United Airlines 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

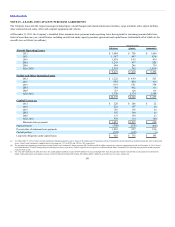

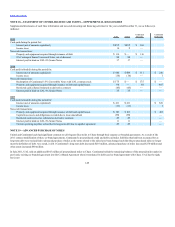

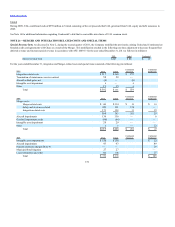

operational performance will remain at historic levels and (5) that inflation is projected to be between 1.3% and 3.0% per year. Based on these assumptions as

of December 31, 2011, our future payments through the end of the terms of our CPAs are presented in the table below (in millions). These amounts exclude

variable pass-through costs such as fuel and landing fees, among others.

2012 $1,653 $912 $741

2013 1,568 855 713

2014 1,403 733 670

2015 1,261 645 616

2016 1,022 418 604

After 2016 2,855 1,127 1,728

$9,762 $4,690 $5,072

It is important to note that the actual amounts we pay to our regional operators under CPAs could differ materially from these estimates. For example, a 10%

increase or decrease in scheduled block hours for all of United’s and Continental’s regional operators (whether as a result of changes in average daily

utilization or otherwise) in 2012 would result in a corresponding change in cash obligations under the CPAs of approximately $78 million (8.6%) and $72

million (9.7%), respectively.

Variable interests are contractual, ownership or other monetary interests in an entity that change with fluctuations in the fair value of the entity’s net assets

exclusive of variable interests. VIEs can arise from items such as lease agreements, loan arrangements, guarantees or service contracts. An entity is a VIE if

(a) the entity lacks sufficient equity or (b) the entity’s equity holders lack power or the obligation and right as equity holders to absorb the entity’s expected

losses or to receive its expected residual returns. Therefore, if the equity owners as a group do not have the power to direct the entity’s activities that most

significantly impact its economic performance, the entity is a VIE.

If an entity is determined to be a VIE, the entity must be consolidated by the primary beneficiary. The primary beneficiary is the holder of the variable interests

that has the power to direct the activities of a VIE that (i) most significantly impact the VIE’s economic performance and (ii) has the obligation to absorb losses

of or the right to receive benefits from the VIE that could potentially be significant to the VIE. Therefore, the Company must identify which activities most

significantly impact the VIE’s economic performance and determine whether it, or another party, has the power to direct those activities.

The Company’s evaluation of its association with VIEs is described below:

Aircraft Leases. We are the lessee in a number of operating leases covering the majority of our leased aircraft. The lessors are trusts established specifically to

purchase, finance and lease aircraft to us. These leasing entities meet the criteria for VIEs. We are generally not the primary beneficiary of the leasing entities if

the lease terms are consistent with market terms at the inception of the lease and do not include a residual value guarantee, fixed-price purchase option or

similar feature that obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case for many of

our operating leases; however, leases of approximately 11 United mainline jet aircraft and 73 Continental mainline jet aircraft contain a fixed-price purchase

option that allow United and Continental to purchase the aircraft at predetermined prices on specified dates during the lease term. Additionally, leases covering

substantially all of Continental’s 256 leased regional jet aircraft contain an option to purchase the aircraft at the end of the lease term at prices that, depending

on market conditions, could be below fair value. The Company has not consolidated the related trusts because, even taking into consideration these purchase

options, the Company is still not the primary beneficiary. The Company’s maximum exposure under these leases is the remaining lease payments, which are

reflected in future lease commitments in Note 15.

144