United Airlines 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

they represent a charge for the Company’s additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer

order are separately determined and represent distinct earnings processes. Refundable tickets expire after one year.

The Company records an estimate of breakage revenue on the flight date for tickets that will expire without usage. These estimates are based on the

evaluation of actual historical results. The Company recognizes cargo and other revenue as service is provided.

Under our capacity purchase agreements with regional carriers, we purchase all of the capacity related to aircraft covered by the contracts and are

responsible for selling all of the related seat inventory. We record the passenger revenue and related expenses as separate operating revenue and expense in

the consolidated statement of operations.

In the separate financial statements of United and Continental, for tickets sold by one carrier but flown by the other, the carrier that operates the aircraft

recognizes the associated revenue. See Note 20 for additional information regarding related party transactions.

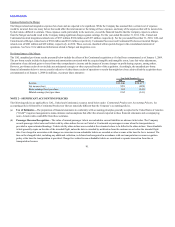

Accounts receivable primarily consist of amounts due from credit card companies and customers of our aircraft maintenance and cargo transportation

services. We provide an allowance for uncollectible accounts equal to the estimated losses expected to be incurred based on historical write-offs and other

specific analyses. Bad debt expense and write-offs were not material for the years ended December 31, 2011, 2010 and 2009.

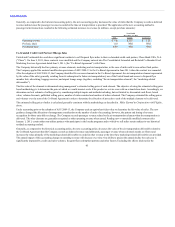

(c) United and Continental have frequent flyer programs that are designed to increase customer loyalty. Program participants

earn mileage credits (“miles”) by flying on United, Continental and certain other participating airlines. Program participants can also earn miles through

purchases from other non-airline partners that participate in the Company’s loyalty programs. We sell miles to these partners, which include credit card

issuers, retail merchants, hotels, car rental companies, and our participating airline partners. Miles can be redeemed for free, discounted or upgraded air

travel and non-travel awards. The Company records its obligation for future award redemptions using a deferred revenue model.

In the case of the sale of air services, the Company recognizes a portion of the ticket sales as revenue when the air transportation occurs and defers a

portion of the ticket sale representing the value of the related miles. The adoption of Accounting Standards Update 2009-13, Multiple-Deliverable

Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force (“ASU 2009-13”) resulted in the revision of this accounting, effective

January 1, 2011.

Under the Company’s prior accounting policy, the Company estimated the weighted average equivalent ticket value by assigning a fair value to the miles

that were issued in connection with the sale of air transportation. The equivalent ticket value is a weighted average ticket value of each outstanding mile,

based upon projected redemption patterns for available award choices when such miles are consumed. The fair value of the miles was deferred and the

residual amount of ticket proceeds was recognized as passenger revenue at the time the air transportation was provided.

The Company began applying the new guidance in 2011 and determines the estimated selling price of the air transportation and miles as if each element

is sold on a separate basis. The total consideration from each ticket sale is then allocated to each of these elements individually on a pro rata basis. The

estimated selling price of miles is computed using an estimated weighted average equivalent ticket value that is adjusted by a sales discount that

considers a number of factors, including ultimate fulfillment expectations associated with miles sold in flight transactions to various customer groups.

92