United Airlines 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

required, to repurchase the pre-purchased miles from Chase during the term of the agreement. The Co-Brand Agreement contains termination penalties that

may require United and Continental to make certain payments and repurchase outstanding pre-purchased miles in cases such as the Company’s insolvency,

bankruptcy or other material breaches. The Company has recorded these amounts as advanced purchase of miles in the non-current liabilities section of the

Company’s consolidated balance sheets.

The obligations of UAL, United, Continental and Mileage Plus Holdings, LLC to Chase under the Co-Brand Agreement are joint and several. Certain of

United’s obligations under the Co-Brand Agreement in an amount not more than $850 million are secured by a junior lien in all collateral pledged by United

under its Amended Credit Facility. All of Continental’s obligations under the Co-Brand Agreement are secured by a junior lien in all collateral pledged by

Continental to secure its 6.75% Notes due 2015. United also provides a first priority lien to Chase on its MileagePlus assets to secure certain of its obligations

under the Co-Brand Agreement and its obligations under the new combined credit card processing agreement among Continental, United, Paymentech, LLC

and JPMorgan Chase. After Continental’s OnePass Program anticipated termination in 2012, certain of the OnePass Program assets will be added as collateral

to the Co-Brand Agreement.

United and Continental

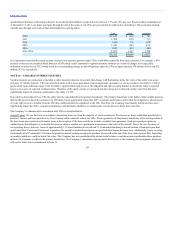

United and Continental participate in extensive code sharing, frequent flyer reciprocity and other cooperative activities. The other cooperative activities are

considered normal to the daily operations of both airlines. As a result of these other cooperative activities, Continental paid United $312 million and United

paid Continental $147 million during the year ended December 31, 2011. These payments do not include interline billings, which are common among airlines

for transportation-related services. The Company accounts for other related party transactions between United and Continental similar to the way it treats other

similar business transactions with other airlines. Most of these transactions are routinely settled through the interline clearing house, which is customarily

used in the monthly settlement of such items. The settlement of other cooperative non-transport type of transactions is typically performed on a quarterly

basis, with direct settlement between United and Continental. There were no material intercompany receivables or payables between United and Continental as

of December 31, 2011.

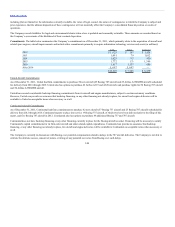

The Company received a single operating certificate from the Federal Aviation Administration in 2011, and has significant additional key integration initiatives

planned for early 2012 including as described below.

In 2011, the Company also announced that MileagePlus will be the loyalty program for the Company beginning in 2012. Continental’s loyalty program is

expected to end in the first quarter 2012 at which point United will automatically enroll OnePass members in MileagePlus and deposit into those MileagePlus

accounts award miles equal to their OnePass award miles balance. At the time of the transition to a single loyalty program, the related frequent flyer deferred

revenue and advance purchase of miles liabilities for Continental’s OnePass program will be transferred to United. No gain or loss is expected from the

transaction as the liabilities are expected to be transferred at their respective net book values.

As part of the integration, the Company plans to move to a single passenger service system in early 2012. In conjunction with a single passenger service

system, all tickets sold after implementation of the system will be using the United ticket stock. As a result, the air traffic liability of Continental will

diminish as remaining tickets sold by Continental are used or refunded, and United advanced ticket sales liability will increase accordingly. Revenue will

continue to be recorded by the carrier that is operating the flight.

The Company also plans to merge Continental and United into one legal entity. Once this legal Merger occurs, the financial statements of United and

Continental will be combined for all periods presented from the date of the Merger at their historical cost, and there will no longer be a requirement to separately

report the historical financial statements of Continental.

150