Xcel Energy 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

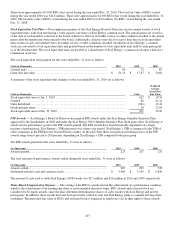

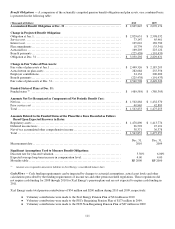

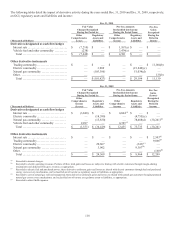

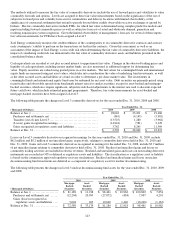

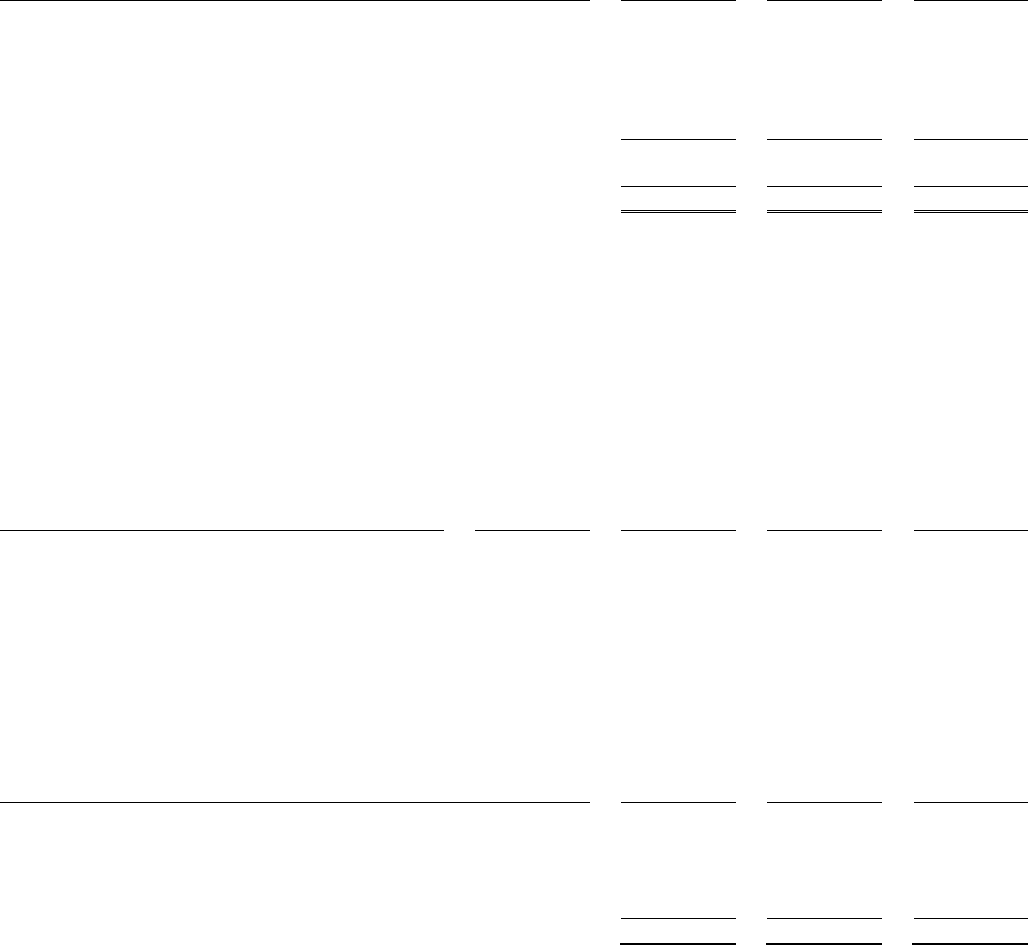

Benefit Costs — The components of net periodic postretirement benefit costs are:

(Thousands of Dollars) 2010 2009 2008

Service cost ......................................................... $ 4,006 $ 4,665 $ 5,350

Interest cost ......................................................... 42,780 50,412 51,047

Expected return on plan assets ........................................ (28,529) (22,775) (31,851)

Amortization of transition obligation .................................. 14,444 14,444 14,577

Amortization of prior service cost ..................................... (4,932) (2,726) (2,175)

Amortization of net loss .............................................. 11,643 19,329 11,498

Net periodic postretirement benefit cost ............................. 39,412 63,349 48,446

Additional cost recognized due to effects of regulation.................. 3,891 3,891 3,891

Net benefit cost recognized for financial reporting .................... $ 43,303 $ 67,240 $ 52,337

Significant Assumptions Used to Measure Costs:

Discount rate ........................................................ 6.00% 6.75% 6.25

%

Expected average long-term rate of return on assets (before tax) ......... 7.50 7.50 7.50

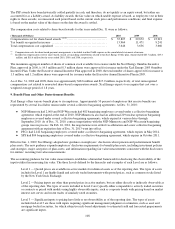

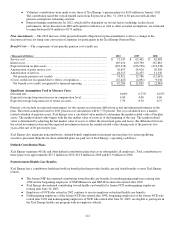

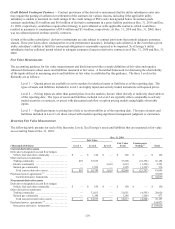

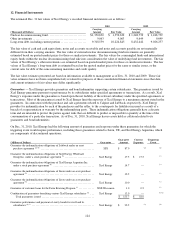

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

(Thousands of Dollars)

Projected

Pension

Benefit

Payments

Gross

Projected

Postretirement

Health Care

Benefit

Payments

Expected

Medicare

Part D

Subsidies

Net Projected

Postretirement

Health Care

Benefit

Payments

2011 ............................................... $ 254,426 $ 59,752 $ 4,770 $ 54,982

2012 ............................................... 247,156 60,230 5,126 55,104

2013 ............................................... 249,908 60,607 5,475 55,132

2014 ............................................... 257,886 61,833 5,773 56,060

2015 ............................................... 259,978 63,184 6,061 57,123

2016-2020 ......................................... 1,338,658 325,154 34,115 291,039

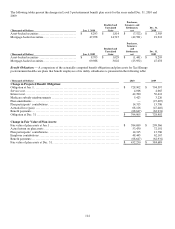

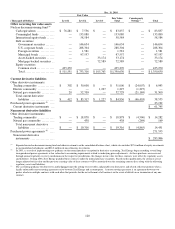

10. Other Income, Net

Other income (expense), net, for the years ended Dec. 31 consisted of the following:

(Thousands of Dollars) 2010 2009 2008

Interest income ...................................................... $ 11,023 $ 14,928 $ 29,753

COLI settlement (See Note 6) ........................................ 25,000

—

—

Other nonoperating income ........................................... 1,689 3,650 6,320

Insurance policy (expenses) income ................................... (6,529) (8,646) 4,337

Other nonoperating expenses ......................................... (40) (161) (4)

Other income, net .................................................. $ 31,143 $ 9,771 $ 40,406

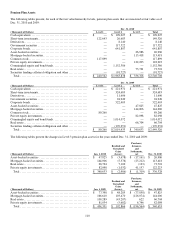

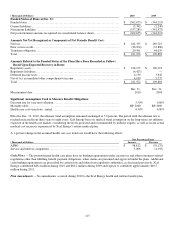

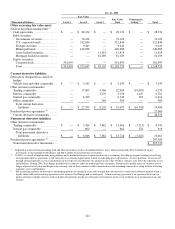

11. Derivative Instruments and Fair Value Measurements

Xcel Energy and its utility subsidiaries enter into derivative instruments, including forward contracts, futures, swaps and options,

for trading purposes and to reduce risk in connection with changes in interest rates, utility commodity prices and vehicle fuel

prices, as well as variances in forecasted weather.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term wholesale

and commodity trading activities, including the purchase and sale of electric capacity, energy and energy-related instruments.

Xcel Energy’s risk management policy allows management to conduct these activities within guidelines and limitations as

approved by its risk management committee, which is made up of management personnel not directly involved in the activities

governed by this policy.