United Airlines 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

consortia members and provide for the allocation of the overall costs to operate the consortia based on usage. The consortia (and in limited cases, the

participating carriers) have entered into long-term agreements to lease certain airport fuel storage and distribution facilities that are typically financed through

tax-exempt bonds (either special facilities revenue bonds or general airport revenue bonds), issued by various local municipalities. In general, each consortium

lease agreement requires the consortium to make lease payments in amounts sufficient to pay the maturing principal and interest payments on the bonds. As of

December 31, 2011, approximately $1.4 billion principal amount of such bonds were secured by significant fuel facility leases in which UAL participates, as

to which UAL and each of the signatory airlines have provided indirect guarantees of the debt. As of December 31, 2011, UAL’s contingent exposure was

approximately $271 million principal amount of such bonds based on its recent consortia participation. As of December 31, 2011, United’s and Continental’s

contingent exposure related to these bonds, based on its recent consortia participation, was approximately $214 million and $57 million, respectively. The

Company’s contingent exposure could increase if the participation of other carriers decreases. The guarantees will expire when the tax-exempt bonds are paid in

full, which range from 2011 to 2041. The Company did not record a liability at the time these indirect guarantees were made.

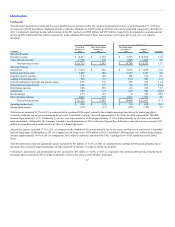

United and Continental—Cash Flows Activities—2011 Compared to 2010

United

Operating Activities

United’s cash from operating activities decreased by $379 million in 2011 as compared to 2010. This year-over-year decrease was primarily due to a decrease

in frequent flyer deferred revenue and advanced purchase of miles. United’s net income in 2011 was $118 million lower than 2010.

Investing Activities

United’s capital expenditures were $464 million and $318 million in 2011 and 2010, respectively. Consistent with UAL’s investing activities discussed

above, United’s capital expenditures in 2011 related to aircraft upgrades across the Company’s fleet for its international premium travel product as well as

various facility and ground equipment projects.

In 2011, purchases of short-term investments, net of proceeds, was $269 million. United did not have any short-term investments in 2010. This year-over-

year increase was primarily due to the placement of additional funds with outside money managers and movement of liquid assets from cash to short-term

investments.

Also, as of December 31, 2011, United had cash collateralized $194 million of letters of credit, most of which had previously been issued and collateralized

under the Amended Credit Facility, resulting in an increase in restricted cash, as discussed in above.

Financing Activities

United’s significant financing activities in 2011 and 2010 are described in the above discussion of UAL’s financing activities in

and Note 14 to the financial statements in Item 8 of this report.

Continental

Operating Activities

Continental’s cash from operating activities decreased by $411 million in 2011 as compared to the combined 2010 period. This year-over-year decrease was

primarily due to a decrease in frequent flyer deferred revenue and advanced purchase of miles, a decrease in receivables and a decrease in advance ticket sales.

55