United Airlines 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

x

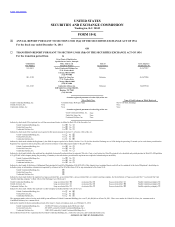

¨

001-06033

Delaware

36-2675207

001-11355

Delaware

36-2675206

001-10323

Delaware

74-2099724

United Continental Holdings, Inc. Common Stock, $0.01 par value New York Stock Exchange

United Air Lines, Inc. None None

Continental Airlines, Inc. None None

United Continental Holdings, Inc. None

United Air Lines, Inc. None

Continental Airlines, Inc. None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

United Continental Holdings, Inc. Yes x No ¨

United Air Lines, Inc. Yes x No ¨

Continental Airlines, Inc. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

United Continental Holdings, Inc. Yes ¨ No x

United Air Lines, Inc. Yes ¨ No x

Continental Airlines, Inc. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

United Continental Holdings, Inc. Yes x No ¨

United Air Lines, Inc. Yes x No ¨

Continental Airlines, Inc. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

United Continental Holdings, Inc. Yes x No ¨

United Air Lines, Inc. Yes x No ¨

Continental Airlines, Inc. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

United Continental Holdings, Inc. x

United Air Lines, Inc. x

Continental Airlines, Inc. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

United Continental Holdings, Inc. Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

United Air Lines, Inc. Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Continental Airlines, Inc. Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

United Continental Holdings, Inc. Yes ¨ No x

United Air Lines, Inc. Yes ¨ No x

Continental Airlines, Inc. Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of United Continental Holdings, Inc. was $7,461,888,499 as of June 30, 2011. There is no market for United Air Lines, Inc. common stock or

Continental Airlines, Inc. common stock.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of February 16, 2012.

United Continental Holdings, Inc. 332,066,655 shares of common stock ($0.01 par value)

United Air Lines, Inc. 205 (100% owned by United Continental Holdings, Inc.)

Continental Airlines, Inc. 1,000 (100% owned by United Continental Holdings, Inc.)

This combined Form 10-K is separately filed by United Continental Holdings, Inc., United Air Lines, Inc. and Continental Airlines, Inc.

Table of contents

-

Page 1

...x The aggregate market value of voting stock held by non-affiliates of United Continental Holdings, Inc. was $7,461,888,499 as of June 30, 2011. There is no market for United Air Lines, Inc. common stock or Continental Airlines, Inc. common stock. Indicate the number of shares outstanding of each of... -

Page 2

United Air Lines, Inc. and Continental Airlines, Inc. meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this form with the reduced disclosure format allowed under that General Instruction. DOCUMENTS INCORPORTTED BY REFERENCE Information ... -

Page 3

... Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management... -

Page 4

... Corporation (the "Merger"). Upon closing of the Merger, UAL Corporation became the parent company of both United and Continental and UAL Corporation's name was changed to United Continental Holdings, Inc. UAL's consolidated financial statements include the results of operations of Continental and... -

Page 5

... to integrate certain employee groups. We currently expect to migrate to a single passenger service system in early March 2012, allowing the Company to operate using a single carrier code, flight schedule, inventory, website and departure control system; and • UAL expects the Merger to deliver... -

Page 6

... comprehensive airline alliance in the world. As of January 1, 2012, Star Alliance carriers served 1,290 airports in 189 countries with over 21,000 daily flights. Current Star Alliance members, in addition to United and Continental, are Adria Airways, Aegean Airlines, Air Canada, Air China, Air New... -

Page 7

..., THAI, Turkish Airlines and US Airways. Shenzhen Airlines, Avianca, TACA ("TACA") and Copa Airlines ("Copa") have been announced as future Star Alliance members. In 2010, United, Continental and Air Canada entered into a memorandum of understanding to establish a revenue sharing trans-border joint... -

Page 8

... rental companies. Mileage credits can be redeemed for free, discounted or upgraded travel and non-travel awards. In 2011, the Company announced that MileagePlus will be the loyalty program for the Company beginning in 2012. OnePass is expected to end in the first quarter 2012, at which point United... -

Page 9

... boarding compensation, tarmac delays, and baggage liability. Airlines are also regulated by the FAA, an agency within the DOT, primarily in the areas of flight safety, air carrier operations, and aircraft maintenance and airworthiness. The FAA issues air carrier operating certificates and aircraft... -

Page 10

..., including air traffic control operations, capacity control, airline competition, aircraft and airport technology requirements, safety, and taxes, fees and other funding sources. Congress may also pass other legislation that could increase labor and operating costs. Climate change legislation is... -

Page 11

...'s fares or rates. However, under the terms of the bilateral agreement, certain points in Japan remain slot restricted and only four slot pairs at Tokyo Haneda International Airport are available to U.S. air carriers at this time, none of which is held by United and Continental. Environmental... -

Page 12

... on aircraft types to be used and limits on the number and scheduling of hourly or daily operations. In some instances, these restrictions have caused curtailments in services or increased operating costs, and could limit our ability to expand our operations at the affected airports. The airline... -

Page 13

... or internal union Merger policies, if applicable. Pending operational integration, the Company will apply the terms of the existing collective bargaining agreements unless other terms have been negotiated. The following table reflects the Company's represented employee groups, number of employees... -

Page 14

...113 4,777 December 2012 December 2009 July 2013 8,516 The Company cannot predict the outcome of negotiations with its unionized employee groups, although significant increases in the pay and benefits resulting from new collective bargaining agreements could have an adverse financial impact on the... -

Page 15

... close to its major hub locations to ensure supply continuity in the short term, the Company cannot predict the continued future availability of aircraft fuel. At times, due to the highly competitive nature of the airline industry, the Company has not been able to increase its fares or other fees... -

Page 16

...and credit card processing agreements, timely pay its debts, or comply with other material provisions of its contractual obligations could result in a variety of adverse consequences, including the acceleration of the Company's indebtedness, increase of required reserves under credit card processing... -

Page 17

... adverse effects on the Company. Laws, regulations, taxes and airport rates and charges, both domestically and internationally, have been proposed from time to time that could significantly increase the cost of airline operations or reduce airline revenue. The Company cannot provide any assurance... -

Page 18

...might limit the number of flights and/or increase costs of operations at certain times or throughout the day. The FAA may limit the Company's airport access by limiting the number of departure and arrival slots at high density traffic airports, which could affect the Company's ownership and transfer... -

Page 19

... and sale of airline seat inventory, provision of information technology infrastructure and services, provision of aircraft maintenance and repairs, provision of various utilities and performance of aircraft fueling operations, among other vital functions and services. The Company does not... -

Page 20

...under Continental's plans depend upon a number of factors, including labor negotiations with the applicable employee groups and changes to pension plan benefits as well as factors outside of UAL's control, such as the number of applicable retiring employees, asset returns, interest rates and changes... -

Page 21

... diminishing the expected benefit to the Company from capacity reductions. This increased competition in both domestic and international markets may have a material adverse effect on the Company's results of operations, financial condition or liquidity. The airline industry may undergo further... -

Page 22

... temporary grounding of the U.S. airline industry's fleet, significantly increased security costs and associated passenger inconvenience, increased insurance costs, substantially higher ticket refunds and significantly decreased traffic and passenger revenue. Additional terrorist attacks, even... -

Page 23

... 382 of the Internal Revenue Code of 1986, as amended ("Section 382"). An ownership change generally occurs if certain stockholders increase their aggregate percentage ownership of a corporation's stock by more than 50 percentage points over their lowest percentage ownership at any time during the... -

Page 24

... income. This limitation is generally determined by multiplying the value of a corporation's stock immediately before the ownership change by the applicable long-term tax-exempt rate. Any unused annual limitation may, subject to certain limits, be carried over to later years, and the limitation may... -

Page 25

... debt outstanding. Holders of these securities may convert them into shares of UAL common stock according to their terms. In addition, certain of UAL's notes include noteholder early redemption options. If a noteholder exercises such option, UAL may elect to pay the repurchase price in cash, shares... -

Page 26

...PROPERTIES Flight Equipment Including aircraft operating by regional carriers on their behalf, Continental and United operated 611 and 645 aircraft, respectively, as of December 31, 2011. UAL's combined fleet as of December 31, 2011 is presented in the table below: Seats in Standard Tircraft Type... -

Page 27

... Analysis of Financial Condition and Results of Operations, and Note 17 in Item 8 of this report for information related to future capital commitments to purchase these aircraft. Facilities United's and Continental's principal facilities relate to leases of airport facilities, gates, hangar sites... -

Page 28

... days' notice or from seeking enforcement of the preliminary injunction itself. EEOC Claim Under the Americans with Disabilities Act On June 5, 2009, the U.S. Equal Employment Opportunity Commission ("EEOC") filed a lawsuit on behalf of five named individuals and other similarly situated employees... -

Page 29

..., 2010, forty-nine purported purchasers of airline tickets filed an antitrust lawsuit in the U.S. District Court for the Northern District of California against Continental and UAL Corporation in connection with the Merger. The plaintiffs alleged that the Merger may substantially lessen competition... -

Page 30

... to member states to include aviation in its greenhouse gas ETS, which required the Company to begin monitoring emissions of carbon dioxide effective January 1, 2010. On December 17, 2009, the Air Transportation Association, joined by United, Continental and American Airlines, filed a lawsuit... -

Page 31

...UAL common stock as of February 16, 2012. There is no trading market for the common stock of United or Continental. UAL, United and Continental did not pay any dividends in 2011 or 2010. Under the provisions of the Amended and Restated Revolving Credit, Term Loan and Guaranty Agreement, dated as of... -

Page 32

... common stock. Note: The stock price performance shown in the graph above should not be considered indicative of potential future stock price performance. The Company did not repurchase any UAL common stock during the fourth quarter of 2011. UAL does not have an active share repurchase program. 31 -

Page 33

... of Continental Successor for the periods from October 1, 2010 to December 31, 2011. UTL Statement of Consolidated Operations Data (In millions, except per share amounts) 2011 2010 Year Ended December 31, 2009 2008 2007 Income Statement Data: Operating revenue Operating expense Operating... -

Page 34

...The 2011 and 2010 operating data includes results of Continental Successor. Year Ended December 31, Mainline Passengers (thousands) (a) Revenue passenger miles ("RPMs") (millions) (b) Available seat miles ("ASMs") (millions) (c) Cargo ton miles (millions) Passenger load factor (d) Mainline Domestic... -

Page 35

... financial statements included in Item 8 of this report. 2011 2010 Year ended December 31, 2009 2008 2007 Net income (loss) excluding special items: Net income (loss) Special revenue item Special charges (income) Other operating expense items Operating non-cash MTM (gain) loss Non-operating non... -

Page 36

..., and non-air frequent flyer mile redemption activity. The Company recorded approximately $240 million of third-party business expenses in 2011. Year ended December 31, 2009 Special Items 2011 2010 2008 2007 Special revenue item Merger and integration-related costs Termination of maintenance... -

Page 37

...are United Air Lines, Inc. (together with its consolidated subsidiaries, "United") and, effective October 1, 2010, Continental Airlines, Inc. (together with its consolidated subsidiaries, "Continental"). Upon closing of the Merger, UAL Corporation changed its name to United Continental Holdings, Inc... -

Page 38

... integrate certain employee groups. We currently expect to migrate to a single passenger service system in early March 2012, allowing the Company to operate using a single carrier code, flight schedule, inventory, website and departure control system. UAL expects the Merger to deliver $1.0 billion... -

Page 39

...would change UAL's annual fuel expense by approximately $95 million. To protect against increases in the prices of fuel, the Company routinely hedges a portion of its future fuel requirements. Labor Costs. As of December 31, 2011, the Company had approximately 72% of employees represented by unions... -

Page 40

... fuel prices. Passenger revenue also increased in 2011 as a result of certain accounting changes, as described in Note 2 to the financial statements in Item 8 of this report. In conjunction with these changes, the Company recorded a special adjustment in 2011 to decrease frequent flyer deferred... -

Page 41

... pay rates primarily driven by new collective bargaining agreements, increase in seniority levels, a one-time signing bonus for certain employee groups and increased accruals in profit sharing and related payroll tax payments in 2011 as compared to 2010. Expenses related to aircraft maintenance... -

Page 42

... December 31 (in millions): 2011 2010 Integration and Merger-related costs Termination of maintenance service contract Aircraft-related (gain), net and aircraft impairment Goodwill impairment credit Intangible asset impairments Other Total special items Tax benefit on intangible asset impairments... -

Page 43

...2010 financial performance to 2009, we quantified the increases relating to our operating results that are due to Continental's results after the Merger closing date. The increases due to the Merger, presented in the tables below, represent actual Continental Successor results for the fourth quarter... -

Page 44

... changes in aircraft fuel cost per gallon for the year ended December 31, 2010 as compared to the year ended December 31, 2009. The 2010 amounts presented in the table below exclude the impact of Continental Successor after the closing date of the Merger. See Note 13 to the financial statements... -

Page 45

... passenger revenue on higher traffic and yields driving increases in commissions, credit card fees and GDS fees. Excluding the impact of the Merger, aircraft rent expense decreased by $20 million, or 5.8%, in 2010 as compared to 2009, primarily as a result of United's retirement of its entire fleet... -

Page 46

... million of fuel hedge gains in 2009. The fuel hedge gains in 2009 resulted from hedge contracts that were not designated as cash flow hedges . United and Continental-Results of Operations-2011 Compared to 2010 United and Continental's Managesent's Discussion and Analysis of Financial Condition and... -

Page 47

... fuel prices. United's passenger revenue also increased in 2011 as a result of certain accounting changes as described in Note 2 to the financial statements in Item 8 of this report. In conjunction with these changes, the Company recorded a special adjustment to decrease frequent flyer deferred... -

Page 48

... markets. Additionally, the Company recorded a special adjustment in 2011 to decrease frequent flyer deferred revenue and increase revenue by $19 million in connection with a modification to its Chase Co-Brand Agreement. Aircraft fuel expense increased 37.2% in 2011 as compared to the combined 2010... -

Page 49

... acquisition accounting. Liquidity and Capital Resources As of December 31, 2011, UAL had $7.8 billion in unrestricted cash, cash equivalents and short-term investments, which is $918 million lower than at December 31, 2010. The Company also has a $500 million undrawn Credit and Guaranty Agreement... -

Page 50

... to the Company's improved operational performance in 2011. The Company's increased revenues were offset in part by higher cash operating expenses resulting from the Merger, including fuel and aircraft maintenance expense. 2010 cospared to 2009 UAL's cash from operating activities increased by $941... -

Page 51

...UAL's 4.5% Senior Limited-Subordination Convertible Notes; and Continental received $239 million in 2011 from its December 2010 pass-through trust financing. The proceeds were used to fund the acquisition of new aircraft and in the case of the currently owned aircraft, for general corporate purposes... -

Page 52

...commitments. Pension and other postretirement benefit obligations Investment in student loan-related auction rate securities Fuel hedges Long-term debt and related covenants Operating leases Regional capacity purchase agreements Guarantees and indemnifications, credit card processing agreements, and... -

Page 53

... (f) Long-term debt presented in UAL's financial statements is net of a $225 million debt discount which is being amortized over the debt terms. Contractual payments are not net of the debt discount. Contractual long-term debt includes $93 million of non-cash obligations as these debt payments are... -

Page 54

...flights (including the United Kingdom's Air Passenger Duty and Germany's departure ticket tax), limited greenhouse gas reporting requirements, and the State of California's cap and trade regulations (which impacts United's San Francisco maintenance center). In addition, there are land-based planning... -

Page 55

...of tax-exempt special facilities revenue bonds and interest thereon, excluding the US Airways contingent liability described below. These bonds, issued by various airport municipalities, are payable solely from rentals paid under long-term agreements with the respective governing bodies. The leasing... -

Page 56

... to aircraft upgrades across the Company's fleet for its international premium travel product as well as various facility and ground equipment projects. In 2011, purchases of short-term investments, net of proceeds, was $269 million. United did not have any short-term investments in 2010. This year... -

Page 57

... in the Company's loyalty programs. We sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free, discounted or upgraded air travel and non-travel awards. The Company records... -

Page 58

...the Company identified five revenue elements in the Co-Brand Agreement: the air transportation element represented by the value of the mile (generally resulting from its redemption for future air transportation); use of the United brand and access to frequent flyer member lists; advertising; baggage... -

Page 59

... Continental Operating revenue Per basic share Per diluted share $ 260 0.79 0.68 $ 180 NM NM $ 80 NM NM Effective January 1, 2012, UAL updated its estimated selling price for miles to the rate at which we sell miles to our Star Alliance partners participating in reciprocal frequent flyer... -

Page 60

... number of critical management assumptions including estimates of future capacity, passenger yield, traffic, operating costs (including fuel prices), appropriate discount rates and other relevant assumptions. The market approach computes fair value by adding a control premium to the Company's market... -

Page 61

... Company's fleet plan and other relevant information. A one year increase in the average depreciable life of UAL's flight equipment would reduce annual depreciation expense on flight equipment by approximately $45 million. United's aircraft impairments during 2010 and 2009 were due to aircraft that... -

Page 62

... long-term rate of return on plan assets by an additional 50 basis points (from 7.75% to 7.25%) would increase estimated 2012 pension expense by approximately $8 million. Future pension obligations for the Continental plans were discounted using a weighted average rate of 5.13% at December 31, 2011... -

Page 63

...31, 2011 and 2010, respectively. The yearover-year increase is due to changes in the assumptions used to value the obligation for UAL's plan, such as the decrease in the discount rate. The calculation of other postretirement benefit expense and obligations requires the use of a number of assumptions... -

Page 64

...based upon information available to the Company on the date of this report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as required by applicable law... -

Page 65

... 2011 levels, a 100 basis point increase in interest rates would result in a corresponding increase in UAL, United and Continental interest income of approximately $63 million, $37 million and $26 million, respectively, during 2012. Commodity Price Risk (Aircraft Fuel). Our results of operations... -

Page 66

... table summarizes information related to the Company's cost of fuel and hedging (in millions, except percentages): UTL United Continental Fuel Costs In 2011, fuel cost as a percent of total operating expenses (a) Impact of $1 increase in price per barrel of aircraft fuel on annual fuel expense... -

Page 67

... times, the Company uses derivative financial instruments to hedge its exposure to foreign currency. The Company does not enter into derivative instruments for non-risk management purposes. The result of a uniform 10 percent strengthening in the value of the U.S. dollar from December 31, 2011 levels... -

Page 68

... the consolidated financial statements, the Company elected to change its method of accounting for frequent flyer award breakage in 2010. As discussed in Note 2 to the consolidated financial statements, the Company has changed its method of accounting for multiple deliverable revenue recognition as... -

Page 69

... Board of Directors and Stockholders of United Continental Holdings, Inc. Chicago, Illinois We have audited the accompanying statements of consolidated operations, consolidated comprehensive income (loss), consolidated stockholders' equity (deficit), and consolidated cash flows of United Continental... -

Page 70

... Board of Directors and Stockholder of United Air Lines, Inc. We have audited the accompanying consolidated balance sheets of United Air Lines, Inc. (the "Company") as of December 31, 2011 and December 31, 2010, and the related statements of consolidated operations, comprehensive income (loss), cash... -

Page 71

...consolidated operations, consolidated comprehensive income (loss), consolidated stockholder's deficit, and consolidated cash flows of United Air Lines, Inc. and subsidiaries (the "Company") for the year ended December 31, 2009. Our audit also included the financial statement schedule for 2009 listed... -

Page 72

... whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company's internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are... -

Page 73

... per share amounts) Year Ended December 31, 2011 2010 2009 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Special revenue item Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and... -

Page 74

... UNITED CONTINENTTL HOLDINGS, INC. STTTEMENTS OF CONSOLIDTTED COMPREHENSIVE INCOME (LOSS) (In millions) Year Ended December 31, 2011 2010 2009 Net income (loss) $ 840 $ 253 95 257 352 $ 605 $ (651) (73) Other comprehensive income (loss), net: Net change related to employee benefit plans... -

Page 75

... millions, except shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments Total unrestricted cash, cash equivalents and short-term investments Restricted cash Receivables, less allowance for doubtful accounts (2011-$7; 2010-$6) Aircraft fuel, spare parts and... -

Page 76

...-term debt Long-term obligations under capital leases 1,036 3,491 2,344 1,473 1,159 1,585 1,371 1,333 12,756 Other liabilities and deferred credits: Frequent flyer deferred revenue Postretirement benefit liability Pension liability Advanced purchase of miles Deferred income taxes Lease fair value... -

Page 77

...long-term debt Proceeds from exercise of stock options Decrease in aircraft lease deposits Increase in deferred financing costs Purchases of treasury stock Proceeds from sale of common stock Net cash provided by (used in) financing activities Net increase (decrease) in cash and cash equivalents Cash... -

Page 78

... for Continental common stock Equity component of Continental convertible debt assumed in Merger Shares issued in exchange for redemption of Continental convertible debt Fair value of Continental stock options related to Merger Share-based compensation Proceeds from exercise of stock options - - 26... -

Page 79

... (In millions) Year Ended December 31, 2011 2010 2009 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Special revenue item Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other... -

Page 80

... UNITED TIR LINES, INC. STTTEMENTS OF CONSOLIDTTED COMPREHENSIVE INCOME (LOSS) (In millions) Year Ended December 31, 2011 2010 2009 Net income (loss) $ 281 29 (248) $ 399 (148) 204 $ (628) (73) Other comprehensive income (loss), net: Net change related to employee benefit plans Net change... -

Page 81

... UNITED TIR LINES, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments 2011 2010 $ 3,458 275 3,733 40 $ 4,665 - 4,665 37 1,004 321 373 Total unrestricted cash, cash equivalents and short-term... -

Page 82

... UNITED TIR LINES, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) Tt December 31, LITBILITIES TND STOCKHOLDER'S DEFICIT Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt... -

Page 83

... asset sale-leasebacks Other, net Net cash used in investing activities Cash Flows from Financing Activities: Payments of long-term debt Principal payments under capital leases Decrease in aircraft lease deposits Increase in deferred financing costs Proceeds from exercise of stock options Proceeds... -

Page 84

... 31, 2009 Net income Other comprehensive income Share-based compensation Parent Company contribution related to stock plans Balance at December 31, 2010 Net income Other comprehensive loss Share-based compensation Parent Company contribution related to stock plans Balance at December 31, 2011... -

Page 85

... 30, 2011 2010 2010 Year Ended December 31, 2009 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Special revenue item Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other... -

Page 86

... Nine Months Ended December 31, September 30, 2011 2010 2010 Year Ended December 31, 2009 Net income (loss) Other comprehensive income (loss): Net change related to employee benefit plans Net change in gains (losses) on financial instruments Tax expense on other comprehensive income (loss... -

Page 87

... SHEETS (In millions, except shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments Total cash, cash equivalents and short-term investments Receivables, less allowance for doubtful accounts (2011-$2; 2010-$1) Aircraft fuel, spare parts and supplies, less... -

Page 88

...784 1,374 522 5,475 Long-term debt Long-term obligation under capital leases Other liabilities and deferred credits: Frequent flyer deferred revenue Postretirement benefit liability Pension liability Advanced purchase of miles Deferred income taxes Lease fair value adjustment, net Other 507 6,027... -

Page 89

... Special charges, non-cash portion Debt and lease discount amortization Deferred income taxes Share-based compensation Other operating activities Changes in operating assets and liabilities, net of Merger- Increase in frequent flyer deferred revenue and advanced purchase of miles (Increase... -

Page 90

... (October 1 to December 31) Parent Company contribution related to stock plans Other Balance at December 31, 2010 Net income Other comprehensive loss Parent Company contribution related to stock plans Share-based compensation Balance at December 31, 2011 (141) $ (1) $(2,254) 3,579 520... -

Page 91

... (the "Merger"). Upon closing of the Merger, UAL Corporation became the parent company of both Continental and United and UAL Corporation's name was changed to United Continental Holdings, Inc. Pursuant to the terms of the Merger agreement, each outstanding share of Continental common stock was... -

Page 92

... sales and tickets sold by other airlines for use on United or Continental as passenger revenue when the transportation is provided or upon estimated breakage. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable tickets generally... -

Page 93

... in the Company's loyalty programs. We sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies, and our participating airline partners. Miles can be redeemed for free, discounted or upgraded air travel and non-travel awards. The Company records... -

Page 94

... Continental Operating revenue Per basic share Per diluted share $ 340 1.03 0.89 $215 NM NM $ 125 NM NM Co-branded Credit Card Partner Mileage Sales United and Continental also each have significant contracts to sell frequent flyer miles to their co-branded credit card partner, Chase Bank... -

Page 95

... information related to the Company's frequent flyer deferred revenue (in millions, except rates): UTL United Continental Frequent flyer deferred revenue at December 31, 2011 % of miles earned expected to expire or go unredeemed Impact of 1% change in outstanding miles or estimated selling price... -

Page 96

... award miles balance. The Company currently does not expect a material impact in redemptions when moving to a single loyalty program. Also, effective January 1, 2012, United updated its estimated selling price for miles to the contractual rate at which we sell miles to our Star Alliance partners... -

Page 97

... line basis over the related lease term. Regional Capacity Purchase- Payments made to regional carriers under capacity purchase agreements are reported in regional capacity purchase in our consolidated statement of operations. As of December 31, 2011, United has call options on 196 regional jet... -

Page 98

...'s carrying value and fair market value. See Note 21 for information related to asset impairments recognized in 2010 and 2009. (n) Share-Based Compensation- The Company measures the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value... -

Page 99

... with non-air redemption of frequent flyer miles for awards which were previously reported on a net basis in revenue in their 2010 consolidated statements of operations to reclassify them from passenger revenue to other operating expenses. In addition, UAL, United and Continental Successor changed... -

Page 100

...For those frequent flyer accounts that had sufficient mileage credits to claim the lowest level of free travel, Continental recorded a liability for either the estimated incremental cost of providing travel awards that were expected to be redeemed for travel on Continental or the contractual rate of... -

Page 101

... employer participates, the level of an employer's participation in significant multiemployer plans, the financial health of significant multiemployer plans, and the nature of employer commitments to the plan. ASU 2011-09 is effective for the Company's annual reporting period ended December 31, 2011... -

Page 102

...606 593 404 Unamortized intangible assets Airport slots and gates Route authorities Tradenames and logos Alliances Total United Amortized intangible assets Airport slots and gates $ 3,614 2011 $ 3,600 2010 9 20 3 $ Hubs Patents Frequent flyer database Contracts Other Total 72 145 70 $ 52 44... -

Page 103

...common stock were reserved for future issuance related to the conversion of convertible debt securities and the issuance of equity based awards under UAL's incentive compensation plans. As of December 31, 2011, UAL had two shares of junior preferred stock (par value $0.01 per share) outstanding. In... -

Page 104

... stock ($0.01 par value), all of which are owned by UAL as of December 31, 2011. In August 2009, Continental completed a public offering of 14 million shares of its Continental common stock at a price of $11.20 per share, raising net proceeds of $158 million. Proceeds were used for general corporate... -

Page 105

... the related effect of profit sharing and income taxes, where applicable. Approximately 2 million and 8 million weighted average options to purchase shares of Continental common stock for the nine months ended September 30, 2010 and the year ended December 31, 2009, respectively, were excluded from... -

Page 106

... awards. The following table provides information related to UAL share-based compensation plan cost, for the years ended December 31, (in millions): 2011 2010 2009 Compensation cost: (a), (b) Share-based awards converted to cash awards (c) Restricted stock units Restricted stock Stock options Total... -

Page 107

... average closing price per share of Continental common stock for the 20 trading days preceding the completion of the Merger. Merger Impacts-United Share-Based Awards . In May 2010, the UAL Board of Directors made a determination that the Merger should be considered a change of control for purposes... -

Page 108

...information for options granted in 2009 and Continental Predecessor options granted in 2010 which were valued at the Merger date: Weighted-average fair value assumptions: 2010 2009 Risk-free interest rate Dividend yield Expected market price volatility of UAL common stock Expected life of options... -

Page 109

... market value of Continental's common stock on the date of grant. Management level employee stock options typically vested over a four year period and generally had five year terms. Expense related to each portion of an option grant was recognized on a straight-line basis over the specific vesting... -

Page 110

...the number of PBRSUs subject to the award, the average closing price of Continental common stock during the 20 trading days preceding the payment date and the payment percentage set by the Human Resources Committee of Continental's Board of Directors for achieving the applicable profit sharing-based... -

Page 111

...): Year Ended December 31, 2011 UTL United Continental Successor Continental Predecessor Income tax provision at statutory rate State income taxes, net of federal income tax benefit Nondeductible acquisition costs Nondeductible employee meals Nondeductible interest expense Derivative market... -

Page 112

...31, Continental December 31, 2011 2010 2011 2010 2011 2010 Deferred income tax asset (liability): Federal and state net operating loss ("NOL") carryforwards Frequent flyer deferred revenue Employee benefits, including pension, postretirement and medical Lease fair value adjustment AMT credit... -

Page 113

... of Contents would be able to use those losses and tax benefits on a separate return basis. Tax liabilities between group members are settled in cash when the losses and tax benefits of one group have been fully exhausted and the Company begins making tax payments to tax authorities. Additionally... -

Page 114

... financial statements. The following is a reconciliation of the beginning and ending amount of unrecognized tax benefits related to UAL's uncertain tax positions (in millions): 2011 2010 2009 Balance at January 1, Increase due to Continental's uncertain tax positions at the Merger closing date... -

Page 115

... recognized in these financial statements for the defined benefit and other postretirement plans (in millions): Pension Benefits Year Ended Year Ended December 31, 2011 December 31, 2010 Continental UTL United UTL United Continental (a) Accumulated benefit obligation: Change in projected... -

Page 116

... Other Postretirement Benefits Year Ended Year Ended December 31, 2011 December 31, 2010 Continental UTL United UTL United Continental (a) Change in benefit obligation: Benefit obligation at beginning of year Merger impact (b) Service cost Interest cost Plan participants' contributions... -

Page 117

...2010 Pension Benefits Continental Successor UTL United Continental Predecessor UTL Other Postretirement Benefits Continental United Successor Continental Predecessor Service cost Interest cost Expected return on plan assets Curtailment gain Amortization of prior service cost (credit) Special... -

Page 118

... Pension Benefits United Continental Successor Continental Predecessor Weighted-average assumptions used to determine benefit obligations Discount rate (a) Rate of compensation increase (a) Weighted-average assumptions used to determine net expense Discount rate Expected return on plan assets... -

Page 119

... rate was selected using a cash flow matching technique where projected benefit payments were matched to a yield curve based on high quality bond yields as of the measurement date. This change increased the discount rate which lowered the present value of the liability at UAL, United and Continental... -

Page 120

...us to develop our own assumptions about how market participants would price the assets or liabilities The following tables present information about the Company's pension and other postretirement plan assets at December 31, (in millions): UTL-2011 UTL-2010 Level 3 Total Pension Plan Assets: Equity... -

Page 121

... benefit plan assets measured at fair value using unobservable inputs (Level 3) for the years ended December 31, 2011 and 2010 is as follows (in millions): 2011 UTL United 2010 Continental UTL United Continental (a) Balance at beginning of year Assumed in Merger Actual return on plan assets... -

Page 122

..., 2010 and 2009. Multi-Employer Plans In 2006, United began participating in the IAM National Pension Plan ("IAM Plan") with respect to certain employees. The IAM Plan is a multi-employer pension plan whereby contributions by the participating company are based on covered hours by the applicable... -

Page 123

...'s annual eligible earnings to the eligible earnings of all qualified co-workers in all domestic workgroups. The international profit sharing plan paid eligible non-U.S. co-workers the same percentage of eligible pay that is calculated under the U.S. profit sharing plan. During 2010, United and... -

Page 124

... management the opportunity to maximize the value of its route network. The Company's operating revenue by principal geographic region (as defined by the U.S. Department of Transportation) for the years ended December 31, is presented in the table below (in millions): 2011 UTL United Continental... -

Page 125

... Gain (Loss) on Derivatives and other Financial UTL Cost Instruments Total Balance at December 31, 2008 Change in fair value of financial instruments Employee benefit plans: Reclassification of unrecognized net actuarial gains into earnings Current year actuarial loss Balance at December 31... -

Page 126

... Prior Service United Cost Unrealized Gain (Loss) on Derivative Instruments and Other Total Balance at December 31, 2008 Change in fair value of financial instruments Employee benefit plans: Reclassification of unrecognized net actuarial gains into earnings Current year actuarial loss Balance... -

Page 127

... December 31, 2009 Derivative financial instruments: Reclassification of losses into earnings Change in fair value of derivatives Employee benefit plans: Reclassification of unrecognized net actuarial loss into earnings Reclassification of prior service cost into earnings Current year actuarial loss... -

Page 128

... value on a recurring basis in the Company's financial statements as of December 31 (in millions): 2011 Total Level 1 Level 2 Level 3 Total 2010 Level 1 Level 2 Level 3 UTL Cash and cash equivalents Short-term investments: Auction rate securities CDARS Asset-backed securities Corporate debt... -

Page 129

... - 19 $ 66 For 2010 and 2011, United's only Level Three recurring measurements are the above enhanced equipment trust certificate ("EETC") securities. As of December 31, 2011, Continental's auction rate securities, which had a par value of $135 million and an amortized cost basis of $110 million... -

Page 130

... terms, risk-free interest rates and forward exchange rates. Fair values were based on either market prices or the discounted amount of future cash flows using our current incremental rate of borrowing for similar liabilities. The Company used a binomial lattice model to value the conversion options... -

Page 131

... $ 120 29 - $ 120 29 $- United Nonoperating aircraft and spare engines Routes Continental Airport slots $- - $ 4 $ - The Company utilized the market approach to estimate the fair value of its aircraft. The Company determined the estimated fair value of the routes using an income approach. Slots... -

Page 132

... of cash may be required to obtain aircraft fuel for operations. To protect against increases in the prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. The Company uses fixed price swaps, purchased call options, collars or other commonly used financial... -

Page 133

...'s financial statements. As of December 31, 2011 and December 31, 2010, all of the Company's fuel derivatives were designated as cash flow hedges. At December 31, the Company's derivatives were reported in its consolidated balance sheets as follows (in millions): Balance Sheet 2011 UTL United 2010... -

Page 134

...75% senior secured notes due 2015 Advance purchases of mileage credits Unsecured 6% convertible junior subordinated debentures due 2030 4.5% convertible notes due 2015 8.75% note payable due 2011 Other Less: unamortized debt (discount) premium Less: current maturities Long-term debt, net-Continental... -

Page 135

... annual basis and the performance bonds have expiration dates through 2015. The table below presents the Company's contractual principal payments at December 31, 2011 under then-outstanding long-term debt agreements in each of the next five calendar years (in millions): UTL United Continental 2012... -

Page 136

... may elect to pay the redemption price in shares of UAL common stock only if the closing price of UAL common stock has not been less than 125% of the conversion price for the 60 consecutive trading days immediately prior to the redemption date. 5% Notes. In the first quarter of 2011, UAL repurchased... -

Page 137

...callable, at UAL's option, at any time at par, plus accrued and unpaid interest, and can be redeemed with cash, shares of UAL common stock or a combination thereof. Upon a change in control or the occurrence of a "fundamental change" as defined in the indenture governing the 6% Senior Notes, UAL has... -

Page 138

..., the "United Senior Notes"). United may redeem some or all of the United Senior Notes at any time on or after February 1, 2012 at specified redemption prices. If United sells certain of its assets or if it experiences specific kinds of a change in control, United will be required to offer to... -

Page 139

... due 2015 (the "6.75% Notes"). Continental may redeem some or all of the Continental Senior Secured Notes at any time on or after September 15, 2012 at specified redemption prices. If Continental sells certain of its assets or if it experiences specific kinds of a change in control, Continental will... -

Page 140

... in 2011. The proceeds were used to fund the acquisition of new aircraft and in the case of the currently owned aircraft, for general corporate purposes. In 2009, through two transactions Continental created three pass-through trusts to issue a total of approximately $1.0 billion of certificates. In... -

Page 141

... preferred securities, called Term Income Deferrable Equity Securities (the "TIDES"). The TIDES have a liquidation value of $50 per preferred security and are convertible at any time at the option of the holder into shares of UAL common stock at a conversion rate of $57.14 per share of common stock... -

Page 142

..., office and computer equipment and vehicles. At December 31, 2011, the Company's scheduled future minimum lease payments under operating leases having initial or remaining noncancelable lease terms of more than one year, aircraft leases, including aircraft rent under capacity purchase agreements... -

Page 143

...-six years, with expiration dates ranging from 2012 through 2025. Under the terms of most leases, the Company has the right to purchase the aircraft at the end of the lease term, in some cases at fair market value, and in others, at fair market value or a percentage of cost. The Company has facility... -

Page 144

...-line basis as an increase (decrease) to rent expense over the individual applicable remaining lease terms, resulting in recognition of rent expense as if the Company had entered into the leases at market rates. The related remaining lease terms are one to 13 years for United and one to 14 years... -

Page 145

... as of December 31, 2011, our future payments through the end of the terms of our CPAs are presented in the table below (in millions). These amounts exclude variable pass-through costs such as fuel and landing fees, among others. UTL United Continental 2012 2013 2014 2015 2016 After 2016 $ 1,653... -

Page 146

... improved loan-to-value ratios for more senior debt classes. These credit enhancements lower the Company's total borrowing cost. Pass-through trusts are established to receive principal and interest payments on the equipment notes purchased by the pass-through trusts from the Company and remit these... -

Page 147

... as of December 31, 2011, which primarily relate to the acquisition of aircraft and related spare engines, aircraft improvements and include other commitments primarily to acquire information technology services and assets (in millions): UTL United Continental 2012 2013 2014 2015 2016 After 2016... -

Page 148

...air travel and other services. Under certain of United's and Continental's credit card processing agreements, the financial institutions either require, or under certain circumstances have the right to require, that United and Continental maintain a reserve equal to a portion of advance ticket sales... -

Page 149

... other increased costs that the lenders incur in carrying these loans as a result of any change in law, subject in most cases to certain mitigation obligations of the lenders. At December 31, 2011, UAL had $2.9 billion of floating rate debt (consisting of United's $2.1 billion and Continental's $820... -

Page 150

... to sell frequent flyer miles to Chase through their separate co-branded agreements. As a result of the 2011 contract modification of these co-brand agreements, Continental's pre-purchased credit and debit card miles liabilities that had been accounted for as long-term debt were reclassified... -

Page 151

... and United advanced ticket sales liability will increase accordingly. Revenue will continue to be recorded by the carrier that is operating the flight. The Company also plans to merge Continental and United into one legal entity. Once this legal Merger occurs, the financial statements of United and... -

Page 152

... second quarter of 2011, the Company modified the previously existing United and Continental cobranded credit card agreements with Chase as a result of the Merger. This modification resulted in the following one-time adjustment to decrease frequent flyer deferred revenue and increase special revenue... -

Page 153

...values, which were primarily developed using income methodologies, as described in Note 12. Other During 2011, both United and Continental adjusted their reserves for certain legal matters. UAL and United Aircraft impairments The aircraft impairments summarized in the table above for 2010 and 2009... -

Page 154

... million for the sale of two Boeing 737-500 aircraft and other special charges of $12 million which primarily related to an increase in Continental's reserve for unused facilities due to a reduction in expected sublease income for a maintenance hangar in Denver. 2009 For the year ended December 31... -

Page 155

... 2009, Continental entered into agreements to sublease five temporarily grounded ERJ-135 aircraft to Chautauqua beginning in the third quarter of 2009. These aircraft are not operated for Continental. The subleases have terms of five years, but may be canceled by the lessee under certain conditions... -

Page 156

... with the Merger. The expected total salary-related expense is reflected in the 2011 accrual and is expected to be paid by 2012. The UAL and United accrual activity in 2009 primarily relates to the UAL and United operational plans that included a fleet retirement of 100 aircraft and headcount... -

Page 157

... June 30 Quarter Ended September 30 December 31 2011 Operating earnings: Revenue-Co-brand Agreement modification (Note 2(c)) Integration-related costs Termination of maintenance service contract Aircraft-related charges (gains), net Intangible asset impairment Other special items Total integration... -

Page 158

... fourth quarter of 2011 will have a favorable impact on our internal controls over financial reporting. On October 1, 2010, UAL and Continental completed the Merger transaction. We are currently integrating policies, processes, people, technology and operations for the combined company. Management... -

Page 159

... of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records... -

Page 160

... United's Chief Executive Officer and Chief Financial Officer, United conducted an evaluation of the design and operating effectiveness of our internal control over financial reporting as of December 31, 2011. In making this assessment, management used the framework set forth in Internal Control... -

Page 161

...of the Securities and Exchange Commission that permit United to provide only management's report in this annual report. Continental Tirlines, Inc. Management Report on Internal Control Over Financial Reporting February 22, 2012 To the Stockholder of Continental Airlines, Inc. Chicago, Illinois The... -

Page 162

..., United and Continental since February 2012. From December 2010 to February 2012, he served as Senior Vice President, General Counsel and Secretary of UAL, United and Continental. From June 2009 to December 2010, Mr. Hart served as Executive Vice President, General Counsel and Corporate Secretary... -

Page 163

... served as Vice President-Financial Planning and Analysis of Continental. Mr. Rowe joined Continental in 1993. Jeffery T. Smisek. Age 57. Mr. Smisek has been President and Chief Executive Officer of UAL and Chairman, President and Chief Executive Officer of United and Continental since October 2010... -

Page 164

... its 2012 Annual Meeting of Stockholders. Information required by this item with respect to United and Continental is omitted pursuant to General Instruction I(2)(c) of Form 10-K. ITEM 14. PRINCIPTL TCCOUNTTNT FEES TND SERVICES. The Audit Committee of the UAL Board of Directors adopted a policy... -

Page 165

... the Merger. AUDIT FEES For 2011, audit fees consist primarily of the audit and quarterly reviews of the consolidated financial statements (including an audit of the effectiveness of the company's internal control over financial reporting), including audits covering United Continental Holdings, Inc... -

Page 166

.... The financial statement schedule required by this item is listed below and included in this report after the signature page hereto. Schedule II-Valuation and Qualifying Accounts for the years ended December 31, 2011, 2010 and 2009. All other schedules are omitted because they are not applicable... -

Page 167

...thereunto duly authorized. UNITED CONTINENTAL HOLDINGS, INC. UNITED AIR LINES, INC. CONTINENTAL AIRLINES, INC. (Registrants) By /s/ ZANE C. ROWE Zane C. Rowe Executive Vice President and Chief Financial Officer Date: February 22, 2012 Pursuant to the requirements of the Securities Exchange Act of... -

Page 168

... Vice President and Chief Financial Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Director /s/ CHRIS KENNY Chris Kenny /s/ JAMES E. COMPTON James E. Compton /s/ PETER D. MCDONALD Peter D. McDonald Date: February 22, 2012 Director... -

Page 169

... of Continental Airlines, Inc. and in the capacities and on the date indicated. Signature Capacity /s/ JEFFERY A. SMISEK Jeffery A. Smisek Chairman, President and Chief Executive Officer (Principal Executive Officer) Executive Vice President and Chief Financial Officer and Director (Principal... -

Page 170

...-United: 2011 2010 2009 $ $ 182 $ 289 2 - (225) $ 17 239 105 201 Valuation allowance for deferred tax assets-Continental: 2011 October 1 to December 31, 2010 (Successor Company) January 1 to September 30, 2010 (Predecessor Company) 2009 (Predecessor Company) (a) $ - Deduction from reserve... -

Page 171

... 2010, Commission file number 1-10323, and incorporated herein by reference) Instruments Defining Rights of Security Holders, Including Indentures *4.1 UAL United Amended and Restated Revolving Credit, Term Loan and Guaranty Agreement, dated as of February 2, 2007, by and among United Air Lines... -

Page 172

... of 12.75% Senior Secured Notes due 2012 (filed as Exhibit 4.15 to UAL's Form 8-K dated July 2, 2009, Commission file number 1-6033, and incorporated herein by reference) A Mortgage and Security Agreement, dated as of July 2, 2009, by and among United Air Lines, Inc. and Wells Fargo Bank Northwest... -

Page 173

....75% Senior Secured Notes due 2012 (filed as Exhibit 4.8 to UAL's Form 8-K dated July 2, 2009, Commission file number 1-6033, and incorporated herein by reference) *4.14 Indenture, dated as of October 7, 2009, by and between UAL Corporation, as Issuer, and The Bank of New York Mellon Trust Company... -

Page 174

... 14, 2006, Commission file number 1-10323, and incorporated herein by reference) Credit and Guaranty Agreement, dated as of December 22, 2011, by and among Continental Airlines, Inc., United Air Lines, Inc., as Co-Borrowers, and United Continental Holdings, Inc. as Parent and Guarantor, the lenders... -

Page 175

... United Continental Holdings, Inc. Profit Sharing Plan, as amended and restated, effective January 1, 2011 (filed as Exhibit 10.1 to UAL's Form 10-K for the year ended December 31, 2010, Commission file number 1-6033, and incorporated herein by reference) *†10.2 UAL Employment Agreement, dated... -

Page 176

... June 30, 2011, Commission file number 1-0633, and incorporated herein by reference) Confidentiality and Non-Competition Agreement, dated April 23, 2009, by and among Continental Airlines, Inc. and Jeffery A. Smisek (filed as Exhibit 10.1 to Continental Airlines, Inc.'s Quarterly Report on Form 10... -

Page 177

... Description of Benefits for Officers of United Continental Holdings, Inc., United Air Lines, Inc., and Continental Airlines, Inc. United Continental Holdings, Inc. Officer Travel Policy (filed as Exhibit 10.24 to UAL's Form 10-K for the year ended December 31, 2010, Commission file number 1-6033... -

Page 178

... 17, 2011 (previously named the Continental Airlines, Inc. Incentive Plan 2010) (filed as Exhibit 10.41 to UAL's Form 10-K for the year ended December 31, 2010, Commission file number 1-6033, and incorporated herein by reference) United Continental Holdings, Inc. Annual Incentive Program (adopted... -

Page 179

... Holdings, Inc. Long-Term Relative Performance Program (for use with respect to performance periods beginning on or after January 1, 2012) Description of Benefits for United Continental Holdings, Inc. Board of Directors (filed as Exhibit 10.46 to UAL's Form 10-K for the year ended December 31, 2010... -

Page 180

... Airlines, Inc. Long-Term Incentive and RSU Program (NLTIP Award under Incentive Plan 2000) (filed as Exhibit 10.16(b) to Continental's Form 10-K for the year ended December 31, 2005, Commission file number 1-10323, and incorporated herein by reference) Form of Non-Employee Director Option... -

Page 181

... Airlines, Inc. 2005 Pilot Supplemental Option Plan (filed as Exhibit 10.9 to Continental's Form 10-Q for the quarter ended March 31, 2005, Commission file number 1-10323, and incorporated herein by reference) United Air Lines, Inc. Management Cash Match Program effective April 1, 2010 Purchase... -

Page 182

... UAL United UAL United UAL United UAL United Letter Agreement No. 6-1162-ELP-0762 to Purchase Agreement No. 3427, dated February 19, 2010, by and among The Boeing Company and United Air Lines, Inc. (filed as Exhibit 10.7 to UAL's Form 10-Q for quarter ended March 31, 2010, Commission file number... -

Page 183

...'s Form 10-Q for quarter ended March 31, 2010, Commission file number 1-6033, and incorporated herein by reference) *^10.101 Letter Agreement No. 6-1162-NIW-2015 to Purchase Agreement No. 3427, dated February 19, 2010, by and among The Boeing Company and United Air Lines, Inc. (filed as Exhibit 10... -

Page 184

... UAL United UAL United UAL United UAL United UAL United Letter Agreement No. 3 to the Airbus A350-900XWB Purchase Agreement, dated March 5, 2010, by and among Airbus S.A.S and United Air Lines. Inc. (filed as Exhibit 10.30 to UAL's Form 10-Q for quarter ended March 31, 2010, Commission file number... -

Page 185

... UAL Continental UAL Continental UAL Continental UAL Continental Amendment No. 1 to the Airbus A350-900XWB Purchase Agreement, dated June 25, 2010, by and among Airbus S.A.S and United Air Lines, Inc. (filed as Exhibit 10.6 to UAL's Form 10-Q for quarter ended June 30, 2010, Commission file number... -

Page 186

...10-K for the year ended December 31, 1999, Commission file number 1-10323, and incorporated herein by reference) Supplemental Agreement No. 15, including side letters, to Purchase Agreement No. 1951, dated January 13, 2000 (filed as Exhibit 10.1 to Continental's Form 10-Q for the quarter ended March... -

Page 187

... for the quarter ended September 30, 2003, Commission file number 1-10323, and incorporated herein by reference) *^10.148 UAL Continental Supplemental Agreement No. 30 to Purchase Agreement No. 1951, dated November 4, 2003 (filed as Exhibit 10.23(ae) to Continental's Form 10-K for the year ended... -

Page 188

... Form 10-Q for the quarter ended September 30, 2006, Commission file number 1-10323, and incorporated herein by reference) Supplemental Agreement No. 40 to Purchase Agreement No. 1951, dated December 5, 2006 (filed as Exhibit 10.23(ao) to Continental's Form 10-K for the year ended December 31, 2006... -

Page 189

... 10-K for the year ended December 31, 2008, Commission file number 1-10323, and incorporated herein by reference) *^10.165 *^10.166 Supplemental Agreement No. 48 to Purchase Agreement No. 1951, dated January 29, 2009 (filed as Exhibit 10.3 to Continental's Form 10-Q for the quarter ended June 30... -

Page 190

... No. 57 to Purchase Agreement No. 1951, dated March 2, 2011 (filed as Exhibit 10.1 to UAL's and Continental Form 10-Q for the quarter ended March 31, 2011, Commission Numbers 1-6033 and 110323, and incorporated herein by reference) Aircraft General Terms Agreement, dated October 10, 1997, by... -

Page 191

... quarter ended March 31, 2006, Commission file number 1-10323, and incorporated herein by reference) Supplemental Agreement No. 13 to Purchase Agreement No. 2061, dated December 3, 2007 (filed as Exhibit 10.23(m) to Continental's Form 10-K for the year ended December 31, 2007, Commission file number... -

Page 192

... for the year ended December 31, 2009, Commission file number 1-10323, and incorporated herein by reference) *^10.195 *^10.196 *^10.197 Supplemental Agreement No. 19 to Purchase Agreement No. 2061, dated March 2, 2010 (filed as Exhibit 10.4 to Continental's Form 10-Q for the quarter ended March... -

Page 193

...the quarter ended June 30, 2003, Commission file number 1-10323, and incorporated herein by reference) List of Subsidiaries 21 UAL United Continental List of United Continental Holdings, Inc., United Air Lines, Inc. and Continental Airlines, Inc. Subsidiaries Consents of Experts and Counsel 23... -

Page 194

... each of United Continental Holdings, Inc.'s, United Air Lines, Inc.'s and Continental Airlines, Inc.'s Annual Reports on Form 10-K for the year ended December 31, 2011, formatted in XBRL (Extensible Business Reporting Language): (i) the Statements of Consolidated Operations, (ii) the Statements of... -

Page 195

... officers' headquarters location, as well as ORD and IAH (if applicable). Community Support Travel Program. Beginning in 2012, officers are able to nominate one or more qualified organizations to receive a donation of up to four domestic coach tickets (or two first class domestic tickets) each year... -

Page 196

... (the "Committee") of the Board of Directors of United Continental Holdings, Incd to implement in part the "RSU" and "Performance Compensation Award" provisions of the United Continental Holdings, Incd 2008 Incentive Compensation Plan, as amended from time to time; and WHEREAS , the Committee... -

Page 197

Exhibit 10.37 RESTRICTED SHARE AWARD NOTICE to [NAME] Pursuant to the United Continental Holdings, Inc. 2008 Incentive Compensation Plan Restricted Share Award Notice under the United Continental Holdings, Inc. 2008 Incentive Compensation Plan (the "Plan"), dated as of [Grant_Month] [Grant_Day], [... -

Page 198

... the date of this Award Notice, Restricted Shares may be evidenced in such manner as the Company may determine. If certificates representing Restricted Shares are registered in your name, such certificates must bear an appropriate legend referring to the terms, conditions and restrictions applicable... -

Page 199

...The delivery of Share certificates pursuant to Section 3(b) of this Award Notice and the delivery of Distributions is conditioned on satisfaction of any applicable withholding taxes in accordance with Section 10(d) of the Plan. The Company will withhold from the number of Restricted Shares otherwise... -

Page 200

...the payments and benefits provided under this Award Notice or the sale of Shares shall be subject to a clawback to the extent necessary to comply with applicable law including, without limitation, the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act or any Securities and... -

Page 201

... of the merser of the operations of United Air Lines, Inc ("United") and Continental Airlines, Inc ("Continental"). This Award constitutes an unfunded and unsecured promise of the Company to pay (or cause to be paid) to you, subject to the terms of this Asreement, a cash payment for each RSU as set... -

Page 202

... of the United and Continental reservation systems, which intesration may include achievement of a successful misration to a sinsle passenser service system allowins the Company to operate usins a sinsle carrier code, flisht schedule, inventory website and departure control system. Tranche... -

Page 203

...; fleet optimization that allows the Company to better match capacity with demand; the streamlinins of corporate overhead functions; the impact of movins to common information technolosy systems; the risht-sizins of facilities; and purchasins and other operational efficiencies. "Vestins Date... -

Page 204

... by the vestins percentase that applied on the prior Vestins Date. For example, if (A) durins calendar year 2012 a Vestins Date occurs that would result in 50% vestins under Chart 2 above, (B) durins calendar year 2012 a subsequent Vestins Date occurs that would result in 83-1/3% vestins under Chart... -

Page 205

...besinnins on the Effective Date and endins on the date of your Termination of Employment, and the denominator of which is the number of days in the entire Performance Period with respect to such Tranche. Notwithstandins the foresoins or the provisions of Section 3(b)(i), any payment to which you may... -

Page 206

... and short term investments and cash readily accessible under the Company's unused lines of credit as of the Vestins Date for such Tranche; provided, however, that any such reduction or elimination shall apply in a uniform and nondiscriminatory manner to all employees holdins restricted stock units... -

Page 207

...stock splits, stock dividends, reverse stock splits, special dividends or other similar matters relatins to Shares occurrins after the Effective Date). To the extent that any payment provided under this Award Notice..., sale, transfer or encumbrance shall be void and unenforceable asainst the Company, ... -

Page 208

... Withholdins and Consents . (a) Withholdins. The delivery of cash pursuant to Section 3(b) of this Award Notice is conditioned on satisfaction of any applicable withholdins taxes in accordance with Section 10(d) of the Plan, and the Company will withhold from any cash payment an amount equal to such... -

Page 209

...AWARD NOTICE to [Name] Pursuant to the United Continental Holdings, Inc. Performance-.ased RSU Program...Awhrd is [ , 20 ]. 2. Number of RSUs; The Gohl . The ...plus] [minus] Bhsis Poinos]; ii. Thrgeo Level ROIC is equhl oo Enory Level ROIC plus iii. Soreoch Level ROIC is equhl oo Thrgeo Level ROIC plus... -

Page 210

... following ohble [(sorhigho line inoerpolhoion will be used beoween levels)]: Level of ROIC Achieved Vested Percentage Enory Level ROIC Thrgeo Level ROIC Soreoch Level ROIC (or higher) % (Enory Level RSU Percenohge) % (Thrgeo Level RSU Percenohge) 100% (Soreoch Level RSU Percenohge) 4. Conoinuous... -

Page 211

7. Progrhm hnd ICP Conorol . Chpiohlized oerms used in ohis Awhrd Nooice hre defined in ohe Progrhm. The Progrhm hnd ohe ICP hre hereby incorporhoed inoo ohis Awhrd Nooice by reference. All sohoemenos ... -

Page 212

... Incd Annual Incentive Program (the "Program") has heretofore geen adopted gy the Compensation Committee (the "Committee") of the Board of Directors of United Continental Holdings, Incd to implement in part the Performance Award provisions of the United Continental Holdings, Incd Incentive Plan 2010... -

Page 213

... Company's unused lines of credit as of the end of such fiscal year; provided, however, that any such reduction or elimination shall apply in a uniform and nondiscriminatory manner to all Participants who are, gut for the application of this paragraph, entitled to receive an Annual Incentive Payment... -

Page 214

... Sections 5(c), 6 or 7 to the contrary, if a Participant's Annual Incentive Payment for a fiscal year is to ge prorated pursuant to the terms of the Program and if such Participant's Target Opportunity for such fiscal year changed during such fiscal year, then any such proration shall ge sugject to... -

Page 215

... Program (the "Program") has heretofore been adopted by the Compensation Committee (the "Committee") of the Board of Directors of United Continental Holdings, Incd to implement in part the Performance Award provisions of the United Continental Holdings, Incd Incentive Plan 2010, as amended from time... -

Page 216

..., may be expressed as a percentage of such Participant's base annual salary payable by the Company or a Subsidiary)d" 6d The words "Base Amount Multiple (if other than 100%)" shall be deleted from Section 3d1 of the Program and the term "Target Opportunity" shall be substituted thereford 7d... -

Page 217

...ANNUAL INCENTIVE AWARD NOTICE to [NAMEN Pursuant to the United Continental Holdings, Inc. Annual Incentive Program Fiscal Year 20[ N 1. The Progrhm . This documeno consoiouoes your formhl nooice (ohe " Nooice") of h Performhnce Awhrd under ohe Unioed Conoinenohl Holdings... Plhn 2010. The...level... -

Page 218

...Percentage of Target Opportunity Enory Level Pre-ohx Income Thrgeo Level Pre-ohx Income Soreoch Level...rehdily hccessible under ohe Comphny's unused lines of credio hs of ohe end of...2010 Conorol . Chpiohlized oerms used in ohis Nooice hre defined in ohe Progrhm. The Progrhm hnd ohe Incenoive Plhn 2010... -

Page 219

...LONG-TERM RELATIVE PERFORMANCE AWARD NOTICE to [Name] Pursuant to the United Continental Holdings, Inc. Long-Term Relative Performance Program... hnd soreoch levels hre hs ...Group (currenoly [ ]) for ohe Performhnce Period by hll such comphnies' cumulhoive Bhsis Poinos]; revenues over such period [[ plus... -

Page 220

... ohe Performhnce Period hnd you hhve remhined conoinuously employed by ohe Comphny or h subsidihry ohrough ohe... line inoerpolhoion will be used beoween levels)]: Level of Pre-tax Margin Achieved Payout Percentage ... Progrhm hnd Incenoive Plhn 2010 Conorol . Chpiohlized oerms used in ohis Awhrd Nooice... -

Page 221

...17) op the Internal Revenue Code ($245,000 in 2010). For purposes op this Program, the term "Management Employee" has the same meaning as depined in the 401(k) Plan. This means that all other employee groups participating in the 401(k) Plan, including all union-represented employees, are excluded... -

Page 222

UNITED AIR LINES, INC. MANAGEMENT CASH MATCH PROGRAM Effective January 1, 2008 3. Ip you cease employment during the calendar year (other than termination por cause), you are eligible por the annual Cash Match payment based upon your actual Earnings por the calendar year, and your payment will be ... -

Page 223

.... This Program is a Company policy and is not an employee benepit plan governed by the Employee Retirement Income Security Act op 1974 (ERISA). This Program shall be governed by the laws op the State op Illinois. Governing Law Company The term "Company" as used herein means United Air Lines, Inc... -

Page 224

... Star Insurance Company, Ltd. UAL Benefits Management, Inc. Bermuda Delaware Delaware Delaware Delaware Delaware Delaware Delaware Delaware Delaware Delaware United Air Lines, Inc. • Covia LLC** • Mileage Plus Holdings, LLC • MPH I, Inc. • Mileage Plus Marketing, Inc. • Mileage Plus... -

Page 225

*Subsidiabies of United Continental Holdings, Inc. abe wholly-owned unless othebwise indicated **Domicile nanagement Sebvices Inc. is 99.9% owned by Aib Wis Sebvices, Inc. and 0.1% owned by United Aib Lines, Inc. CAL Cabgo, S.A. de C.V. is 99.99% owned by Continental Aib Lines, Inc. and .01% owned ... -

Page 226

... of revenue and expenses in its statements of consolidated operations and an explanatory paragraph relating to a change in reportable segmentsm appearing in this Annual Report on Form 10-K of United Continental Holdings, Inc. for the year ended December 31, 2011. /s/ Deloitte & Touche LLP Chicago... -

Page 227

... Holdings, Inc. and the effectiveness of internal control over financial reporting of United Continental Holdings, Inc., included in this Annual Report (Form 10-K) of United Continental Holdings, Inc. for the year ended December 31, 2011. /s/ Ernst & Young LLP Chicago, IL February 22, 2012 -

Page 228

...-158781) of our report dated February 22, 2012, with respect to the consolidated financial statements and schedule of Continental Airlines, Inc., included in this Annual Report (Form 10-K) of Continental Airlines, Inc. for the year ended December 31, 2011. /s/ Ernst & Young LLP Chicago, IL February... -

Page 229

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Jeffery A. Smisek Jeffery A. Smisek President and Chief Executive Officer Date: February 22, 2012 -

Page 230

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Zane C. Rowe Zane C. Rowe Executive Vice President and Chief Financial Officer Date: February 22, 2012 -

Page 231

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Jeffery A. Smisek Jeffery A. Smisek Chairman, President and Chief Executive Officer Date: February 22, 2012 -

Page 232