United Airlines 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

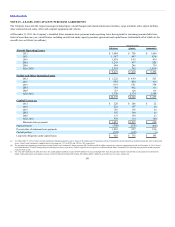

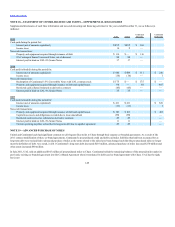

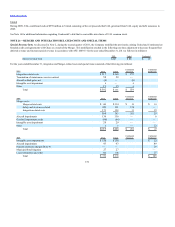

Supplemental disclosures of cash flow information and non-cash investing and financing activities for the years ended December 31, are as follows (in

millions):

Cash paid during the period for:

Interest (net of amounts capitalized) $855 $495 $360

Income taxes 10 2 —

Non-cash transactions:

Property and equipment acquired through issuance of debt $130 $ — $130

8% Contingent Senior Unsecured Notes, net of discount 88 88 —

Interest paid in kind on UAL 6% Senior Notes 37 37 —

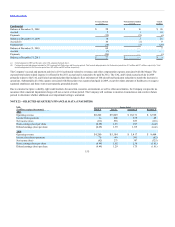

Cash paid (refunded) during the period for:

Interest (net of amounts capitalized) $600 $ 489 $111 $210

Income taxes (16) (16) — 1

Non-cash transactions:

Redemption of Continental’s 5% Convertible Notes with UAL common stock $175 $ — $175 $ —

Property and equipment acquired through issuance of debt and capital leases 98 — 98 465

Restricted cash collateral returned on derivative contracts (45) (45) — —

Interest paid in kind on UAL 6% Senior Notes 35 35 — —

Cash paid (refunded) during the period for:

Interest (net of amounts capitalized) $411 $411 $ 326

Income taxes (11) (11) 1

Non-cash transactions:

Property and equipment acquired through issuance of debt and capital leases $183 $183 $402

Capital lease assets and obligations recorded due to lease amendment 250 250 —

Restricted cash received as collateral on derivative contracts 49 49 —

Interest paid in kind on UAL 6% Senior Notes 33 33 —

Current operating payables reclassified to long-term debt due to supplier agreement 49 49 —

United and Continental each had significant contracts to sell frequent flyer miles to Chase through their separate co-branded agreements. As a result of the

2011 contract modification of these co-brand agreements, Continental’s pre-purchased credit and debit card miles liabilities that had been accounted for as

long-term debt were reclassified to advanced purchase of miles as the terms related to the miles have been changed such that the pre-purchased miles no longer

meet the definition of debt. As a result, in 2011 Continental’s long-term debt decreased $210 million, advanced purchase of miles increased $270 million and

other assets increased $60 million.

In July 2011, UAL sold an additional $165 million of pre-purchased miles to Chase. Continental rolled the remaining balance of the pre-paid miles under its

previously existing co-branded agreement into the Co-Brand Agreement when it terminated its debit card co-brand agreement with Chase. UAL has the right,

but is not

149