United Airlines 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

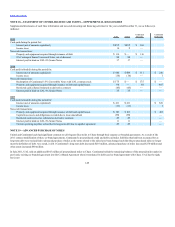

Table of Contents

principal amount of Class B pass-through certificates with a stated interest rate of 6.0%. The proceeds of the issuance of the Class A and Class B pass-

through trusts, which amounted to approximately $427 million, were used to purchase equipment notes issued by Continental. Of the $427 million in

proceeds, $188 million was received in 2010 and the remaining amount was received in 2011. The proceeds were used to fund the acquisition of new aircraft

and in the case of the currently owned aircraft, for general corporate purposes. In 2009, through two transactions Continental created three pass-through trusts

to issue a total of approximately $1.0 billion of certificates. In connection with these transactions, Continental issued $390 million of equipment notes in 2009

and $644 million of equipment notes in 2010. The proceeds from the issuances were used to finance the acquisition of new aircraft and in the case of the

currently owned aircraft, for general corporate purposes. Consistent with the United EETC structure described above, Continental records the debt obligation

upon issuance of the equipment notes rather than upon the initial issuance of EETCs. See Note 16 for additional information related to the Continental

EETCs.

Continental EETCs Secured by Spare Parts Inventory . Continental has two series of notes totaling $304 million, which bear interest at LIBOR plus a

margin that are secured by the majority of its spare parts inventory. In connection with these equipment notes, Continental entered into a collateral maintenance

agreement requiring it, among other things, to maintain a loan-to-collateral value ratio of not greater than 45% with respect to the senior series of equipment

notes and a loan-to-collateral value ratio of not greater than 75% with respect to both series of notes combined. Continental must also maintain a certain level of

rotable components within the spare parts collateral pool. These ratios are calculated semi-annually based on an independent appraisal of the spare parts

collateral pool. If any of the collateral ratio requirements are not met, Continental must take action to meet all ratio requirements by adding additional eligible

spare parts to the collateral pool, redeeming a portion of the outstanding notes, providing other collateral acceptable to the bond insurance policy provider for

the senior series of equipment notes or any combination of the above actions.

Convertible Debt Securities

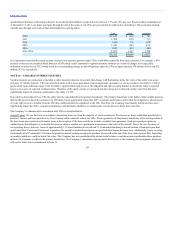

Following the Merger, UAL, Continental and the trustees for Continental’s 4.5% Convertible Notes due 2015 (the “Continental 4.5% Notes”), 5% Convertible

Notes due 2023 (the “Continental 5% Notes”) and 6% Convertible Junior Subordinated Debentures due 2030 (the “6% Convertible Debentures”) entered into

supplemental indenture agreements to make Continental’s convertible debt, which was previously convertible into shares of Continental common stock,

convertible into shares of UAL common stock. For purposes of the Continental separate-entity reporting, as a result of the Continental debt becoming

convertible into the stock of a non-consolidated entity, the embedded conversion options in Continental’s convertible debt are required to be separated and

accounted for as though they are free-standing derivatives. As a result, the carrying value of Continental’s debt, net of current maturities, on a separate-entity

reporting basis as of December 31, 2011 and December 31, 2010 was $4,957 million and $5,536 million, respectively, which is $64 million and $73

million, respectively, lower than the consolidated UAL carrying values on those dates.

In addition, UAL’s contractual commitment to provide common stock to satisfy Continental’s obligation upon conversion of the debt is an embedded call

option on UAL common stock that is also required to be separated and accounted for as though it is a free-standing derivative. The fair value of the indenture

derivatives on a separate-entity reporting basis as of December 31, 2011 and December 31, 2010 was an asset of $193 million and $286 million, respectively.

The fair value of the embedded conversion options as of December 31, 2011 and December 31, 2010, was a liability of $95 million and $164 million,

respectively. The initial contribution of the indenture derivatives to Continental by UAL is accounted for as additional-paid-in-capital in Continental’s separate-

entity financial statements. Changes in fair value of both the indenture derivatives and the embedded conversion options subsequent to October 1, 2010 are

recognized currently in nonoperating income (expense).

Continental 4.5% Notes. The Continental 4.5% Notes are convertible into UAL common stock at a conversion price of approximately $18.93 per share.

Continental does not have the option to pay the conversion price in cash; however, holders of the notes may require Continental to repurchase all or a portion of

the notes for cash at par plus any accrued and unpaid interest if certain changes in control of Continental occur.

139