United Airlines 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

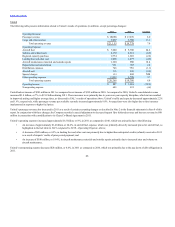

Investing Activities

Continental’s capital expenditures were $236 million and $300 million in 2011 and 2010, respectively. In addition, Continental acquired aircraft in both 2011

and 2010 with proceeds from financings that were delivered directly to the manufacturer. See Note 18 to the financial statements in Item 8 of this report for

information related to these non-cash financing and investing activities.

In 2011, purchases of short-term investments, net of proceeds, was $629 million, as compared to $273 million in 2010. This year-over-year variance was

primarily due to investment of higher cash balances and more funds being placed with outside money managers and moving liquid assets from cash to short-

term investments.

Financing Activities

Continental’s significant financing activities in 2011 and 2010 are described in the above discussion of UAL’s financing activities in

and Note 14 to the financial statements in Item 8 of this report.

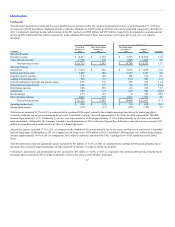

Critical accounting policies are defined as those that are affected by significant judgments and uncertainties which potentially could result in materially

different accounting under different assumptions and conditions. The Company has prepared the financial statements in conformity with GAAP, which

requires management to make estimates and assumptions that affect the reported amounts in the financial statements. Actual results could differ from those

estimates under different assumptions or conditions. The Company has identified the following critical accounting policies that impact the preparation of the

financial statements.

Passenger Revenue Recognition. The value of unused passenger tickets is included in current liabilities as advance ticket sales. The Company records

passenger ticket sales and tickets sold by other airlines for use on United and Continental as passenger revenues when the transportation is provided or upon

estimated breakage. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable tickets generally expire

on the date of the intended flight, unless the date is extended by notification from the customer on or before the intended flight date. Fees charged in association

with changes or extensions to non-refundable tickets are recorded as other revenue at the time the fee is collected. The fare on the changed ticket, including any

additional collection, is deferred and recognized in accordance with our transportation revenue recognition policy at the time the transportation is provided.

Change fees related to non-refundable tickets are considered a separate transaction from the air transportation because they represent a charge for the

Company’s additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer reservation are separately determined

and represent distinct earnings processes. Refundable tickets expire after one year. The Company records an estimate of breakage revenue for tickets that will

expire in twelve months without usage. These estimates are based on the evaluation of actual historical results. The Company recognizes cargo and other

revenue as service is provided. See separate discussion in below.

Frequent Flyer Accounting. United and Continental have frequent flyer programs that are designed to increase customer loyalty. Program participants earn

mileage credits (“miles”) by flying on United, Continental and certain other participating airlines. Program participants can also earn miles through purchases

from other non-airline partners that participate in the Company’s loyalty programs. We sell miles to these partners, which include credit card issuers, retail

merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free, discounted or upgraded air travel and non-travel

awards. The Company records its obligation for future award redemptions using a deferred revenue model.

56