United Airlines 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

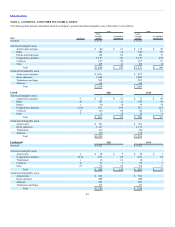

Table of Contents

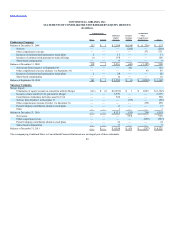

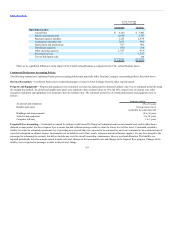

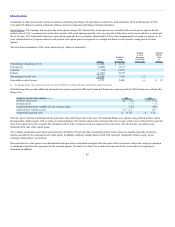

Aircraft fuel $4,204 $3,405

Salaries and related costs 3,919 3,773

Regional capacity purchase 1,523 2,939

Landing fees and other rent 1,011 905

Depreciation and amortization 917 902

Distribution expenses 670 534

Other operating expenses 2,567 956

Purchased services — 1,167

Cost of third party sales — 230

$14,811 $14,811

There are no significant differences in the impact of the United reclassifications as compared to the UAL reclassifications above.

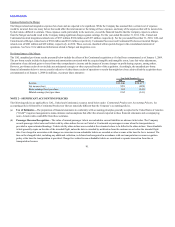

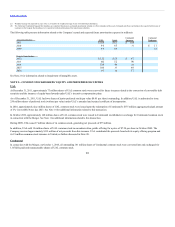

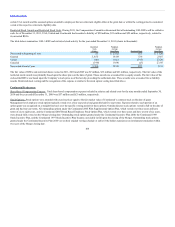

The following summarizes Continental Predecessor accounting policies that materially differ from the Company’s accounting policies, described above.

Continental Predecessor recognized passenger revenue for ticket breakage when the ticket expired unused.

Property and equipment was recorded at cost and was depreciated to estimated residual value over its estimated useful life using

the straight-line method. Jet aircraft and rotable spare parts were assumed to have residual values of 15% and 10%, respectively, of original cost; other

categories of property and equipment were assumed to have no residual value. The estimated useful lives of Continental property and equipment were as

follows:

Jet aircraft and simulators 25 to 30 years

Rotable spare parts

Average lease term or

useful life for related aircraft

Buildings and improvements 10 to 30 years

Vehicles and equipment 5 to 10 years

Computer software 3 to 5 years

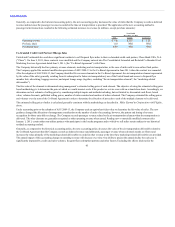

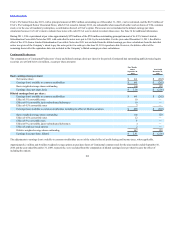

Continental accounted for mileage credits earned by flying on Continental under an incremental cost model, rather than a

deferred revenue model. For those frequent flyer accounts that had sufficient mileage credits to claim the lowest level of free travel, Continental recorded a

liability for either the estimated incremental cost of providing travel awards that were expected to be redeemed for travel on Continental or the contractual rate of

expected redemption on alliance carriers. Incremental cost included the cost of fuel, meals, insurance and miscellaneous supplies, less any fees charged to the

passenger for redeeming the rewards, but did not include any costs for aircraft ownership, maintenance, labor or overhead allocation. The liability was

adjusted periodically based on awards earned, awards redeemed, changes in the incremental costs and changes in the frequent flyer program. Changes in the

liability were recognized as passenger revenue in the period of change.

99