US Airways 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

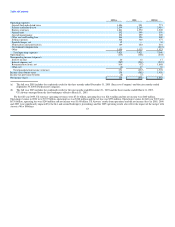

increased by $157 million during 2005 primarily due to an increase in cash reserves required under an agreement for processing AWA's Visa and MasterCard

credit card transactions. The 2004 period included purchases of property and equipment totaling $219 million, of which $139 million was expenditures for

capitalized maintenance. The 2004 period also included net sales of short-term investments and investments in debt securities totaling $205 million.

In 2005, net cash used in financing activities was $187 million, consisting principally of $183 million of debt repayments. This included principal

repayments of $94 million for the government guaranteed loan, the redemption of 10.75% senior unsecured notes totaling $40 million and the retirement of

$39 million of equipment notes payable as a result of the sale and leaseback transaction discussed above. In 2004 net cash used in financing activities was

$42 million for AWA, consisting principally of $176 million of debt repayments including principal repayments of $86 million for the government guaranteed

loan. In addition, AWA entered into a term loan financing with GECC resulting in proceeds of $111 million, approximately $77 million of which was used to

pay off the balance of the term loan with Mizuho Corporate Bank, Ltd. and certain other lenders. The 2004 period also includes $31 million of proceeds from

the issuance of senior secured discount notes, secured by AWA's leasehold interest in its Phoenix maintenance facility and flight training center.

Capital expenditures for 2005 were $37 million for AWA. This compares to $219 million of capital expenditures for 2004, which includes capital

expenditures for capitalized maintenance of approximately $139 million. The 2005 period does not include capital expenditures for capitalized maintenance,

as AWA changed its accounting policy from the deferral method to the direct expense method effective January 1, 2005. See note 3, "Change in Accounting

Policy for Maintenance Costs," in the notes to consolidated financial statements included in Item 8B of this report.

US Airways

As discussed in "Results of Operations," the financial statements prior to September 30, 2005 are not comparable with the financial statements for the

three months ended December 31, 2005. However for purposes of discussion of US Airways' sources and uses of cash, the full year 2005 has been compared

to the full year 2004 as included in the US Airways statements of cash flows.

As of December 31, 2005, US Airways' cash, cash equivalents, short-term investments and restricted cash were $1.17 billion, of which $594 million was

unrestricted. See "Emergence and Merger Transactions" above for discussion of additional financing and liquidity obtained, which was critical to US Airways

Group's emergence from bankruptcy and merger with America West Holdings.

Net cash used in operating activities was $421 million and $106 million in 2005 and 2004, respectively. Cash flows during 2005 were adversely affected

by higher interest expense and significant increases in fuel prices. Operating cash flows for 2005 included $125 million for reorganization items as compared

to $11 million for reorganization items in 2004.

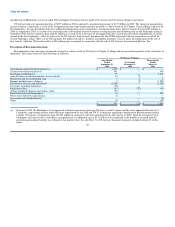

Net cash provided by (used in) investing activities was ($28) million and $102 million in 2005 and 2004, respectively. Investing activities in 2005

included net purchases of short-term investments totaling $132 million and purchases of property and equipment totaling $141 million. US Airways received

proceeds of $189 million from flight equipment and other asset sale transactions. Restricted cash decreased by $56 million in 2005 primarily due to release of

reserves related to tax trusts. The 2004 period included purchases of property and equipment totaling $198 million and an increase in restricted cash of

$76 million. The 2004 period also included net sales of short-term investments totaling $358 million and proceeds of $18 million from asset sales.

Net cash provided by (used in) financing activities was $177 million and ($185) million in 2005 and 2004, respectively. Principal financing activities in

2005 included proceeds from flight equipment asset sale leaseback transactions of $561 million and proceeds from the issuance of debt of $265 million. The

2005 debt issuance proceeds included $125 million of debtor-in-possession financing that converted into shares of common stock in US Airways Group upon

emergence from bankruptcy. Debt repayments totaled 72