United Airlines 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

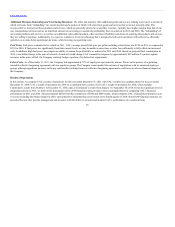

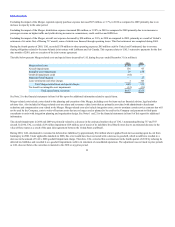

Aircraft rent decreased $177 million, or 20.5%, in 2011 as compared to the combined 2010 period, primarily due to the amortization of a lease fair value

adjustment which was recorded as part of acquisition accounting.

Liquidity and Capital Resources

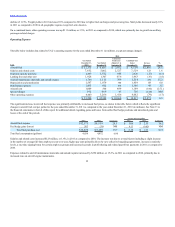

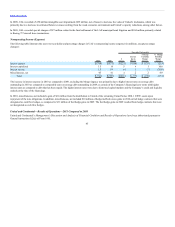

As of December 31, 2011, UAL had $7.8 billion in unrestricted cash, cash equivalents and short-term investments, which is $918 million lower than at

December 31, 2010. The Company also has a $500 million undrawn Credit and Guaranty Agreement (the “Revolving Credit Facility”) as of December 31,

2011. At December 31, 2011, UAL also had $569 million of restricted cash and cash equivalents, which is primarily collateral for performance bonds,

letters of credit, credit card processing agreements and estimated future workers’ compensation claims. We may be required to post significant additional cash

collateral to provide security for obligations that are not currently backed by cash. Restricted cash and cash equivalents at December 31, 2010 totaled $387

million. As of December 31, 2011, United had cash collateralized $194 million of letters of credit, most of which had previously been issued and

collateralized under the Amended Credit Facility. As of December 31, 2011, the Company had all of its commitment capacity under its new $500 million

Revolving Credit Facility available for letters of credit or borrowings.

As is the case with many of our principal competitors, we have a high proportion of debt compared to capital. We have a significant amount of fixed

obligations, including debt, aircraft leases and financings, leases of airport property and other facilities and pension funding obligations. At

December 31, 2011, UAL had approximately $12.7 billion of debt and capital lease obligations, including $1.3 billion that are due within the next 12 months.

In addition, we have substantial non-cancelable commitments for capital expenditures, including the acquisition of new aircraft and related spare engines. The

Company reduced debt and capital lease obligations by $2.6 billion in 2011.

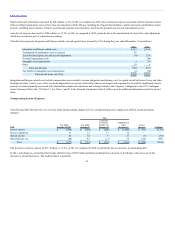

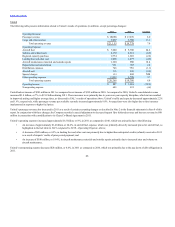

As of December 31, 2011, United had firm commitments to purchase 50 new aircraft (25 Boeing 787 aircraft and 25 Airbus A350XWB aircraft) scheduled

for delivery from 2016 through 2019. United also has options to purchase 42 Airbus A319 and A320 aircraft, and purchase rights for 50 Boeing 787 aircraft

and 50 Airbus A350XWB aircraft. United has secured considerable backstop financing commitments from its aircraft and engine manufacturers, subject to

certain customary conditions. However, United can provide no assurance that backstop financing, or any other financing not already in place, for aircraft and

engine deliveries will be available to United on acceptable terms when necessary or at all.

As of December 31, 2011, Continental had firm commitments to purchase 82 new aircraft (57 Boeing 737 aircraft and 25 Boeing 787 aircraft) scheduled for

delivery from 2012 through 2016. Continental expects to place into service 19 Boeing 737 aircraft, of which two have been delivered prior to the filing of this

report, and five Boeing 787 aircraft in 2012. Continental also has options to purchase 89 additional Boeing 737 and 787 aircraft. Continental does not have

backstop financing or any other financing currently in place for the Boeing aircraft on order. Financing will be necessary to satisfy Continental’s capital

commitments for its firm order aircraft and other related capital expenditures. Continental can provide no assurance that backstop financing, or any other

financing not already in place, for aircraft and engine deliveries will be available to Continental on acceptable terms when necessary or at all.

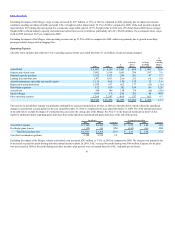

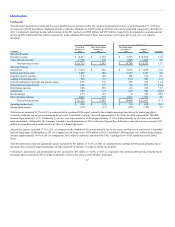

The Company is currently in discussions with Boeing over potential compensation related to delays in the 787 aircraft deliveries. The Company is not able to

estimate the ultimate success, amount of, nature or timing of any potential recoveries from Boeing over such delays.

As of December 31, 2011, a substantial portion of UAL’s assets, principally aircraft, spare engines, aircraft spare parts, route authorities and certain other

intangible assets, was pledged under various loan and other agreements. See Note 14 to the financial statements in Item 8 of this report for additional

information on assets provided as collateral by the Company.

Although access to the capital markets improved in 2011 and 2010, as evidenced by our financing transactions in both years, we cannot give any assurances

that we will be able to obtain additional financing or otherwise access

48