United Airlines 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

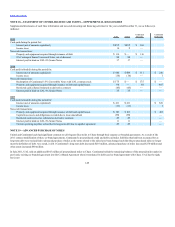

Goodwill impairment credit

During 2010, UAL determined that it overstated its deferred tax liabilities by approximately $64 million when it applied fresh start accounting upon its exit

from Chapter 11 bankruptcy protection in 2006. Under applicable standards in 2008, this error would have been corrected with a decrease to goodwill, which

would have resulted in a decrease in the amount of UAL’s 2008 goodwill impairment charge. Therefore, UAL corrected this overstatement in the fourth quarter

of 2010 by reducing its deferred tax liabilities and recorded it as goodwill impairment credit in its consolidated statement of operations. The adjustment was not

made to prior periods as UAL does not believe the correction is material to the current or any prior period. As the goodwill from fresh start accounting was

pushed down to United, the above disclosure also applies to United.

Municipal bond litigation

United’s other charges in 2009 included a $27 million expense related to a bankruptcy matter that was finalized in 2009 as the final settlement was greater

than United’s estimated obligation.

Termination charges

During 2011, United recorded $58 million of charges related to the early termination of a maintenance service contract. During 2009, United incurred $104

million primarily for aircraft lease termination charges related to its operational plans to significantly reduce its operating fleet.

UAL and Continental

Aircraft-related gains, net

During 2011, Continental recorded net gains of $6 million related to gains and losses on the disposal of aircraft and related spare parts.

Continental Predecessor

2010

During 2010, Continental Predecessor incurred aircraft-related charges of $6 million for the sale of two Boeing 737-500 aircraft and other special charges of

$12 million which primarily related to an increase in Continental’s reserve for unused facilities due to a reduction in expected sublease income for a

maintenance hangar in Denver.

2009

For the year ended December 31, 2009, Continental recorded a $31 million impairment charge on the Boeing 737-300 and 737-500 fleets related to its decision

in June 2008 to retire all of its Boeing 737-300 aircraft and a significant portion of their Boeing 737-500 aircraft by early 2010. Continental recorded an initial

impairment charge in 2008 for each of these fleet types. The additional write-down in 2009 reflects the further reduction in the fair value of these fleet types in

the current economic environment. In both periods, Continental determined that indicators of impairment were present for these fleets. Fleet assets include

owned aircraft, improvements on leased aircraft, rotable spare parts, spare engines, and simulators. Based on the evaluations, Continental determined that the

carrying amounts of these fleets were impaired and wrote them down to their estimated fair value. Continental estimated the fair values based on current market

quotes and their expected proceeds from the sale of the assets.

In addition, Continental recorded $39 million of other charges for its mainline fleet, primarily related to the grounding and sale of Boeing 737-300 and 737-500

aircraft and the write-off of certain obsolete spare parts. The 737-300 and 737-500 aircraft fleets and spare parts experienced further declines in fair values

during the fourth quarter of 2009 primarily as the result of additional 737 aircraft being grounded by other airlines. During 2009, Continental sold eight 737-

500 aircraft to foreign buyers. Its gain on these sales was not material.

153