United Airlines 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

debt obligations, the issuer may be required to pay additional interest at the rate of 2% per annum, provide additional collateral to secure the noteholders’ lien

or repay a portion of the Senior Notes. A breach of certain of the covenants or restrictions contained in the Amended Credit Facility, the Revolving Credit

Facility or the indentures governing the Senior Notes could result in a default and a subsequent acceleration of the applicable debt obligations. The indentures

governing the United Senior Notes contain a cross-acceleration provision pursuant to which a default resulting in the acceleration of indebtedness under the

Amended Credit Facility would result in a default under such indentures. The Revolving Credit Facility includes events of default customary for similar

financings. In addition, the Amended Credit Facility and the Revolving Credit Facility contain cross-default and/or cross-acceleration provisions pursuant to

which default and/or acceleration of certain other material indebtedness of the Company could result in a default under the Amended Credit Facility, the

Revolving Credit Facility, or both.

Capital Commitments and Off-Balance Sheet Arrangements. The Company’s business is capital intensive, requiring significant amounts of capital to

fund the acquisition of assets, particularly aircraft. In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing

debt, by entering into capital or operating leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports

to ensure access to terminal, cargo, maintenance and other required facilities.

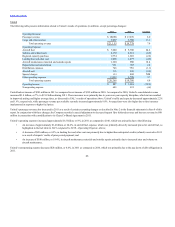

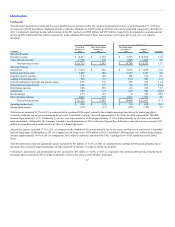

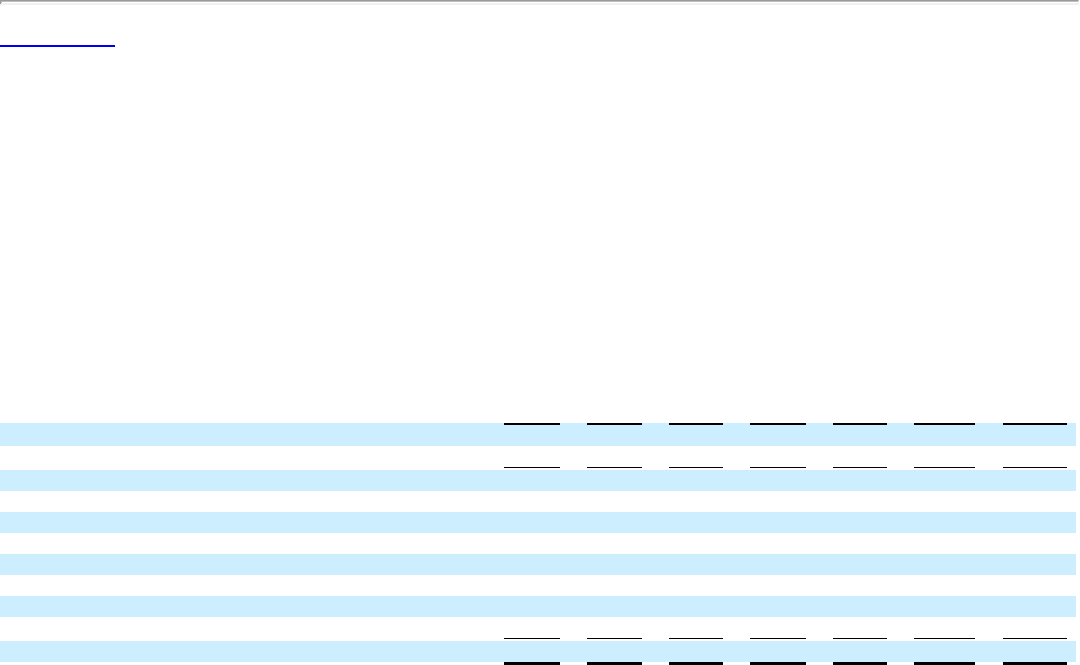

The table below provides a summary of UAL’s material contractual obligations as of December 31, 2011 (in millions):

Long-term debt (a) $1,186 $1,857 $ 2,123 $1,963 $904 $3,874 $11,907

Capital lease obligations—principal portion 125 122 118 116 109 463 1,053

Total debt and capital lease obligations 1,311 1,979 2,241 2,079 1,013 4,337 12,960

Interest on debt and capital lease obligations (b) 800 736 585 463 340 1,702 4,626

Aircraft operating lease obligations 1,688 1,597 1,518 1,243 984 2,391 9,421

Capacity purchase agreements (c) 1,653 1,568 1,403 1,261 1,022 2,855 9,762

Other operating lease obligations 1,222 998 919 795 723 5,738 10,395

Postretirement obligations (d) 147 150 156 163 170 971 1,757

Pension obligations (e) 178 180 181 185 184 1,060 1,968

Capital purchase obligations (f) 1,625 1,091 1,025 1,772 1,817 5,697 13,027

Total contractual obligations $8,624 $8,299 $ 8,028 $7,961 $6,253 $24,751 $63,916

(a) Long-term debt presented in UAL’s financial statements is net of a $225 million debt discount which is being amortized over the debt terms. Contractual payments are not net of the debt discount. Contractual

long-term debt includes $93 million of non-cash obligations as these debt payments are made directly to the creditor by a company that leases three aircraft from United. The creditor’s only recourse to United is

repossession of the aircraft.

(b) Includes interest portion of capital lease obligations of $103 million in 2012, $99 million in 2013, $89 million in 2014, $71 million in 2015, $64 million in 2016 and $373 million thereafter. Future interest

payments on variable rate debt are estimated using estimated future variable rates based on a yield curve.

(c) Represents our estimates of future minimum noncancelable commitments under our capacity purchase agreements and does not include the portion of the underlying obligations for aircraft and facility rent that is

disclosed as part of aircraft and nonaircraft operating leases. Amounts also exclude a portion of United’s capital lease obligation recorded for certain of its capacity purchase agreements. See Note 15 to the financial

statements in Item 8 of this report for the significant assumptions used to estimate the payments.

(d) Amounts represent postretirement benefit payments, net of subsidy receipts, through 2021. Benefit payments approximate plan contributions as plans are substantially unfunded.

(e) Represents estimate of the minimum funding requirements as determined by government regulations for Continental plans only, as the United plans are not material. Amounts are subject to change based on

numerous assumptions, including the performance of assets in the plan and bond rates. See below, for a discussion of our assumptions regarding UAL’s pension plans.

(f) Represents contractual commitments for firm order aircraft and spare engines only, net of previously paid purchase deposits, and noncancelable commitments to purchase goods and services, primarily information

technology support. See Note 17 to the financial statements in Item 8 of this report for a discussion of our purchase commitments.

52