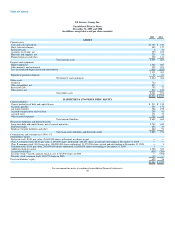

US Airways 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

price per share due to the fact that US Airways Group was operating under bankruptcy protection. The $4.82 per share value was based on the five-day

average share price of America West Holdings, with May 19, 2005, the merger announcement date, as the midpoint. US Airways' equity value of $1 million

was determined based on an allocation of the purchase price to each of US Airways Group subsidiaries' fair values of assets and liabilities. The remaining

equity of $116 million was assigned to US Airways Group and its other subsidiaries. US Airways has engaged an outside appraisal firm to assist in

determining the fair value of the long-lived tangible and identifiable intangible assets and certain noncurrent liabilities. The foregoing estimates and

assumptions are inherently subject to significant uncertainties and contingencies beyond the control of US Airways. Accordingly, we cannot assure you that

the estimates, assumptions, and values reflected in the valuations will be realized, and actual results could vary materially. In accordance with SFAS 141, the

preliminary allocation of the equity values is subject to additional adjustment within one year after emergence from bankruptcy when additional information

on asset and liability valuations becomes available. US Airways expects that adjustment to recorded fair values may include those relating to:

• Long-lived tangible and identifiable intangible assets, and certain noncurrent liabilities, all of which may change based on the consideration of

additional analysis by US Airways and its valuation consultants;

• Accrued expenses that may change based on identification of final fees and costs associated with emergence from bankruptcy, resolution of disputed

claims and completion of the bankruptcy proceedings relating to the Debtors; and

• Tax liabilities, which may be adjusted based upon additional information to be received from taxing authorities.

See note 3(b) to the US Airways financial statements in Item 8C of this Form 10-K for further detail related to the fresh-start fair-value and purchase

accounting adjustments.

Deferred tax asset valuation allowance

US Airways Group, AWA and US Airways have each recorded a full valuation allowance against their net deferred tax assets. In assessing the

realizability of the deferred tax assets, we considered whether it was more likely than not that all or a portion of the deferred tax assets will not be realized, in

accordance with SFAS No. 109, "Accounting for Income Taxes." The Company expects to continue to record a full valuation allowance on any future tax

benefits until we have achieved several quarters of consecutive profitable results coupled with an expectation of continued profitability.

Pensions and other postretirement benefits

Prior to the merger, America West Holdings had no obligations for defined benefit or other postretirement benefit plans. As a result of the merger, the

Company had defined benefit plans with benefit obligations of $60 million and plan assets valued at $37 million and other postretirement benefit obligations

of $234 million as of December 31, 2005.

The obligations for our pension plans and postretirement benefit obligations are calculated based on several long-term assumptions, including discount

rates for employee benefit liabilities, rate of return on plan assets, expected annual rates for salary increases for employee participants in the case of pension

plans and expected annual increases in the cost of medical and other health care costs in the case of other postretirement benefit obligations. These long-term

assumptions are subject to revision based on changes in interest rates, financial market conditions, expected versus actual return on plan assets, participant

mortality rates and other actuarial assumptions, including future rates of salary increases, benefit formulas and levels, and rates of increase in the costs of

benefits. Changes in assumptions, if significant, can materially affect the amount of annual net periodic benefit costs recognized in our results of operations

from one year to the next, the liabilities for the pension plans and postretirement benefit plans.

89