US Airways 2005 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

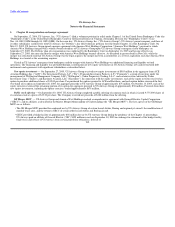

Notes to the Financial Statements — (Continued)

certain payment obligations, and amendments to maintenance agreements. The payment was funded through the issuance of 7% Senior Convertible

Notes due 2020, as discussed in more detail below.

• In June 2005, GECC purchased and immediately leased back to US Airways Group: (a) the assets securing the credit facility obtained from GE in 2001

(the "2001 GE Credit Facility") and the liquidity facility obtained from GE in 2003 in connection with US Airways Group's emergence from the first

bankruptcy (the "2003 GE Liquidity Facility"), and other GE obligations, consisting of 11 Airbus aircraft and 28 spare engines and engine stands; and

(b) ten regional jet aircraft previously debt financed by GECC. The proceeds from the sale leaseback transaction of approximately $633 million were

used to pay down balances due to GE by US Airways Group under the 2003 GE Liquidity Facility in full, the GECC mortgage-debt financed CRJ

aircraft in full, and a portion of the 2001 GE Credit Facility. The 2001 GE Credit Facility was amended to allow certain additional borrowings up to

$28 million.

Airbus MOU — In connection with the merger, a Memorandum of Understanding (the "Airbus MOU") was executed between AVSA S.A.R.L., an

affiliate of Airbus S.A.S. ("Airbus"), US Airways Group, US Airways and America West Airlines, Inc. ("AWA"). The key aspects of the Airbus MOU are as

follows:

• On September 27, 2005, US Airways and AWA entered into two loan agreements with Airbus Financial Services ("AFS"), as Initial Lender and

Loan Agent, Wells Fargo Bank Northwest, National Association, as Collateral Agent, and US Airways Group, as guarantor, with commitments in

initial aggregate amounts of up to $161 million and up to $89 million (the "Airbus $161 Million Loan" and the "Airbus $89 Million Loan" and,

collectively, the "Airbus Loans"). The Airbus Loans bear interest at a rate of LIBOR plus a margin, subject to adjustment. The outstanding principal

amount of the Airbus $89 Million Loan will be forgiven in writing on December 31, 2010, or an earlier date, if on that date the outstanding principal

amount of, accrued interest on, and all other amounts due under the Airbus $161 Million Loan have been paid in full.

• Airbus has rescheduled US Airways Group's A320-family and A330-200 delivery commitments and has agreed to provide backstop financing for a

substantial number of aircraft, subject to certain terms and conditions, on an order of 20 A350 aircraft. US Airways Group's A320-family aircraft are

now scheduled for delivery in 2009 and 2010. US Airways Group's A330-200 aircraft are scheduled for delivery in 2009 and 2010 and A350 aircraft

deliveries are currently scheduled to occur beginning in 2011. The Airbus MOU also eliminates cancellation penalties on US Airways Group's orders

for the ten A330-200 aircraft, provided that US Airways Group has met certain predelivery payment obligations under the A350 order. In connection

with the restructuring of aircraft firm orders, US Airways and America West Holdings were required to pay an aggregate non-refundable restructuring

fee which was paid by means of set-off against existing equipment purchase deposits of US Airways Group and America West Holdings held by

Airbus. US Airways recorded its restructuring fee of $39 million as a reorganization item in the third quarter of 2005. AWA's restructuring fee was

$50 million.

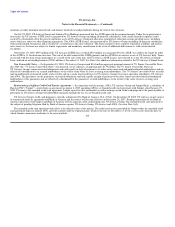

Restructuring of the ATSB Loan Guarantees — US Airways Group and America West Holdings each had loans outstanding guaranteed under the Air

Transportation Safety and System Stabilization Act by the Air Transportation Stabilization Board ("ATSB" and the loans, the "ATSB Loans"). In connection

with the September 12, 2004 Chapter 11 filing, the ATSB and the lenders under the US Airways ATSB Loan agreed to authorize US Airways to continue to

use cash collateral securing the US Airways ATSB Loan on an interim basis (the "Cash Collateral Agreement"). US Airways reached agreements with the

ATSB concerning interim extensions to the Cash Collateral Agreement, the last of which was extended to the earlier of the effective date of the plan of

reorganization or October 25, 2005. The Cash Collateral Agreement and subsequent extensions each required US Airways Group, among other conditions, to

213