United Airlines 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Aircraft operating leases have initial terms of one to twenty-six years, with expiration dates ranging from 2012 through 2025. Under the terms of most leases,

the Company has the right to purchase the aircraft at the end of the lease term, in some cases at fair market value, and in others, at fair market value or a

percentage of cost. The Company has facility operating leases that extend to 2032.

United and Continental are the lessees of real property under long-term operating leases at a number of airports where we are also the guarantor of

approximately $270 million and $1.4 billion, respectively, of underlying debt and interest thereon. These leases are typically with municipalities or other

governmental entities, which are excluded from the consolidation requirements concerning VIEs. To the extent the Company’s leases and related guarantees are

with a separate legal entity other than a governmental entity, the Company is not the primary beneficiary because the lease terms are consistent with market

terms at the inception of the lease and the lease does not include a residual value guarantee, fixed-price purchase option, or similar feature as discussed in Note

16.

In October 2009, United amended a capacity agreement with one of its regional carriers. The amendment extended the lease terms on 40 existing aircraft and

added 14 new aircraft to the amended agreement. As a result of this amendment, capital lease assets and obligations increased by $250 million.

In January 2009, United amended its lease of the Chicago O’Hare International Airport cargo facility. This amendment resulted in proceeds to United of

approximately $160 million in return for United’s agreement to vacate its currently leased cargo facility earlier than the lease expiration date in order for the

airport authority to continue with its long-term airport modernization plan. The proceeds were recorded as a deferred credit. This deferred credit, net of $18

million of carrying value of abandoned leasehold interests, will be amortized through 2022.

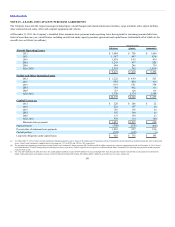

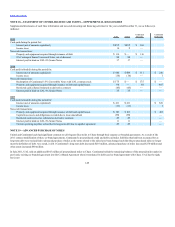

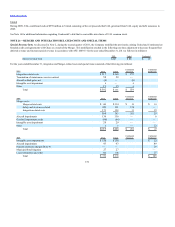

The table below summarizes the Company’s nonaircraft rent expense, net of minor amounts of sublease rentals, for the years ended December 31, (in

millions):

2011 $1,265 $666 $599

2010 839 685 154 $ 452

2009 644 644 578

In addition to nonaircraft rent in the table above and aircraft rent, which is separately presented in the consolidated statements of operations, UAL had aircraft

rent related to regional aircraft operating leases, which is included as part of regional capacity purchase expense in UAL’s consolidated statement of operations,

of $498 million, $411 million and $443 million for the years ended December 31, 2011, 2010 and 2009, respectively. For the year ended December 31, 2011,

UAL’s regional aircraft rent, which is included as part of regional capacity purchase expense, consisted of $395 million and $103 million related to United

and Continental, respectively.

142