United Airlines 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

There are no significant amounts included in the balance at December 31, 2011 for tax positions for which the ultimate deductibility is highly certain but for

which there is uncertainty about the timing of such deductibility.

The Company records penalties and interest relating to uncertain tax positions in other operating expenses and interest expense, respectively, in its consolidated

statements of operations. The Company has not recorded any significant expense or liabilities related to interest or penalties in its consolidated financial

statements.

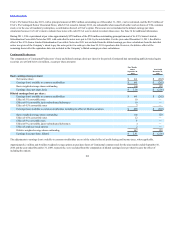

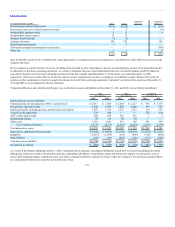

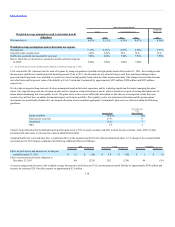

The following is a reconciliation of the beginning and ending amount of unrecognized tax benefits related to UAL’s uncertain tax positions (in millions):

Balance at January 1, $32 $16 $20

Increase due to Continental’s uncertain tax positions at the Merger closing date — 6 —

Increase in unrecognized tax benefits as a result of tax positions taken during the current period 1 10 1

Decrease in unrecognized tax benefits as a result of tax positions taken during a prior period (9) — (5)

Decrease in unrecognized tax benefits relating to settlements with taxing authorities — — —

Balance at December 31, $24 $32 $16

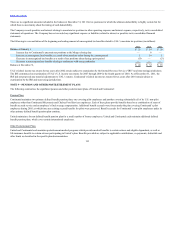

UAL’s federal income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service (“IRS”) and state taxing jurisdictions.

The IRS commenced an examination of UAL’s U.S. income tax returns for 2007 through 2009 in the fourth quarter of 2010. As of December 31, 2011, the

IRS had not proposed any material adjustments to UAL’s returns. Continental’s federal income tax returns for tax years after 2001 remain subject to

examination by the IRS and state taxing jurisdictions.

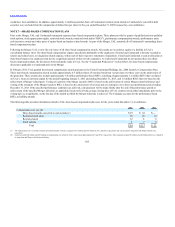

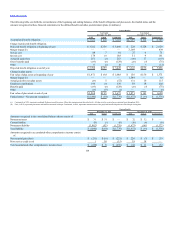

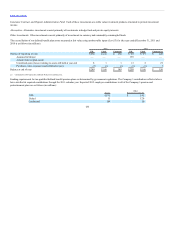

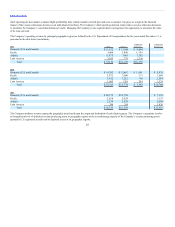

The following summarizes the significant pension and other postretirement plans of United and Continental:

Pension Plans

Continental maintains two primary defined benefit pension plans, one covering pilot employees and another covering substantially all of its U.S. non-pilot

employees other than Continental Micronesia and Chelsea Food Services employees. Each of these plans provide benefits based on a combination of years of

benefit accruals service and an employee’s final average compensation. Additional benefit accruals were frozen under the plan covering Continental’s pilot

employees during 2005, at which time any existing accrued benefits for pilots were preserved. Benefit accruals for Continental’s non-pilot employees under its

other primary defined benefit pension plan continue.

United maintains a frozen defined benefit pension plan for a small number of former employees. United and Continental each maintain additional defined

benefit pension plans, which cover certain international employees.

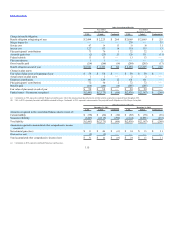

Other Postretirement Plans

United and Continental each maintain postretirement medical programs which provide medical benefits to certain retirees and eligible dependents, as well as

life insurance benefits to certain retirees participating in United’s plan. Benefits provided are subject to applicable contributions, co-payments, deductible and

other limits as described in the specific plan documentation.

113