United Airlines 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

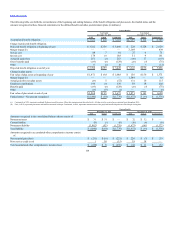

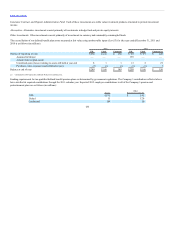

United’s participation in the IAM Plan for the annual period ended December 31, 2011, is outlined in the table below. There have been no significant changes

that affect the comparability of 2011 and 2010 contributions. The IAM Plan reported $332 million and $318 million in employers’ contributions for the years

ended December 31, 2010 and 2009 respectively; United’s contributions to the IAM Plan were $34 million for each of the years ended December 31, 2011,

2010 and 2009. For 2010 and 2009, the employer’s contribution to the Company’s plan represented more than 5% of total contributions.

Pension Fund IAM National Pension Fund

EIN/ Pension Plan Number 51-6031295 - 002

Pension Protection Act Zone Status (2010 and 2009)* Green Zone

FIP/RP Status Pending/Implemented No

United’s Contributions (Years ended December 31, 2011 and December 31,

2010) $34 million

Surcharge Imposed No

Expiration Date of Collective-Bargaining Agreement N/A

*Plans in the green zone are at least 80 percent funded.

At the date the financial statements were issued, Forms 5500 were not available for the plan year ending in 2011.

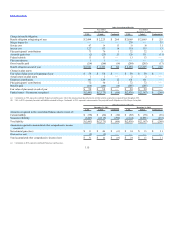

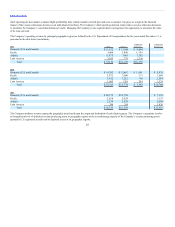

UAL, United and Continental recorded profit sharing and related payroll tax expense of $265 million, $122 million and $143 million, respectively, in 2011.

UAL, United, Continental Successor and Continental Predecessor recorded profit sharing and related payroll tax expense of $166 million, $165 million, less

than $1 million and $77 million, respectively, in 2010. Profit sharing expense is recorded as a component of salaries and related costs in the consolidated

statements of operations. The Company did not record profit sharing expense in 2009 due to pretax losses.

In 2011, substantially all employees participated in profit sharing plans, which paid 15% of total pre-tax earnings, excluding special items and share-based

compensation expense, to eligible employees when pre-tax profit, excluding special items, profit sharing expense and share-based compensation program

expense, exceeds $10 million. Eligible U.S. co-workers in each participating work group received a profit sharing payout using a formula based on the ratio of

each qualified co-worker’s annual eligible earnings to the eligible earnings of all qualified co-workers in all domestic workgroups. The international profit

sharing plan paid eligible non-U.S. co-workers the same percentage of eligible pay that is calculated under the U.S. profit sharing plan.

During 2010, United and Continental maintained separate employee profit sharing plans for the employees of each respective subsidiary. United’s profit

sharing plan paid 15% of total GAAP pre-tax profits, excluding special items and share-based compensation expense, to the employees of United when pre-tax

profit excluding special items, profit sharing expense and share-based compensation program expense exceeded $10 million. Continental’s profit sharing plan

created an award pool of 15% of annual pre-tax income excluding special, unusual or non-recurring items.

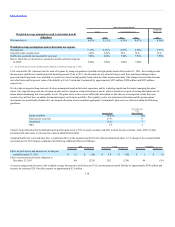

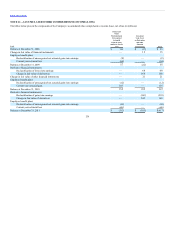

Operating segments are defined as components of an enterprise with separate financial information, which are evaluated regularly by the chief operating

decision maker and are used in resource allocation and performance assessments. Prior to the Merger, the Company managed its business by two reporting

segments: Mainline and Regional. In connection with the Merger integration and design of the new organization, the new management determined that the

Company will be managed as one segment, airline operations, because the Company’s services are passenger and cargo air transportation. The Company has

retrospectively applied its new segment reporting.

The Company has multiple aircraft fleets which are deployed across its route network through a single route scheduling system to maximize the value of UAL.

When making resource allocation decisions, the Company’s

122