Xcel Energy 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.130

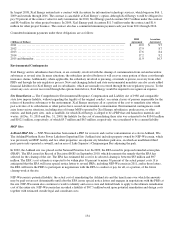

14. Commitments and Contingent Liabilities

Commitments

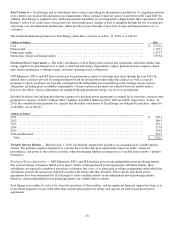

Capital Commitments — As of Dec. 31, 2010, the estimated cost of capital expenditure programs of Xcel Energy and its

subsidiaries is approximately $2.45 billion in 2011, $2.35 billion in 2012, $3.0 billion in 2013, $2.8 billion in 2014 and $2.55

billion in 2015. Xcel Energy’s capital forecast includes the following major projects:

Nuclear Capacity Increases and Life Extension — NSP-Minnesota is seeking a 20-year license renewal for the Prairie Island

nuclear plant. A renewed operating license was approved and issued for Monticello by the NRC in November 2006 licensing the

plant to operate until 2030, and the MPUC order approving the spent fuel storage capacity needed to support plant operations until

2030 went into effect in June 2007. The application to renew Prairie Island’s operating licenses was submitted to the NRC in

April 2008 and a final decision is expected in early 2011. The application for a CON for additional spent fuel storage capacity to

support 20 additional years of plant operation was approved by the MPUC in December 2009.

NSP-Minnesota is pursuing capacity increases of Monticello and Prairie Island that will total approximately 235 MW, to be

implemented, if approved, between 2010 and 2015. Total capital investment between 2011 and 2015 for these activities is

estimated to be approximately $725 million to bring the total investment to over $1 billion. The MPUC approved the Monticello

power uprate CON and site permit in December 2008 and the Prairie Island power uprate CON and site permit in December 2009.

The filing for the Monticello power uprate was placed on hold by the NRC staff to address concerns raised by the ACRS related

to containment pressure associated with pump performance. NSP-Minnesota is working with the NRC to determine whether it

needs to supplement its filing as necessary to address the issues and expects to complete the license proceeding in 2011. NSP-

Minnesota cannot file for NRC approval of the extended power uprate for Prairie Island until after the NRC renews the plants’

current operating licenses. A decision is expected in 2011. The extended power uprates are scheduled to be implemented during

the 2014 and 2015 refueling outages.

Wind Generation — NSP-Minnesota invested approximately $500 million in wind generation through 2010 and expects to invest

an additional $400 million in 2011. The 201 MW Nobles Wind Project in southwestern Minnesota began commercial operations

in 2010 and the 150 MW Merricourt Wind Project in southeastern North Dakota is expected to reach commercial operation in

2011. NSP-Minnesota received regulatory approval for these projects, and has requested recovery of eligible costs, which began

in 2010.

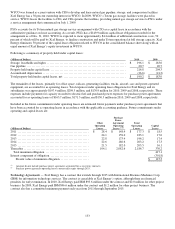

CapX2020 — In 2006, CapX2020, an alliance of electric cooperatives, municipals and investor-owned utilities in the upper

Midwest, including Xcel Energy, announced that it had identified several groups of transmission projects that proposed to be

complete by 2020. Group 1 project investments are expected to total approximately $1.9 billion. Major construction began in

2010 on two of the four Group 1 projects, with the in-service date of the last project expected to be in 2015. Xcel Energy’s

investment is expected to be approximately $1.0 billion depending on the routes and configurations approved by affected state

commissions. The remainder of the costs will be born by other utilities in the upper Midwest. Approximately 75 percent of the

2010 capital expenditures and return on investment for transmission projects are expected to be recovered under an NSP-

Minnesota TCR tariff rider mechanism authorized by Minnesota legislation, as well as a similar TCR mechanism passed in South

Dakota. Cost-recovery by NSP-Wisconsin is expected to occur through the biennial PSCW rate case process.

Black Dog Repowering — NSP-Minnesota is proposing construction over the next five years to repower the Black Dog plant in

Burnsville, Minn. The $585 million project will replace the remaining coal-fired units and install approximately 680 MW of

natural gas generation in 2016. The new gas-fired generation is a combined-cycle facility consisting of two combustion turbines

and one steam turbine.

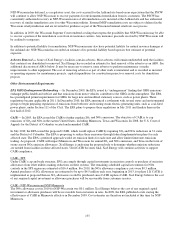

CACJA — The CACJA was signed into law in April 2010. The CACJA aims to reduce annual emissions of NOx by at least 70 to

80 percent or greater from 2008 levels by 2017 from the coal fired generation identified in the plan. The total cost of the plan

would result in new construction of approximately $1.0 billion over the next seven years.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions,

legislative initiatives, reserve margins, the availability of purchased power, alternative plans for meeting Xcel Energy’s long-term

energy needs, compliance with future requirements and RPS to install emission-control equipment, and merger, acquisition and

divestiture opportunities to support corporate strategies may impact actual capital requirements.