decreased by approximately $30.7 million, for 2010 compared with 2009. The decrease is partially due to

Comanche Unit 3 going into service in May 2010, as well as lower interest rates.

AFUDC increased by approximately $12.9 million, or 12.6 percent, for 2009 compared with 2008. The increase was due

primarily to the construction of Comanche Unit 3, as well as other construction projects.

Interest Charges — Interest charges increased by approximately $15.6 million, or 2.8 percent, for 2010 compared with 2009. The

increase is due to higher long-term debt levels to fund investments in utility operations, partially offset by lower interest rates.

Interest charges increased by $8.7 million, or 1.6 percent, for 2009 compared with 2008. The increase was primarily the result of

increased debt levels to fund new capital investments, partially offset by lower interest rates on short-term debt.

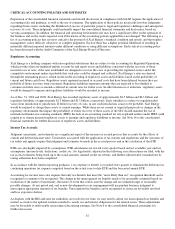

Income Taxes — Income tax expense for continuing operations increased by $65.3 million for 2010 compared with 2009. The

increase in income tax expense was primarily due to an increase in pretax income, and one time adjustments for a write-off of tax

benefit previously recorded for Medicare Part D subsidies and an adjustment related to the COLI Tax Court proceedings. This

was partially offset by a reversal of a valuation allowance for certain state tax credit carryovers. The effective tax rate for

continuing operations was 36.7 percent for 2010 compared with 35.1 percent for 2009. The higher effective tax rate for 2010 was

primarily due to the adjustments referenced above. The effective tax rate for ongoing earnings for 2010 was 35.3 percent.

Income tax expense for continuing operations increased by $32.6 million for 2009 compared with 2008. The increase in income

tax expense was primarily due to an increase in pretax income. The ETR for continuing operations was 35.1 percent for 2009,

compared with 34.4 percent for 2008. The higher ETR for 2009 was primarily due to the establishment of a valuation allowance

against certain state tax credit carryovers that are now expected to expire prior to full utilization. Excluding this item, the ETR for

2009 would have been 34.6 percent.