United Airlines 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

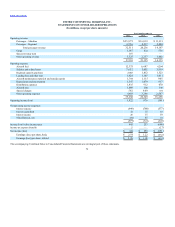

losses are not required to be recognized currently as other postretirement expense, but instead may be deferred as part of accumulated other comprehensive

income and amortized into expense over the average remaining service life of the covered active employees. The Company’s accounting policy for postretirement

welfare benefit plans is to not apply the corridor approach available under applicable GAAP with respect to amortization of amounts included in accumulated

other comprehensive income. Under the corridor approach, amortization of any gain or loss in accumulated other comprehensive income is required only if, at

the beginning of the year, the accumulated gain or loss exceeds 10% of the greater of the benefit obligation or the fair value of assets. If amortization is required,

the minimum amount outside the corridor divided by the average remaining service period of active employees is recognized as expense. The corridor approach

is intended to reduce volatility of amounts recorded in postretirement welfare benefit plan expense each year. Since the Company has elected not to apply the

corridor approach, all gains and losses in accumulated other comprehensive income are amortized to expense over the remaining years of service of the covered

active employees. At December 31, 2011 and 2010, UAL had unrecognized actuarial gains for postretirement welfare benefit plans of $33 million and $24

million, respectively, recorded in accumulated other comprehensive income.

Income Taxes

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income (including the reversals of deferred tax liabilities)

during the periods in which those deferred tax assets will become deductible. The Company’s management assesses available positive and negative evidence

regarding the realizability of its deferred tax assets, and records a valuation allowance when it is more likely than not that all or a portion of the deferred tax

assets will not be realized. To form a conclusion, management considers positive evidence in the form of reversing temporary differences, projections of future

taxable income and tax planning strategies, and negative evidence such as recent history of losses. Prior to 2011, the Company was in a cumulative three-year

loss position, which we weighted as a significant source of negative evidence indicating the need for a valuation allowance on our net deferred tax assets.

Although the Company was no longer in a three-year cumulative loss position at the end of 2011, management determined that the size and frequency of

financial losses in recent years and the uncertainty associated with projecting future taxable income supported the conclusion that the valuation allowance was

still needed on net deferred assets. If UAL achieves significant profitability in 2012, then management will evaluate whether its recent history of profitability

constitutes sufficient positive evidence to support a reversal of a portion, or all, of the remaining valuation allowance.

Certain statements throughout Item 7, and elsewhere in this

report are forward-looking and thus reflect the Company’s current expectations and beliefs with respect to certain current and future events and financial

performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to the Company’s operations and business

environment that may cause actual results to differ materially from any future results expressed or implied in such forward-looking statements. Words such as

“expects,” “will,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook” and similar expressions are intended to identify forward-

looking statements.

Additionally, forward-looking statements include statements which do not relate solely to historical facts, such as statements which identify uncertainties or

trends, discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known trends or uncertainties

cannot be predicted, guaranteed or assured. All forward-looking statements in this report are based upon information available to the Company on the date of

this report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise, except as required by applicable law.

The Company’s actual results could differ materially from these forward-looking statements due to numerous factors including, without limitation, the

following: its ability to comply with the terms of its various financing

63