US Airways 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323

|

|

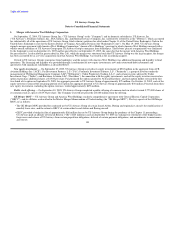

Table of Contents

consider the effects that an adverse change may have on the overall economy nor do they consider additional actions the Company may take to mitigate its

exposure to these changes. Actual results of changes in prices or rates may differ materially from the following hypothetical results.

Commodity Price Risk

Prices and availability of all petroleum products are subject to political, economic and market factors that are generally outside of the Company's control.

Accordingly, the price and availability of aviation fuel, as well as other petroleum products, can be unpredictable. Prices may be affected by many factors,

including:

• the impact of global political instability on crude production;

• unexpected changes to the availability of petroleum products due to disruptions in distribution systems or refineries as evidenced in the third quarter of

2005 when Hurricane Katrina and Hurricane Rita caused widespread disruption to oil production, refinery operations and pipeline capacity along

certain portions of the U.S. Gulf Coast. As a result of these disruptions, the price of jet fuel increased significantly and the availability of jet fuel

supplies was diminished;

• unpredicted increases to oil demand due to weather or the pace of economic growth;

• inventory levels of crude, refined products and natural gas; and

• other factors, such as the relative fluctuation between the U.S. dollar and other major currencies and influence of speculative positions on the futures

exchanges.

Because our operations are dependent upon aviation fuel, significant increases in aviation fuel costs materially and adversely affect the Company's

liquidity, results of operations and financial condition. Forecasted fuel consumption for the Company is approximately 1.57 billion gallons per year, and a one

cent per gallon increase in fuel price results in a $16 million annual increase in expense, excluding the impact of hedges.

As of December 31, 2005, the Company had entered into costless collar transactions, which establish an upper and lower limit on heating oil futures

prices. These transactions are in place with respect to approximately 20% of the Company's 2006 fuel requirements.

The use of such hedging transactions in the Company's fuel hedging program could result in the Company not fully benefiting from certain declines in

heating oil futures prices. Further, these instruments do not provide protection from the increases. The Company estimates that a 10% increase in price levels

of heating oil on December 31, 2005 would increase the fair value of the costless collar transactions by approximately $30 million. The Company estimates

that a 10% decrease in heating oil futures prices would decrease the fair value of the costless collar transactions by approximately $28 million.

As of February 28, 2006, approximately 34% of the Company's 2006 projected fuel requirements, respectively, are hedged. In January of 2006, the

Company diversified the instruments used in its hedge portfolio to include call options. Although call options require up-front premium payments, the

Company can fully participate in price decreases. As of February 28, 2006, the hedges held by the Company do not qualify for hedge accounting per

SFAS 133.

Interest Rate Risk

The Company's exposure to interest rate risk relates primarily to its cash equivalents and short-term investments portfolios and variable rate debt

obligations. At December 31, 2005, the Company's variable-rate long-term debt obligations of approximately $2.73 billion represented approximately 87% of

its total long-term debt. If interest rates increased 10% in 2006, the impact on the Company's results of operations

92