US Airways 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

reporting of a change in accounting principle. SFAS 154 requires retrospective application to prior periods' financial statements of a voluntary change in

accounting principle unless it is impracticable. APB Opinion 20 previously required that most voluntary changes in accounting principle be recognized by

including in net income of the period of the change the cumulative effect of changing to the new accounting principle. The provisions in SFAS 154 are

effective for accounting changes and correction of errors made in fiscal years beginning after December 15, 2005. The adoption of SFAS 154 is not expected

to have a material effect on the results of operations of the Company.

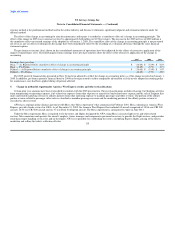

3. New equity structure and conversion

Pursuant to US Airways Group's plan of reorganization, all securities of US Airways Group outstanding prior to September 27, 2005 were cancelled upon

emergence from Chapter 11. In connection with the merger, US Airways Group adopted an Amended and Restated Certificate of Incorporation and Amended

and Restated Bylaws effective September 27, 2005. US Airways Group's authorized capital stock, following the merger, consists of 200 million shares of

common stock, par value $0.01 per share. Holders of new US Airways Group common stock are entitled to one vote per share on all matters submitted to a

vote of common shareholders, except that voting rights of non-U.S. citizens are limited to the extent that the shares of common stock held by such

non-U.S. persons would otherwise be entitled to more than 24.9% of the aggregate votes of all outstanding equity securities of US Airways Group.

In the merger, holders of America West Holdings Class A common stock received 0.5362 of a share of new US Airways Group common stock for each

share of America West Holdings Class A common stock they owned, and holders of America West Holdings Class B common stock received 0.4125 of a

share of new US Airways Group common stock for each share of America West Holdings Class B common stock they owned, according to the terms

specified in the merger agreement.

As noted in Note 1 above, the new equity investors acquired an aggregate of approximately 44 million shares of common stock, including the shares

acquired upon exercise of their options. In connection with these new equity investments, the new equity investors entered into stockholders agreements that

prohibit the equity investors' sale of US Airways Group common stock for a period of six months following the closing date of the investment. Under the

terms of the Pension Benefit Guaranty Corporation ("PBGC") settlement agreement, shares issued to the PBGC in connection with the reorganization could

not be sold, assigned, transferred or pledged prior to five months after the merger effective date.

Upon expiration of each tranche of the investor options, US Airways Group was required to make an additional offer to Eastshore, in an amount equal to

one-third of the proceeds received from exercise of the options, to repurchase shares of common stock held by Eastshore at a purchase price of $15.00 per

share. Eastshore had the right, but not the obligation, to accept that offer to repurchase in whole or in part for a period of at least 30 days after the receipt of

the offer. On October 4, 2005, the Company made the offer in connection with the first expiration date, and on November 3, 2005 the offer expired. On

November 8, 2005, the Company made the offer to Eastshore in connection with the second expiration date and on December 8, 2005 the offer expired.

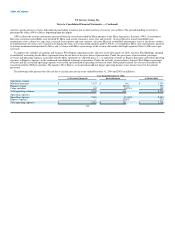

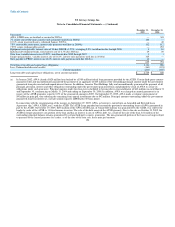

4. Change in accounting policy for maintenance costs

AWA historically recorded the cost of major scheduled airframe, engine and certain component overhauls as capitalized assets that were subsequently

amortized over the periods benefited (referred to as the deferral method). US Airways Group charges maintenance and repair costs for owned and leased flight

equipment to operating expense as incurred (direct expense method). During the fourth quarter of 2005, AWA changed its accounting policy from the deferral

method to the direct expense method. While the deferral method is permitted under accounting principles generally accepted in the United States of America,

US Airways Group believes that the direct expense method is preferable because the direct

114