United Airlines 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

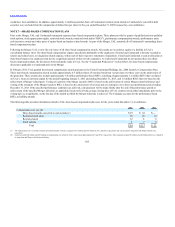

In September 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2011-09 (“ASU 2011-09”),

. This update requires additional disclosures, both quantitative and qualitative, about an

employer’s participation in a multiemployer pension plan. Some of the required disclosures include the plan names and identifying numbers of the significant

multiemployer plans in which an employer participates, the level of an employer’s participation in significant multiemployer plans, the financial health of

significant multiemployer plans, and the nature of employer commitments to the plan. ASU 2011-09 is effective for the Company’s annual reporting period

ended December 31, 2011 and the required disclosures are disclosed in Note 9.

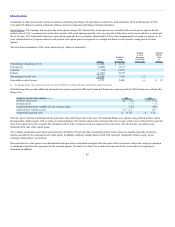

In September 2011, the FASB issued Accounting Standards Update No. 2011-08 (“ASU 2011-08”), . This update permits

an entity to first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount

as a basis for determining whether it is necessary to perform the two-step goodwill impairment test. Previous guidance requires an entity to test goodwill for

impairment, on at least an annual basis, by comparing the fair value of a reporting unit with its carrying amount, including goodwill. If the fair value of a

reporting unit is less than its carrying amount, then the second step of the test must be performed to measure the amount of the impairment loss, if any. ASU

2011-08 is effective for the Company for annual and interim periods beginning January 1, 2012. The Company does not expect the adoption of ASU 2011-08

to have a material impact on its results of operations or financial position.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05 (“ASU 2011-05”), . This guidance

eliminates the option to present components of other comprehensive income as part of the statement of changes in stockholders’ equity and requires all non-

owner changes in stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive

statements. In the two-statement approach, the first statement should present total net income and its components followed consecutively by a second statement

that should present total other comprehensive income, the components of other comprehensive income, and the total of comprehensive income. ASU 2011-05 is

effective for fiscal years, and interim periods within those years, beginning January 1, 2012 and should be applied retrospectively. As permitted, the

Company elected to early adopt ASU 2011-05 during 2011 and the two-statement approach is presented within this report. The adoption of this guidance only

relates to the presentation of comprehensive income.

100