United Airlines 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

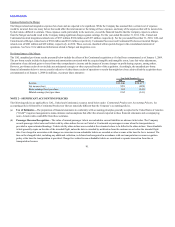

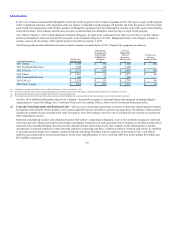

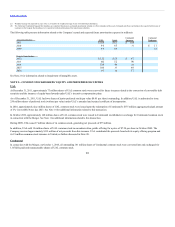

(l) The Company has finite-lived and indefinite-lived intangible assets, including goodwill. As of December 31, 2011, goodwill represents

the excess purchase price over the fair values of tangible and identifiable intangible assets acquired and liabilities assumed from Continental in the

Merger. Finite-lived intangible assets are amortized over their estimated useful lives. Goodwill and indefinite-lived intangible assets are not amortized but

are reviewed for impairment annually or more frequently if events or circumstances indicate that the asset may be impaired. Goodwill and indefinite-

lived assets are reviewed for impairment on an annual basis as of October 1, or on an interim basis whenever a triggering event occurs.

In addition to indefinite-lived intangible assets being recorded at the UAL level, such asset values are allocated to Continental and United for their

separate company reporting. In most cases, these indefinite-lived assets are separately associated with and directly assignable to a specific separate

company. In cases where the asset is shared between the companies, a prorate allocation was performed based on historical financial and operating

measures. This resulted in a fair value allocation of such assets to Continental and United of 44% and 56%, respectively. Any impairment charges

resulting from the testing of the fair values of these indefinite-lived intangible assets are also assigned to the applicable company using the same

methodology; the impairment charge is recognized at the company to which the asset is assigned. See Notes 4 and 21 for additional information related to

intangibles, including impairments recognized in 2011, 2010 and 2009.

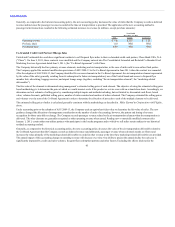

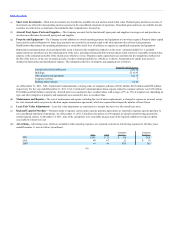

(m) The Company evaluates the carrying value of long-lived assets and intangible assets subject to amortization

whenever events or changes in circumstances indicate that an impairment may exist. For purposes of this testing, the Company has generally identified

the aircraft fleet type as the lowest level of identifiable cash flows for purposes of testing aircraft for impairment. An impairment charge is recognized

when the asset’s carrying value exceeds its net undiscounted future cash flows and its fair market value. The amount of the charge is the difference

between the asset’s carrying value and fair market value. See Note 21 for information related to asset impairments recognized in 2010 and 2009.

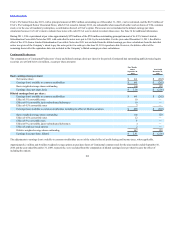

(n) The Company measures the cost of employee services received in exchange for an award of equity instruments based

on the grant-date fair value of the award. The resulting cost is recognized over the period during which an employee is required to provide service in

exchange for the award, usually the vesting period. Obligations for cash-settled restricted stock units are remeasured at fair value throughout the requisite

service period on the last day of each reporting period based upon the Company’s stock price. In addition to the service requirement, cash-settled

performance-based restricted stock units have performance metrics that must be achieved prior to vesting. These awards are accrued based on the

expected level of achievement at each reporting period. A cumulative adjustment is recorded to adjust compensation expense based on the current fair

value of the awards and expected level of achievement for the performance-based awards. See Note 7 for additional information on the Company’s share-

based compensation plans.

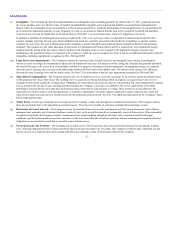

(o) Certain governmental taxes are imposed on the Company’s ticket sales through a fee included in ticket prices. The Company collects

these fees and remits them to the appropriate government agency. These fees are recorded on a net basis (excluded from operating revenue).

(p) The Company accrues for estimated lease costs over the remaining term of the lease at the present value of future

minimum lease payments, net of estimated sublease rentals (if any), in the period that aircraft are permanently removed from service. When reasonably

estimable and probable, the Company estimates maintenance lease return condition obligations for items such as minimum aircraft and engine

conditions specified in leases and accrues these amounts over the lease term while the aircraft are operating, and any remaining unrecognized estimated

obligations are accrued in the period that an aircraft is removed from service.

(q) The Company has recorded reserves for income taxes and associated interest that may become payable in future

years. Although management believes that its positions taken on income tax matters are reasonable, the Company nevertheless has established tax and

interest reserves in recognition that various taxing authorities may challenge certain of the positions taken by the Company,

97