United Airlines 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

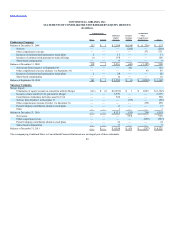

Expenses Related to the Merger

The Merger-related and integration expenses have been and are expected to be significant. While the Company has assumed that a certain level of expenses

would be incurred, there are many factors that could affect the total amount or the timing of these expenses, and many of the expenses that will be incurred are,

by their nature, difficult to estimate. These expenses could, particularly in the near term, exceed the financial benefits that the Company expects to achieve

from the Merger and could result in the Company taking significant charges against earnings. For the year ended December 31, 2011, UAL, United and

Continental incurred integration-related costs of $517 million, $360 million and $157 million, respectively. For the year ended December 31, 2010, UAL and

United incurred Merger-related costs of $564 million and $363 million, respectively. Continental Successor and Continental Predecessor incurred Merger-

related costs of $201 million and $29 million, respectively, in 2010. These costs are classified within special charges in the consolidated statement of

operations. See Note 21 for additional information related to Merger and integration costs.

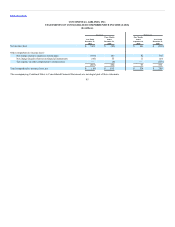

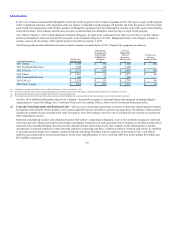

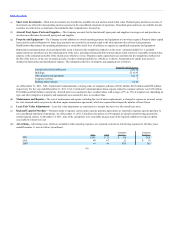

Pro-forma Impact of the Merger

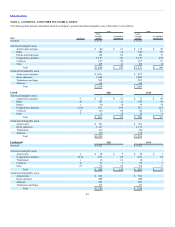

The UAL unaudited pro-forma results presented below include the effects of the Continental acquisition as if it had been consummated as of January 1, 2009.

The pro-forma results include the depreciation and amortization associated with the acquired tangible and intangible assets, lease fair value adjustments,

elimination of any deferred gains or losses from other comprehensive income and the impact of income changes on profit sharing expense, among others.

However, pro-forma results do not include any anticipated synergies or other expected benefits of the acquisition. Accordingly, the unaudited pro-forma

financial information below is not necessarily indicative of either future results of operations or results that might have been achieved had the acquisition been

consummated as of January 1, 2009 (in millions, except per share amounts):

Revenue $33,946 $28,677

Net income (loss) 958 (689)

Basic earnings (loss) per share 3.02 (2.41)

Diluted earnings (loss) per share 2.62 (2.41)

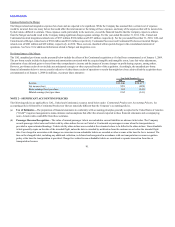

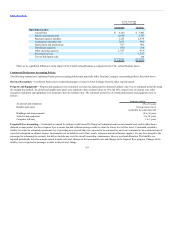

The following policies are applicable to UAL, United and Continental, except as noted below under for

accounting policies followed by Continental Predecessor that are materially different than the Company’s accounting policies.

(a) The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

(“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying

notes. Actual results could differ from those estimates.

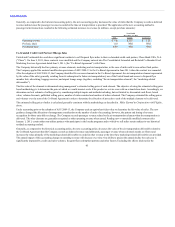

(b) The value of unused passenger tickets are included in current liabilities as advance ticket sales. The Company

records passenger ticket sales and tickets sold by other airlines for use on United or Continental as passenger revenue when the transportation is

provided or upon estimated breakage. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable

tickets generally expire on the date of the intended flight, unless the date is extended by notification from the customer on or before the intended flight

date. Fees charged in association with changes or extensions to non-refundable tickets are recorded as other revenue at the time the fee is incurred. The

fare on the changed ticket, including any additional collection, is deferred and recognized in accordance with our transportation revenue recognition

policy at the time the transportation is provided. Change fees related to non-refundable tickets are considered a separate transaction from the air

transportation because

91