United Airlines 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

arrangements; the costs and availability of financing; its ability to maintain adequate liquidity; its ability to execute its operational plans; its ability to control

its costs, including realizing benefits from its resource optimization efforts, cost reduction initiatives and fleet replacement programs; its ability to utilize its net

operating losses; its ability to attract and retain customers; demand for transportation in the markets in which it operates; an outbreak of a disease that affects

travel demand or travel behavior; demand for travel and the impact that global economic conditions have on customer travel patterns; excessive taxation and

the inability to offset future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit market

conditions, crude oil prices, costs of aircraft fuel and energy refining capacity in relevant markets); its ability to cost-effectively hedge against increases in the

price of aircraft fuel; any potential realized or unrealized gains or losses related to fuel or currency hedging programs; the effects of any hostilities, act of war

or terrorist attack; the ability of other air carriers with whom the Company has alliances or partnerships to provide the services contemplated by the respective

arrangements with such carriers; the costs and availability of aviation and other insurance; the costs associated with security measures and practices;

industry consolidation or changes in airline alliances; competitive pressures on pricing and demand; its capacity decisions and the capacity decisions of its

competitors; U.S. or foreign governmental legislation, regulation and other actions (including open skies agreements and environmental regulations); labor

costs; its ability to maintain satisfactory labor relations and the results of the collective bargaining agreement process with its union groups; any disruptions to

operations due to any potential actions by its labor groups; weather conditions; the possibility that expected Merger synergies will not be realized or will not be

realized within the expected time period; and other risks and uncertainties set forth under Item 1A, , of this report, as well as other risks and

uncertainties set forth from time to time in the reports the Company files with the SEC.

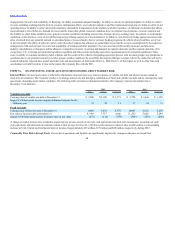

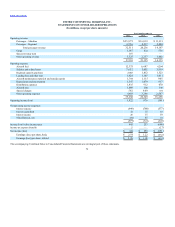

Our net income (loss) is affected by fluctuations in interest rates (e.g. interest expense on variable-rate debt and interest income earned on

short-term investments). The Company’s policy is to manage interest rate risk through a combination of fixed and variable rate debt and by entering into swap

agreements, depending upon market conditions. The following table summarizes information related to the Company’s interest rate market risk at

December 31 (in millions):

Carrying value of variable rate debt at December 31 $3,280 $2,109 $1,171 $3,758 $2,400 $1,358

Impact of 100 basis point increase on projected interest expense for the

following year 31 20 11 37 24 13

Carrying value of fixed rate debt at December 31 8,402 3,636 4,357 10,087 4,626 5,043

Fair value of fixed rate debt at December 31 8,996 3,717 4,420 11,292 5,026 5,284

Impact of 100 basis point increase in market rates on fair value (272) (110) (159) (369) (159) (206)

A change in market interest rates would also impact interest income earned on our cash, cash equivalents and short-term investments. Assuming our cash,

cash equivalents and short-term investments remain at their average 2011 levels, a 100 basis point increase in interest rates would result in a corresponding

increase in UAL, United and Continental interest income of approximately $63 million, $37 million and $26 million, respectively, during 2012.

Commodity Price Risk (Aircraft Fuel). Our results of operations and liquidity are significantly impacted by changes in the price of aircraft fuel.

64