United Airlines 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In the case of the sale of air services, the Company recognizes a portion of the ticket sales as revenue when the air transportation occurs and defers a portion of

the ticket sale representing the value of the related miles. The adoption of Accounting Standards Update 2009-13, Multiple-Deliverable Revenue Arrangements

—a consensus of the FASB Emerging Issues Task Force (“ASU 2009-13”) resulted in the revision of this accounting, effective January 1, 2011.

Under the Company’s prior accounting policy, the Company estimated the weighted average equivalent ticket value by assigning a fair value to the miles that

were issued in connection with the sale of air transportation. The equivalent ticket value is a weighted average ticket value of each outstanding mile, based

upon projected redemption patterns for available award choices when such miles are consumed. The fair value of the miles was deferred and the residual

amount of ticket proceeds was recognized as passenger revenue at the time the air transportation was provided.

The Company began applying the new guidance in 2011 and determines the estimated selling price of the air transportation and miles as if each element is sold

on a separate basis. The total consideration from each ticket sale is then allocated to each of these elements individually on a pro rata basis. The estimated

selling price of miles is computed using an estimated weighted average equivalent ticket value that is adjusted by a sales discount that considers a number of

factors, including ultimate fulfillment expectations associated with miles sold in flight transactions to various customer groups.

Generally, as compared to the historical accounting policy, the new accounting policy decreases the value of miles that the Company records as deferred

revenue and increases the passenger revenue recorded at the time air transportation is provided. The application of the new accounting method to passenger

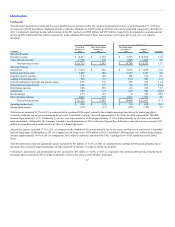

ticket transactions resulted in the following estimated increases to revenue (in millions, except per share amounts):

Operating revenue $340 $215 $125

Per basic share 1.03 NM NM

Per diluted share 0.89 NM NM

United and Continental also each had significant contracts to sell frequent flyer miles to their co-branded credit card partner, Chase. In June 2011, these

contracts were modified and the Company entered into The Consolidated Amended and Restated Co-Branded Card Marketing Services Agreement dated June

9, 2011, (the “Co-Brand Agreement”) with Chase.

The Company historically had two primary revenue elements, marketing and air transportation, in the case of miles sold to non- airline third parties. The

Company applied the material modification provisions of ASU 2009-13 to the Co-Brand Agreement in June 2011 when the contract was amended. After the

adoption of ASU 2009-13, the Company identified five revenue elements in the Co-Brand Agreement: the air transportation element represented by the value of

the mile (generally resulting from its redemption for future air transportation); use of the United brand and access to frequent flyer member lists; advertising;

baggage services; and airport lounge usage (together, excluding “the air transportation element”, the “marketing-related deliverables”).

The fair value of the elements is determined using management’s estimated selling price of each element. The objective of using the estimated selling price based

methodology is to determine the price at which we would transact a sale if the product or service were sold on a stand-alone basis. Accordingly, we determine

our best estimate of selling price by considering multiple inputs and methods including, but not limited to, discounted cash flows, brand value, volume

discounts, published selling prices, number of miles awarded and number of miles redeemed. The Company estimated the selling prices and volumes over the

term of the Co-Brand Agreement in order to determine the allocation of proceeds to each of the multiple elements to be delivered.

57