US Airways 2005 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

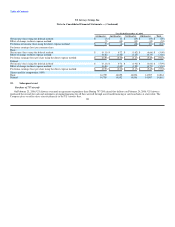

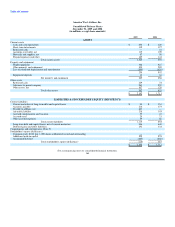

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

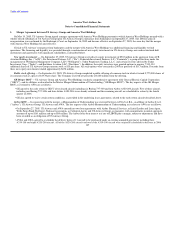

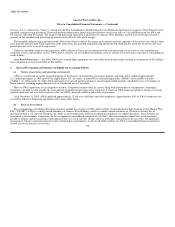

with the last A319-100 to be delivered in the first quarter of 2007. As rescheduled, these aircraft will be from March through December 2009.

• In connection with the restructuring of aircraft firm orders, US Airways Group and America West Holdings were required to pay an aggregate non-

refundable restructuring fee which was paid by means of set-off against existing equipment purchase deposits of US Airways Group and America West

Holdings held by Airbus. The America West Holdings restructuring fee of $50 million has been recorded as a special charge in the accompanying

consolidated statement of operations, along with $7 million in related capitalized interest.

Restructuring of the ATSB Loan Guarantees — US Airways Group and America West Holdings each had loans outstanding guaranteed under the Air

Transportation Safety and System Stabilization Act by the Air Transportation Stabilization Board ("ATSB" and the loans, the "ATSB Loans").

On July 22, 2005, US Airways Group and America West Holdings announced that the ATSB approved the proposed merger. Under the negotiated new

loan terms, the US Airways ATSB Loan is guaranteed by US Airways Group (including all domestic subsidiaries, with certain limited exceptions) and is

secured by substantially all of the present and future assets of US Airways Group not otherwise encumbered, other than certain specified assets, including

assets which are subject to other financing agreements. The AWA ATSB Loan is also guaranteed by US Airways Group (including all domestic subsidiaries,

with certain limited exceptions) and is secured by a second lien in the same collateral. The loans continue to have separate repayment schedules and interest

rates; however, the loans are subject to similar repayments and mandatory amortization in the event of additional debt issuances, with certain limited

exceptions.

On October 19, 2005, $238 million of AWA's ATSB Loan, of which $228 million was guaranteed by the ATSB, was sold by the lender by order of the

ATSB to 13 fixed income investors. The sale of the debt removed the ATSB guarantee. Due to the sale on October 19, 2005, the ATSB no longer guarantees

any portion of the loan and has no interest in any of AWA's debt. Terms associated with this loan remain unchanged. As a result of the sale of the loan, the

AWA ATSB Loan is now referred to as the AWA Citibank Loan, and had an outstanding balance of $250 million at December 31, 2005. See Note 8 for

additional information related to the AWA Citibank Loan.

New Convertible Notes — On September 30, 2005, US Airways Group issued $144 million aggregate principal amount of 7% Senior Convertible Notes

due 2020 (the "7% Senior Convertible Notes") for proceeds, net of expenses, of approximately $139 million. The 7% Senior Convertible Notes are

US Airways Group's senior unsecured obligations and rank equally in right of payment to its other senior unsecured and unsubordinated indebtedness and are

effectively subordinated to its secured indebtedness to the extent of the value of assets securing such indebtedness. The 7% Senior Convertible Notes are fully

and unconditionally guaranteed, jointly and severally and on a senior unsecured basis, by US Airways Group's two major operating subsidiaries, US Airways

and AWA. The guarantees are the guarantors' unsecured obligations and rank equally in right of payment to the other senior unsecured and unsubordinated

indebtedness of the guarantors and are effectively subordinated to the guarantors' secured indebtedness to the extent of the value of assets securing such

indebtedness.

Restructuring of Affinity Credit Card Partner Agreement — In connection with the merger, AWA, US Airways Group and Juniper Bank, a subsidiary of

Barclays PLC ("Juniper"), entered into an agreement on August 8, 2005 amending AWA's co-branded credit card agreement with Juniper, dated January 25,

2005. Pursuant to the amended credit card agreement, Juniper agreed to offer and market an airline mileage award credit card program to the general public to

participate in US Airways Group's Dividend Miles program through the use of a co-branded credit card.

168