Xcel Energy 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

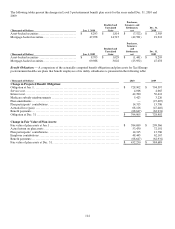

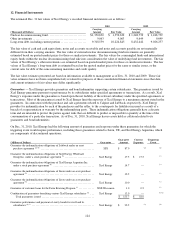

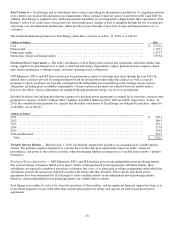

12. Financial Instruments

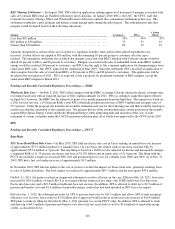

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments are as follows:

2010 2009

(Thousands of Dollars) Carrying

Amount Fair Value Carrying

Amount Fair Value

N

uclear decommissioning fund .............................

.

$1,350,630 $ 1,350,630 $ 1,248,739 $ 1,248,739

Other investments .........................................

.

9,063 9,063 9,649 9,649

Long-term debt, including current portion ...................

.

9,318,559 10,224,845 8,432,442 9,026,257

The fair value of cash and cash equivalents, notes and accounts receivable and notes and accounts payable are not materially

different from their carrying amounts. The fair value of external nuclear decommissioning fund investments are generally

estimated based on quoted market prices for those or similar investments. The fair values for commingled funds and international

equity funds within the nuclear decommissioning fund take into consideration the value of underlying fund investments. The fair

values of Xcel Energy’s other investments are estimated based on quoted market prices for those or similar investments. The fair

values of Xcel Energy’s long-term debt is estimated based on the quoted market prices for the same or similar issues, or the

current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2010 and 2009. These fair

value estimates have not been comprehensively revalued for purposes of these consolidated financial statements since that date,

and current estimates of fair values may differ significantly.

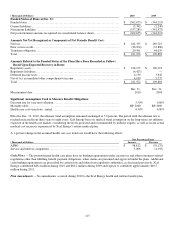

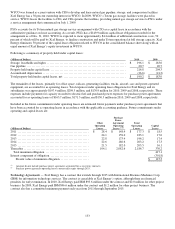

Guarantees — Xcel Energy provides guarantees and bond indemnities supporting certain subsidiaries. The guarantees issued by

Xcel Energy guarantee payment or performance by its subsidiaries under specified agreements or transactions. As a result, Xcel

Energy’s exposure under the guarantees is based upon the net liability of the relevant subsidiary under the specified agreements or

transactions. Most of the guarantees issued by Xcel Energy limit the exposure of Xcel Energy to a maximum amount stated in the

guarantees. In connection with the purchase and sale agreements related to Calpine and Lubbock, respectively, Xcel Energy

provides for indemnification by each of the purchaser and the seller, to the counterparty for liabilities incurred as a result of a

breach of a representation or warranty by the indemnifying party. These indemnification obligations generally have a discrete

term and are intended to protect the parties against risks that are difficult to predict or impossible to quantify at the time of the

consummation of a particular transaction. As of Dec. 31, 2010, Xcel Energy has no assets held as collateral related to its

guarantees and bond indemnities.

On Dec. 31, 2010, Xcel Energy had the following amount of guarantees and exposure under these guarantees for which the

triggering event would require performance, including those guarantees related to Seren, UE, and Xcel Energy Argentina, which

are components of discontinued operations:

(Millions of Dollars) Guarantor Guarantee

Amount Current

Exposure Triggering

Event

Guarantee the indemnification obligations of Lubbock under an asset

purchase agreement (g) (h) .........................................

.

SPS $ 87.0 (g) (g)

Guarantee the indemnification obligations of Xcel Energy Wholesale

Group Inc. under a stock purchase agreement (h) ......................

.

Xcel Energy 17.5 $ 17.5 (c)

Guarantee the indemnification obligations of Xcel Energy Argentina Inc.

under a stock purchase agreement (h) ...............................

.

Xcel Energy 14.7

—

(c)

Guarantee the indemnification obligations of Seren under an asset purchase

agreement (h) ...................................................

.

Xcel Energy 12.5

—

(c)

Guarantee the indemnification obligations of Seren under an asset purchase

agreement (h) ...................................................

.

Xcel Energy 10.0

—

(c)

Guarantee of customer loans for the Farm Rewiring Program

(

e

)

...........

.

NSP-Wisconsin 1.0 0.5

(

e

)

Combination of guarantees benefiting various Xcel Energy subsidiaries

(h)

..

.

Xcel Energy 13.0

—

(b)

(

c

)

Total guarantees issued ........................................

.

$ 155.7 $ 18.0

Guarantee performance and payment of surety bonds for itself and its

subsidiaries (f) (i) ................................................

.

Xcel Energy $ 32.5 (a) (d)