Xcel Energy 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

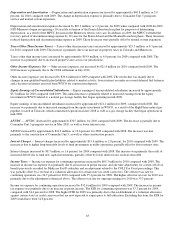

● Cost Estimate with Spent Fuel Disposal — Federal regulations require the DOE to provide a permanent repository for

the storage of spent nuclear fuel. NSP-Minnesota has funded its portion of the DOE’s permanent disposal program since

1981. The spent fuel storage assumptions have a significant influence on the decommissioning cost estimate. The manner

in which spent nuclear fuel is managed and the assumptions used to develop cost estimates of decommissioning

programs have a dramatic impact, which in turn can have a corresponding impact on the resulting accrual.

The decommissioning calculation covers all expenses, including decontamination and removal of radioactive material, and

extends over the estimated lives of the plants. The total obligation for decommissioning currently is expected to be funded

100 percent by a portion of the rates charged to customers, as approved by the MPUC and other commissions. Decommissioning

expense recoveries are based upon the same assumptions and methodologies as the fair value obligations are recorded.

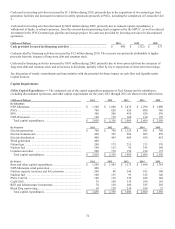

In addition to these assumptions discussed previously, assumptions related to future earnings of the nuclear decommissioning

fund are utilized by the MPUC in determining the recovery of decommissioning costs. Through utilization of the annuity

approach, an assumed rate of return on funding is calculated which provides the earnings rate. With a long period of

decommissioning and a funding period over the operating lives of each facility, the ability of the fund to sustain the required

payments after inflation while assuring the appropriate investment structure is critical for meeting future decommissioning

obligations. Currently, an assumption that the external funds will earn a return of 6.3 percent, after tax, is utilized when setting

recovery by the MPUC.

Significant uncertainties exist in estimating the future cost of decommissioning including the method to be utilized, the ultimate

costs to decommission, and the planned treatment of spent fuel. Materially different results could be obtained if different

assumptions were utilized. Currently, our estimates of future decommissioning costs and the obligation to retire the plants have a

significant impact to our financial position. The amounts recorded for AROs and regulatory assets for unrecovered costs are

$969.3 million and $150.9 million, respectively, as of Dec. 31, 2010, and $881.5 million and $207.0 million, respectively, as of

Dec. 31, 2009. If different cost estimates, shorter life assumptions or different cost escalation rates were utilized, this ARO and

the unrecovered balance in regulatory assets could change materially. If future earnings on the decommissioning fund are lower

than those estimated currently, future decommissioning recoveries would need to increase. The significance to our results of

operations is reduced due to the fact that we record decommissioning expense based upon recovery amounts approved by our

regulators. This treatment reduces the volatility of expense over time. The difference between regulatory funding (including both

depreciation expense less returns from the investments fund) and amounts recorded under current accounting guidance are

deferred as a regulatory asset. See Note 15 to the consolidated financial statements for further discussion.

Xcel Energy continually makes judgments and estimates related to these critical accounting policy areas, based on an evaluation

of the varying assumptions and uncertainties for each area. The information and assumptions underlying many of these judgments

and estimates will be affected by events beyond the control of Xcel Energy, or otherwise change over time. This may require

adjustments to recorded results to better reflect the events and updated information that becomes available. The accompanying

financial statements reflect management’s best estimates and judgments of the impact of these factors as of Dec. 31, 2010. See

Note 1 to the consolidated financial statements for further discussion.

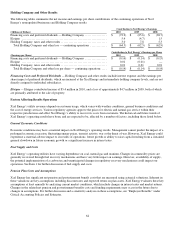

Recent and Pending Accounting Changes

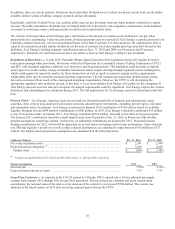

Consolidation of Variable Interest Entities — In June 2009, the FASB issued new guidance on consolidation of variable interest

entities. The guidance affects various elements of consolidation, including the determination of whether an entity is a variable

interest entity and whether an enterprise is a variable interest entity’s primary beneficiary. These updates to the ASC were

effective for interim and annual periods beginning after Nov. 15, 2009. Xcel Energy implemented the guidance on Jan. 1, 2010,

and the implementation did not have a material impact on its consolidated financial statements. See Note 14 to the consolidated

financial statements for further discussion and required disclosures regarding variable interest entities.

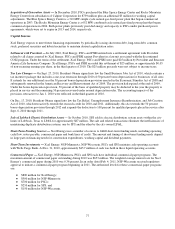

Fair Value Measurement Disclosures — In January 2010, the FASB issued Fair Value Measurements and Disclosures

(Topic 820) — Improving Disclosures about Fair Value Measurements (ASU No. 2010-06), which updates the Codification to

require new disclosures for assets and liabilities measured at fair value. The requirements include expanded disclosure of

valuation methodologies for fair value measurements, transfers between levels of the fair value hierarchy, and gross rather than

net presentation of certain changes in Level 3 fair value measurements. The updates to the Codification contained in ASU

No. 2010-06 were effective for interim and annual periods beginning after Dec. 15, 2009, except for requirements related to gross

presentation of certain changes in Level 3 fair value measurements, which are effective for interim and annual periods beginning

after Dec. 15, 2010. Xcel Energy implemented the portions of the guidance required on Jan. 1, 2010, and the implementation did

not have a material impact on its consolidated financial statements. See Note 11 to the consolidated financial statements for

further discussion and required disclosures.