US Airways 2005 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

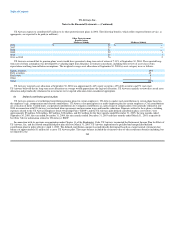

that was approved by the Bankruptcy Court in June 2005. In part, the GE Merger MOU modified and supplemented the agreements reached between

US Airways and GE in the GE Master MOU, which was further amended by an amendment dated September 9, 2005. The amendment provided that, in

lieu of the issuance to an affiliate of GE of a convertible note in the amount of $125 million, US Airways Group would pay cash in the amount of

$125 million. The $125 million was paid to GE before September 30, 2005.

The bridge facility entered into between US Airways and GE pursuant to the GE Master MOU on December 20, 2004 (the "GE Bridge Facility")

continued in effect during the pendency of the Chapter 11 cases. The GE Bridge Facility provided for a loan in the amount of up to approximately

$56 million, which was drawn down in 2004 and 2005. The GE Bridge Facility bore interest at the rate of LIBOR plus 4.25% and matured on the date

US Airways Group emerged from the Chapter 11 cases, and was settled in cash by US Airways by September 30, 2005 in connection with the

$125 million payment.

In June 2005, GE purchased the assets securing the GE Credit Facility in a sale-leaseback transaction. The sale proceeds realized from the sale-

leaseback transaction were applied to repay the 2003 GE Liquidity Facility, the mortgage financing associated with the CRJ aircraft and a portion of the

2001 GE Credit Facility. The balance of the GE Credit Facility was amended to allow additional borrowings of $21 million in July 2005, which resulted

in a total principal balance outstanding thereunder of $28 million. The operating leases are cross-defaulted with all other GE obligations, other than

excepted obligations, and are subject to agreed upon return conditions.

(e) On September 27, 2005, US Airways and AWA entered into two loan agreements with Airbus Financial Services ("AFS"), an affiliate of Airbus, with

commitments in initial aggregate amounts of up to $161 million and up to $89 million. The Airbus loans bear interest at a rate of LIBOR plus a margin,

subject to adjustment during the term of the loans under certain conditions and have been recorded as an obligation of US Airways Group. Amounts

drawn upon the Airbus loans are drawn first upon the Airbus $161 million loan until it has been drawn in its full amount, in which event the remaining

portion of the $250 million total commitment is drawn upon the Airbus $89 million loan.

On September 27, 2005, all of the Airbus $161 million loan and $14 million of the Airbus $89 million loan were drawn and are available for use for

general corporate purposes. At December 31, 2005, a total of $186 million was drawn under the Airbus loans. The remaining portion of the Airbus

loans is payable in multiple draws upon the occurrence of certain conditions, including the taking of delivery of certain aircraft, on the due dates for

certain amounts owing to AFS or its affiliates to refinance such amounts, after payment of certain invoices for goods and services provided by AFS or

its affiliates, or upon receipt by AFS of certain amounts payable in respect of existing aircraft financing transactions. The full amount of the Airbus

loans is expected to be available by the end of 2006. US Airways and AWA are jointly and severally liable for the Airbus loans; accordingly, the full

amount outstanding under the loans is reflected in financial statements of US Airways.

The amortization payments under the Airbus $161 million loan will become due in equal quarterly installments of $13 million beginning on March 31,

2008, with the final installment due on December 31, 2010. The outstanding principal amount of the Airbus $89 million loan will be forgiven in writing

December 31, 2010, or an earlier date, if on that date the outstanding principal amount of, accrued interest on, and all other amounts due under the

Airbus $161 million loan have been paid in full and US Airways and AWA comply with the aircraft delivery schedule.

(f) In connection with US Airways Group's emergence from bankruptcy in September 2005, it reached a settlement with the PBGC related to the

termination of three of its defined benefit pension plans which included the issuance of a $10 million note which matures in 2012 and bears interest at

6% payable annually in arrears. 238