US Airways 2005 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

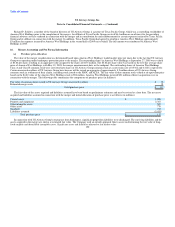

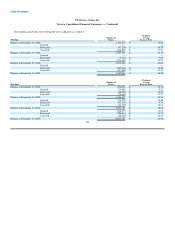

the ATSB and additional warrants to purchase 3.8 million shares of its Class B common stock to other loan participants, in each case at an exercise price of

$3 per share and a term of ten years. For accounting purposes, the warrants were valued at $35.4 million, or $1.57 per share, using the Black-Scholes pricing

model with the following assumptions: expected dividend yield of 0.0%, risk-free interest rate of 4.8%, volatility of 44.9% and an expected life of ten years.

The warrants were recorded by AWA as a non-cash capital contribution in the accompanying consolidated statements of stockholder's equity and

comprehensive income and classified as other assets, net in the accompanying consolidated balance sheets. The warrants will be amortized over the life of the

AWA ATSB Loan as an increase to interest expense. In the first quarter of 2004, approximately 220,000 warrants were exercised at $3 per share. In the third

quarter of 2003, approximately 2.6 million warrants were exercised at $3 per share. These warrant exercises were cashless transactions resulting in the

issuance of approximately 1.6 million shares of America West Holdings' Class B common stock.

In the fourth quarter of 2005, US Airways Group announced an agreement to repurchase all of the replacement warrants issued to the ATSB in connection

with the merger with America West Holdings. US Airways Group repurchased approximately 7.7 million warrants to purchase shares of common stock that

had an exercise price of $7.27 per share. The total purchase price for the warrants was $116 million, which approximated their fair value at the purchase date.

In connection with this repurchase, AWA recorded $8 million of nonoperating expense. This amount represented the unamortized balance recorded as an

other asset, which was being amortized over the life of the AWA ATSB Loan as an increase to interest expense.

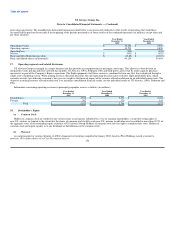

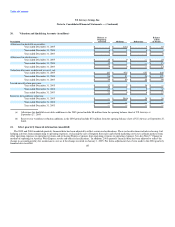

19. Stock options and awards

At the effective time of the merger all outstanding options to purchase America West Holdings Class B common stock under America West Holdings'

stock-based benefit plans and under individual employment agreements were converted into options to acquire US Airways Group common stock in

accordance with the merger agreement. At the effective time of the merger, options were outstanding under America West Holding's 1994 Incentive Equity

Plan (the "1994 Incentive Plan") and 2002 Incentive Equity Plan (the "2002 Incentive Plan"). Pursuant to those plans, these options outstanding became fully

vested.

In connection with the merger, each outstanding America West Holdings stock option was converted into an option to purchase the number of shares of

US Airways Group common stock that is equal to the product of the number of shares of America West Holdings Class B common stock that could have been

purchased before the merger upon the exercise of the option multiplied by 0.4125 and rounded up to the nearest whole share. The exercise price per share of

US Airways Group common stock for the converted option is equal to the exercise price per share of America West Holdings Class B common stock subject

to the option before the conversion divided by 0.4125 and rounded down to the nearest whole cent. The other terms of each America West Holdings stock

option applicable before the conversion continue to apply to the converted option after the conversion. Except as specifically provided above and to the extent

the terms, conditions and restrictions may be altered in accordance with their terms as a result of the merger, following the effective time of the merger, each

America West Holdings stock option is governed by the same terms and conditions as were applicable under that America West Holdings stock option

immediately prior to the effective time of the merger, including its vesting schedule and expiration date.

As part of the plan of reorganization, the Bankruptcy Court approved a new equity incentive plan, referred to as the 2005 Incentive Equity Plan (the "2005

Incentive Plan"). The 2005 Incentive Plan provides for the grant of incentive stock options, nonstatutory stock options, stock appreciation rights, stock

purchase awards, stock bonus awards, stock unit awards, and other forms of equity compensation, collectively referred to as stock awards, as well as

performance-based cash awards. Incentive stock options 153