United Airlines 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

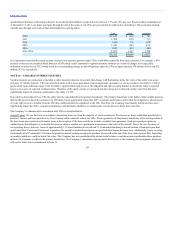

value to debt obligations, which if not met may result in the acceleration of payments under the United Senior Notes. United may meet this minimum ratio by

providing certain non-cash collateral and/or by redeeming, repurchasing or repaying in part the United Senior Notes pursuant to any available optional

redemption provisions of the indentures governing the United Senior Notes. In addition, if United fails to maintain a collateral coverage ratio of 1.5 to 1.0 on

the United Senior Secured Notes, United must pay additional interest on the United Senior Notes at the rate of 2% per annum until the collateral coverage ratio

on the United Senior Secured Notes equals at least 1.5 to 1.0. The indentures governing the United Senior Notes also contain a cross-acceleration provision

pursuant to which a default resulting in the acceleration of indebtedness under the Amended Credit Facility would result in a default under such indentures.

The indentures for the United Senior Notes also include events of default customary for similar financings.

United EETCs. United has several EETC financings currently outstanding. Generally, the structure of all of these EETC financings consist of pass-through

trusts created by United to issue pass-through certificates. The pass-through certificates represent fractional undivided interests in the respective pass-through

trusts and are not obligations of United. The proceeds of the issuance of the pass-through certificates are used to purchase equipment notes which are issued

by United and secured by United’s aircraft. The payment obligations of United under the equipment notes are fully and unconditionally guaranteed by UAL.

In 2009, through two transactions, United created three pass-through trusts that issued a total of approximately $1.5 billion of pass-through certificates. In

connection with these transactions, United issued $161 million of equipment notes in 2009 and the remaining amount of equipment notes ($1.308 billion) in

2010. Proceeds received from the sale of pass-through certificates are initially held by a depository in escrow for the benefit of the certificate holders until

United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These escrowed funds are not guaranteed by

United and are not reported as debt on United’s consolidated balance sheet because the proceeds held by the depositary are not United’s assets. Approximately

$1.1 billion of the 2010 proceeds was used to repay equipment notes related to EETCs that had been issued in prior years and the remaining amount was used

for general corporate purposes. See Note 16 for additional information related to the United EETCs.

6.75% Notes. In August 2010, Continental issued $800 million aggregate principal amount of 6.75% Senior Secured Notes due 2015 (the “6.75% Notes”).

Continental may redeem some or all of the Continental Senior Secured Notes at any time on or after September 15, 2012 at specified redemption prices. If

Continental sells certain of its assets or if it experiences specific kinds of a change in control, Continental will be required to offer to repurchase the notes.

Continental’s obligations under the notes are unconditionally guaranteed by certain of its subsidiaries. The 6.75% Notes and related guarantees are secured by

certain of Continental’s U.S.-Asia and U.S.-London Heathrow routes and related assets, all of the outstanding common stock and other assets of the guarantor

subsidiaries and substantially all of the other assets of the guarantors, including route authorities and related assets.

The indenture for the 6.75% Notes includes covenants that, among other things, restrict Continental’s ability to sell assets, incur additional indebtedness,

issue preferred stock, make investments or pay dividends. In addition, if Continental fails to maintain a collateral coverage ratio of 1.5 to 1.0, Continental

must pay additional interest on notes at the rate of 2% per annum until the collateral coverage ratio equals at least 1.5 to 1.0. The indenture for the 6.75%

Notes also includes events of default customary for similar financings. In conjunction with the issuance of the notes, Continental repaid a $350 million senior

secured term loan credit facility that was due in June 2011.

Continental EETCs Secured by Aircraft. Continental has several EETC financings outstanding, which are similar in structure to the United EETCs

described above. In December 2010, Continental created two pass-through trusts, one of which issued approximately $363 million aggregate principal amount

Class A pass-through certificates with a stated interest rate of 4.75% and one which issued approximately $64 million aggregate

138