United Airlines 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

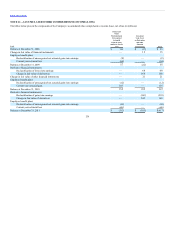

(a) As further described below under “Convertible Debt Securities,” there is a basis difference between UAL and Continental debt values, because we were required to apply different accounting methodologies. The

Continental debt presented above does not agree to Continental balance sheet by the amount of this adjustment.

On December 22, 2011, the Company entered into a new $500 million Credit and Guaranty Agreement, dated as of December 22, 2011 (the “Revolving Credit

Facility”) with a syndicate of banks, led by Citibank, N.A., as administrative agent. The facility has an expiration date of January 30, 2015 and is secured

by take-off and landing slots of United and Continental at Newark Liberty, LaGuardia and Washington Reagan and certain of their other assets. The

Revolving Credit Facility requires the Company to maintain at least $3.0 billion of unrestricted liquidity at all times, which includes unrestricted cash, short-

term investments and any undrawn amounts under any revolving credit facility and to maintain a minimum ratio of appraised value of collateral to the

outstanding obligations under the Revolving Credit Facility of 1.67 to 1.0 at all times. The Revolving Credit Facility includes events of default customary for

similar financings. In addition, the Revolving Credit Facility contains cross-default and cross-acceleration provisions pursuant to which a default and/or

acceleration of certain other material indebtedness of the Company could result in a default under the Revolving Credit Facility. The commitment capacity of

$500 million can be used for any combination of revolving loans and letters of credit. As of December 31, 2011, the Company had all of its commitment

capacity available under the Revolving Credit Facility.

As of December 31, 2011, United had cash collateralized $194 million of letters of credit, most of which had previously been issued under the Amended and

Restated Revolving Credit, Term Loan and Guaranty Agreement, dated as of February 2, 2007 (the “Amended Credit Facility”). United also had $163 million

of performance bonds. Continental had letters of credit and performance bonds relating to various real estate, customs and aircraft financing obligations at

December 31, 2011 in the amount of approximately $71 million. Most of the letters of credit have evergreen clauses and are expected to be renewed on an

annual basis and the performance bonds have expiration dates through 2015.

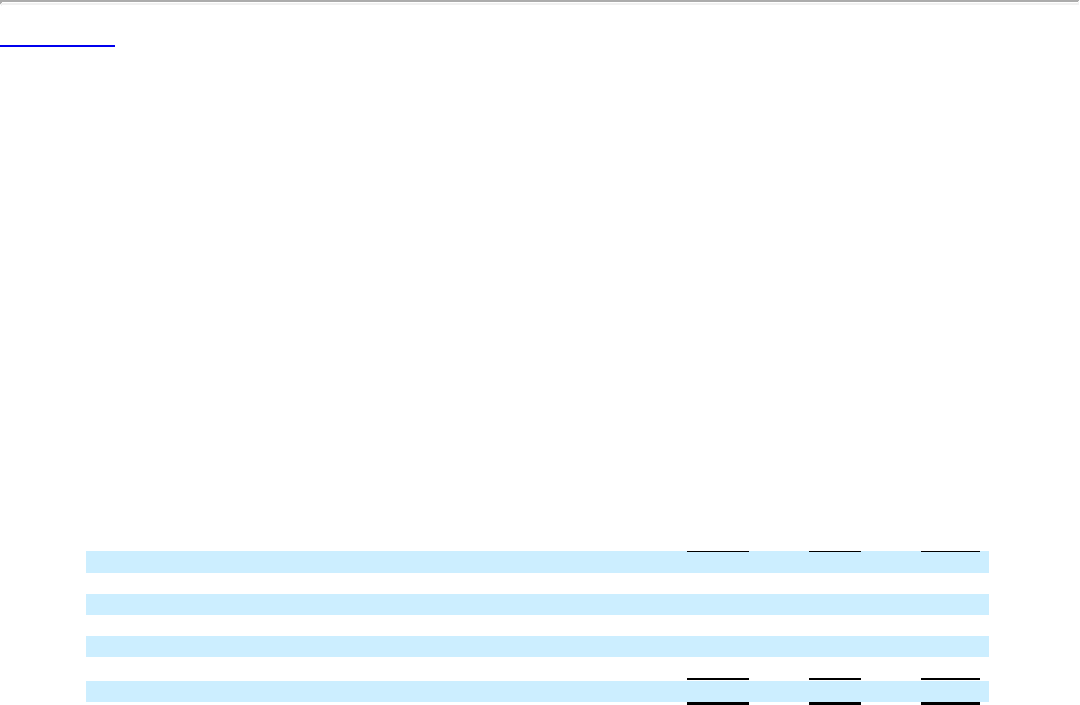

The table below presents the Company’s contractual principal payments at December 31, 2011 under then-outstanding long-term debt agreements in each of

the next five calendar years (in millions):

2012 $1,186 $615 $571

2013 1,857 1,154 703

2014 2,123 1,721 402

2015 1,963 396 1,567

2016 904 411 493

After 2016 3,874 1,723 1,806

$11,907 $ 6,020 $5,542

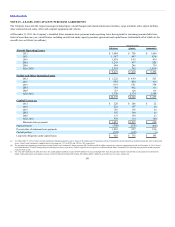

As of December 31, 2011, a substantial portion of UAL’s assets, principally aircraft, spare engines, aircraft spare parts, route authorities and certain other

intangible assets, were pledged under various loan and other agreements. As of December 31, 2011, UAL, United and Continental were in compliance with

their respective debt covenants. Continued compliance depends on many factors, some of which are beyond the Company’s control, including the overall

industry revenue environment and the level of fuel costs.

The Company’s significant financing agreements are summarized below:

Chase Co-Brand Agreement. United and Continental each had significant contracts to sell frequent flyer miles to Chase through their separate co-branded

agreements. As a result of the contract modification of these co-brand agreements, Continental’s pre-purchased credit and debit card miles liabilities that had

been accounted for as long-term debt were reclassified to advanced purchase of miles as the terms related to the miles have been changed such that the pre-

purchased miles no longer meet the definition of debt. As a result, Continental’s long-term debt decreased $210 million and advanced purchase of miles

increased $270 million.

134