Xcel Energy 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

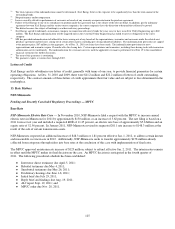

REC Sharing Settlement — In August 2009, PSCo filed an application seeking approval of treatment of margins associated with

sales of Colorado RECs that are bundled with energy into California. In January 2010, PSCo, the OCC, the CPUC staff, the

Colorado Governor’s Energy Office and Western Resource Advocates entered into a unanimous settlement in this case. The

settlement establishes a pilot program and defines certain margin splits during this pilot period. The settlement provides that

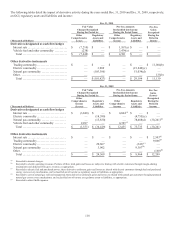

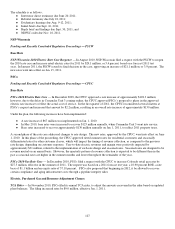

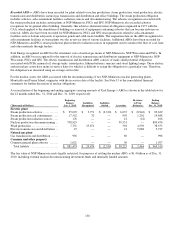

margins would be shared based on the following allocations:

Margin Customers PSCo Carbon

Offsets

Less than $10 million ...................................................... 50% 40% 10

%

$10 million to $30 million .................................................. 55 35 10

Greater than $30 million .................................................... 60 30 10

Amounts designated as carbon offsets are recorded as a regulatory liability until carbon offset-related expenditures are

incurred. Carbon offsets are capped at $10 million, with the remaining 10 percent going to customers after the cap is

reached. The unanimous settlement also clarified that margins associated with RECs bundled with Colorado energy would be

shared 20 percent to PSCo and 80 percent to customers. Margins associated with sales of unbundled stand-alone RECs without

energy would be credited 100 percent to customers, and PSCo has the right to file a separate application for sharing margins from

stand-alone REC sales. The CPUC approved the settlement in May 2010. Since the settlement, PSCo has filed an application to

share margins from the sales of stand alone RECs at 20 percent to PSCo and 80 percent to customers. The application will be

decided in the first quarter of 2011. PSCo is expected to file a proposal for permanent treatment of REC margins, except the

stand-alone REC margins in March 2011.

Pending and Recently Concluded Regulatory Proceedings — FERC

Wholesale Rate Case — On Feb. 8, 2011, PSCo filed a request with the FERC to change Colorado wholesale electric customer rates

to formula based rates with an expected increase of $16.1 million annually for 2011. PSCo is seeking to make the request effective

in April 2011; however, the FERC has the authority to grant a five month suspension from the April date. The request was based on

a 2011 forecast test year, a 10.9 percent ROE, a total PSCo wholesale production rate base of $407.4 million and an equity ratio of

57.1 percent. Under the proposal, the formula rate would be estimated each year for the following year and then would be trued up to

actual costs after the conclusion of the calendar year. The primary drivers of the revenue deficiency are the inclusion of the recently

acquired Blue Spruce Energy Center and Rocky Mountain Energy Center generating units and inclusion of the costs of early

retirement of certain coal plants under the CACJA emissions reduction plan, all of which were approved by the CPUC in late 2010.

SPS

Pending and Recently Concluded Regulatory Proceedings — PUCT

Base Rate

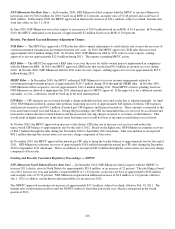

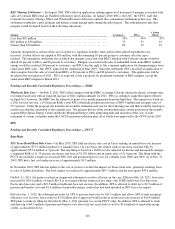

SPS Texas Retail Base Rate Case — In May 2010, SPS filed an electric rate case in Texas seeking an annual base rate increase

of approximately $71.5 million inclusive of franchise fees. On a net basis, the request seeks to increase customer bills by

approximately $53.4 million or 7 percent. The rate filing is based on a 2009 test year adjusted for known and measurable changes,

a requested ROE of 11.35 percent, an electric rate base of $1.031 billion and an equity ratio of 51.0 percent. The filing with the

PUCT also includes a request to reconcile SPS’ fuel and purchased power costs for calendar years 2008 and 2009. As of Dec. 31,

2009, SPS had a fuel cost under-recovery of approximately $3.3 million.

In November 2010, SPS filed an update to the cost of service to reflect the impact on Texas retail rates, primarily resulting from

its sale of Lubbock facilities. The total request was reduced to approximately $63.7 million and the net request $47.6 million.

On Feb. 11, 2011, the parties reached an unopposed settlement to resolve all issues in the case. Effective Feb. 16, 2011, base rates

increased by $39.4 million, of which $16.9 is associated with the transfer of two riders, the TCRF and Power Cost Recovery

Factor into base rates and a $22.5 million traditional base rate increase. In addition, SPS is allowed to defer up to $2.3 million of

pension and benefit costs and $1.6 million of renewable energy credits that had been included in SPS’ base rate request.

Effective Jan. 1, 2012, the settlement provides for SPS to increase base rates by $13.1 million and allows SPS to seek an energy

efficiency cost recovery factor rider for $2.9 million that if approved would result in an effective rate increase of $16.0 million.

SPS plans to make its filing for the rider by May 1, 2011 pursuant to a recent PUCT order. In addition, SPS is allowed to track

and defer up to $4.3 million of pension and benefit costs above the test year levels as well as $1.6 million of renewable energy

credits, as described above.