United Airlines 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

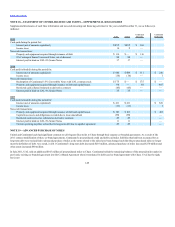

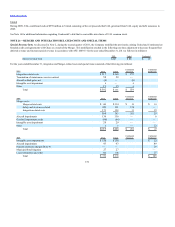

UAL, United and Continental

Integration-related costs

Integration-related costs include costs to terminate certain service contracts that will not be used by the Company, costs to write-off system assets that are no

longer used or planned to be used by the Company, payments to third-party consultants to assist with integration planning and organization design, severance

related costs primarily associated with administrative headcount reductions, relocation and training, and compensation costs related to the systems integration.

In addition, during 2011, UAL became obligated under the 8% Notes indenture to issue to the PBGC $125 million aggregate principal amount of 8% Notes,

which UAL issued in January 2012. UAL recorded a liability for the fair value of the obligation of approximately $88 million, as described above in Note 14.

This is being classified as an integration-related cost since the financial results of UAL, excluding Continental’s results, would not have resulted in a

triggering event under the 8% Notes indenture.

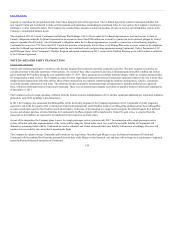

Merger-related costs

Merger-related costs include charges related to the planning and execution of the Merger, including costs for items such as financial advisor, legal and other

advisory fees. Salary and severance related costs are primarily associated with administrative headcount reductions and compensation costs related to the

Merger. Integration-related costs include costs to terminate certain service contracts that will not be used by the Company, costs to write-off duplicate system

assets that are no longer used or planned to be used by the Company, and third-party consultant fees to assist with integration planning and organization

design. See Note 1 for additional information related to Merger-related costs.

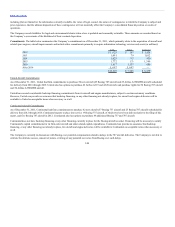

Intangible asset impairments

During 2011, Continental recorded impairment charges of $4 million on certain intangible assets related to foreign take-off and landing slots to reflect the

estimated fair value of these assets as part of its annual impairment test of indefinite-lived intangible assets.

During 2010, the U.S. and Brazilian governments reached an open skies aviation agreement that removed the restriction on the number of flights into Sao

Paulo by October 2015. As a result of these changes, United recorded a $29 million non-cash charge to write-down its indefinite-lived route asset in Brazil. In

2009, United recorded $150 million impairment of its tradename, which was primarily due to a significant decrease in expected future cash flows due to poor

economic conditions. These impairments were based on estimated fair values, which were primarily developed using income methodologies, as described in

Note 12.

Other

During 2011, both United and Continental adjusted their reserves for certain legal matters.

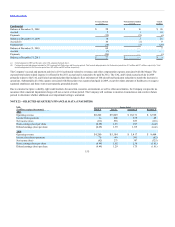

UAL and United

Aircraft impairments

The aircraft impairments summarized in the table above for 2010 and 2009 relate to United’s nonoperating Boeing 737 and Boeing 747 aircraft which declined

in value, as older, less fuel efficient models became less valuable with increasing fuel costs. The carrying values of these nonoperating aircraft were reduced to

estimated fair values. During the first quarter of 2010, the Company also estimated that certain of its aircraft-related assets were fully impaired resulting in a

charge of $16 million. See Note 12 for additional information related to the use of fair values in impairment testing.

152