United Airlines 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

and results of operations. The Company’s financial resources may not be sufficient to absorb the adverse effects of any future terrorist attacks or other

international hostilities.

An outbreak of a disease or similar public health threat could have a material adverse impact on the Company’s business, financial position and

results of operations.

An outbreak of a disease that affects travel demand or travel behavior, such as Severe Acute Respiratory Syndrome, avian flu or H1N1 virus, or other illness,

or travel restrictions or reduction in the demand for air travel caused by similar public health threats in the future, could have a material adverse impact on the

Company’s business, financial condition and results of operations.

The Company may never realize the full value of its intangible assets or its long-lived assets causing it to record impairments that may negatively

affect its financial position and results of operations.

In accordance with applicable accounting standards, the Company is required to test its indefinite-lived intangible assets for impairment on an annual basis on

October 1 of each year, or more frequently if conditions indicate that an impairment may have occurred. In addition, the Company is required to test certain of

its other assets for impairment if conditions indicate that an impairment may have occurred.

During the years ended December 31, 2010 and 2009, the Company performed impairment tests of certain intangible assets and certain long-lived assets

(principally aircraft, related spare engines and spare parts). The interim impairment tests were due to events and changes in circumstances that indicated an

impairment might have occurred. Certain of the factors deemed by management to have indicated that impairments may have occurred include a significant

decrease in actual and forecasted revenues, record high fuel prices, significant losses, a weak U.S. economy, and changes in the planned use of assets. As a

result of the impairment testing, the Company recorded significant impairment charges as described in Note 21 to the financial statements included in Item 8

of this report. The Company may be required to recognize additional impairments in the future due to, among other factors, extreme fuel price volatility, tight

credit markets, a decline in the fair value of certain tangible or intangible assets, unfavorable trends in historical or forecasted results of operations and cash

flows and an uncertain economic environment, as well as other uncertainties. The Company can provide no assurance that a material impairment charge of

tangible or intangible assets will not occur in a future period. The value of our aircraft could be impacted in future periods by changes in supply and demand

for these aircraft. Such changes in supply and demand for certain aircraft types could result from grounding of aircraft by the Company or other carriers. An

impairment charge could have a material adverse effect on the Company’s financial position and results of operations.

The Company’s ability to use its net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes may be

significantly limited due to various circumstances, including certain possible future transactions involving the sale or issuance of UAL common

stock, or if taxable income does not reach sufficient levels.

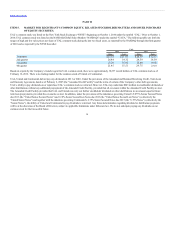

As of December 31, 2011, UAL reported consolidated federal net operating loss (“NOL”) carryforwards of approximately $10.0 billion.

The Company’s ability to use its NOL carryforwards may be limited if it experiences an “ownership change” as defined in Section 382 of the Internal Revenue

Code of 1986, as amended (“Section 382”). An ownership change generally occurs if certain stockholders increase their aggregate percentage ownership of a

corporation’s stock by more than 50 percentage points over their lowest percentage ownership at any time during the testing period, which is generally the three-

year period preceding any potential ownership change.

There is no assurance that the Company will not experience a future ownership change under Section 382 that may significantly limit or possibly eliminate its

ability to use its NOL carryforwards. Potential future transactions

22