United Airlines 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

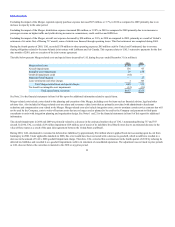

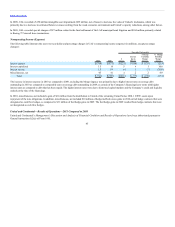

In 2009, United received $175 million from three sale-leaseback agreements. These transactions were accounted for as capital leases, resulting in an increase

to capital lease assets and capital lease obligations during 2009.

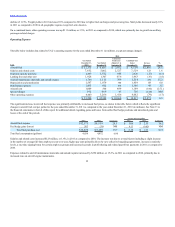

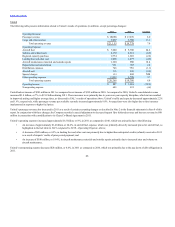

Cash Flows from Financing Activities

Significant financing events in 2011 were as follows:

• The Company entered into a new $500 million Revolving Credit Facility with a syndicate of banks, led by Citibank, N.A., as administrative

agent. The facility was undrawn at December 31, 2011 and has an expiration date of January 30, 2015. It is secured by take-off and landing slots

at Newark Liberty, LaGuardia and Washington Reagan and certain other assets of United and Continental. The Company terminated its prior

$255 million revolver under the Amended Credit Facility on December 21, 2011. As of December 31, 2011, United had cash collateralized $194

million of letters of credit, most of which had previously been issued and collateralized under the Amended Credit Facility. As of

December 31, 2011, the Company had all of its commitment capacity under its new $500 million Revolving Credit Facility available for letters of

credit or borrowings;

• During 2011, UAL made debt and capital lease payments of $2.6 billion. These payments include $150 million related to UAL’s 5% Senior

Convertible Notes and $570 million related to UAL’s 4.5% Senior Limited-Subordination Convertible Notes; and

• Continental received $239 million in 2011 from its December 2010 pass-through trust financing. The proceeds were used to fund the acquisition

of new aircraft and in the case of the currently owned aircraft, for general corporate purposes.

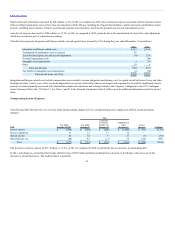

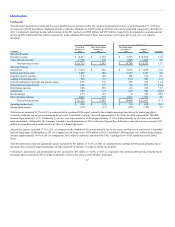

Significant financing events in 2010 were as follows:

• In January 2010, United issued $500 million of the United Senior Secured Notes due 2013 and $200 million of the United Senior Second Lien

Notes due 2013, which are secured by United’s route authority to operate between the United States and Japan and beyond Japan to points in other

countries, certain airport takeoff and landing slots and airport gate leaseholds utilized in connection with these routes;

• In January 2010, United issued the remaining $1.3 billion in principal amount of the equipment notes relating to the Series 2009-1 and 2009-2

EETCs. Issuance proceeds of approximately $1.1 billion were used to repay the Series 2000-2 and 2001-1 EETCs and the remaining proceeds

were used for general corporate purposes;

• In December 2010, Continental issued approximately $427 million of Series 2010-1 Class A and Class B pass-through certificates through two

pass-through trusts. In December 2010, Continental issued $188 million in principal amount of equipment notes relating to its December 2010

pass-through trust financing. Continental used $90 million of the proceeds for general corporate purposes and $98 million of the proceeds to

purchase three new Boeing 737 aircraft. The proceeds used to purchase the three new Boeing 737 aircraft were accounted for as a noncash

investing and financing activity; and

• In 2010, United acquired six aircraft through the exercise of its lease purchase options. Aircraft lease deposits of $236 million provided financing

cash that was primarily utilized by United to make the final payments due under these capital lease obligations.

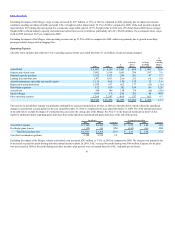

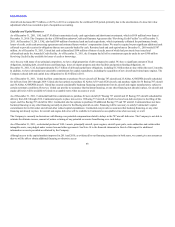

Significant financing events in 2009 for UAL and United were as follows:

• $322 million from multiple financings by United that are secured by certain aircraft spare parts, aircraft and spare engines;

• $345 million from UAL’s issuance of 6% Senior Convertible Notes due 2029;

50