United Airlines 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

option under applicable accounting standards for the put right, with changes in the fair value of the auction rate securities and the underlying put right

recognized in earnings currently. Continental recognized gains on the sales using the specific identification method. The gains were substantially offset by the

cancellation of the related put rights. The net gains are included in other nonoperating income (expense) in the Continental Predecessor statement of consolidated

operations and were not material. The Company did not hold any put rights as of December 31, 2010. In 2011, Continental sold, at par, auction rate securities

having a par value of $10 million and recorded an immaterial gain in nonoperating income (expense).

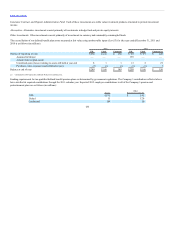

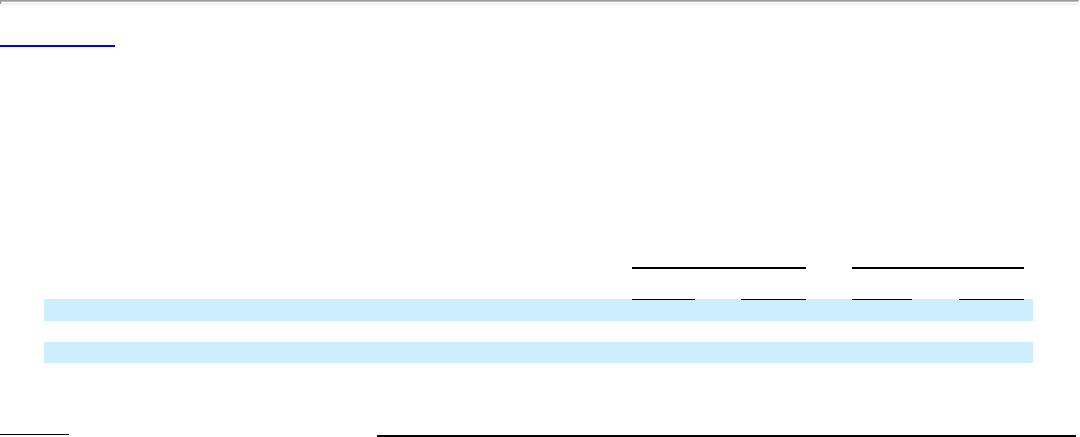

Derivative instruments and investments presented in the tables above have the same fair value as their carrying value. The table below presents the carrying

values and estimated fair values of financial instruments not presented in the tables above for the years ended December 31 (in millions):

UAL debt $11,682 $11,992 $13,845 $14,995

United debt 5,745 5,630 7,026 7,350

Continental debt 5,528 5,503 6,401 6,663

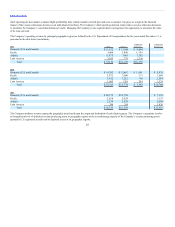

Fair value of the Company’s financial instruments was determined as follows:

The carrying amounts approximate fair value because of the short-term maturity of these assets and

liabilities. These assets have maturities of less than one year except for the EETCs, auction rate

securities and corporate debt.

Fair value is based on (a) the trading prices of the investment or similar instruments, (b) an income

approach, which uses valuation techniques to convert future amounts into a single present amount

based on current market expectations about those future amounts when observable trading prices are

not available, or (c) internally-developed models of the expected future cash flows related to the

securities.

Derivative contracts are privately negotiated contracts and are not exchange traded. Fair value

measurements are estimated with option pricing models that employ observable inputs. Inputs to the

valuation models include contractual terms, market prices, yield curves, fuel price curves and

measures of volatility, among others.

Fair value is determined with a formula utilizing observable inputs. Significant inputs to the valuation

models include contractual terms, risk-free interest rates and forward exchange rates.

Fair values were based on either market prices or the discounted amount of future cash flows using our

current incremental rate of borrowing for similar liabilities.

The Company used a binomial lattice model to value the conversion options and the supplemental

derivative assets. Significant binomial model inputs that are not objectively determinable include

volatility and discount rate.

129