US Airways 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

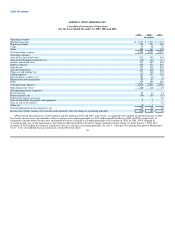

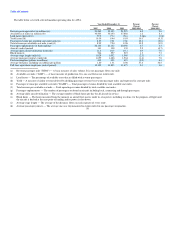

US Airways Group's Results of Operations

For 2005, US Airways Group's operating revenues were $5.1 billion, operating loss was $217 million and loss per common share before cumulative effect

of a change in accounting principle was $10.65 on a loss of $335 million. In 2005, America West Holdings retroactively changed its accounting policy for

certain maintenance costs from the deferral method to the direct expense method as if that change occurred January 1, 2005. This resulted in a $202 million

loss from the cumulative effect of a change in accounting principle, or $6.41 per common share. See note 4, "Change in Accounting Principle for Maintenance

Costs," to the consolidated financial statements in Item 8A of this report. For 2004, operating revenues were $2.7 billion, operating loss was $20 million and

loss per common share was $5.99 on a net loss of $89 million. For 2003, US Airways Group's operating revenues were $2.6 billion, operating income was

$33 million and diluted earnings per common share was $3.07 on net income of $57 million. As noted above, the 2005 statement of operations presented

includes the results of America West Holdings for the 269 days through September 27, 2005, the effective date of the merger, and the consolidated results of

US Airways Group and its subsidiaries, including US Airways, America West Holdings and AWA, for the 96 days from September 27, 2005 to December 31,

2005. The table below shows the consolidated results of the 96 days of US Airways Group and the operating results of America West Holdings for the

269 days ended September 27, 2005 (in millions):

2005 2004 2003

Consolidated 96 Days

US Airways US Airways America West America West America West

Group Group, Inc. Holdings Holdings Holdings

Operating revenues $ 5,077 $ 1,822 $ 3,255 $ 2,748 $ 2,572

Operating expenses 5,294 1,914 3,380 2,768 2,539

Operating income (loss) (217) (92) (125) (20) 33

Nonoperating income (expense), net (118) (44) (74) (69) 24

Income (loss) before cumulative effect of a change in accounting principle $ (335) $ (136) $ (199) $ (89) $ 57

For 2004 and 2003, the consolidated statements of operations for US Airways Group reflect only the results of America West Holdings.

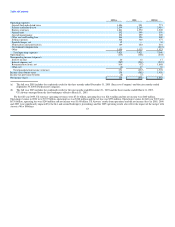

The 2005 results included $75 million of net gains associated with AWA's fuel hedging transactions. This includes $71 million of net realized gains on

settled hedge transactions and $4 million of unrealized gains resulting from the application of mark-to-market accounting for changes in the fair value of fuel

hedging instruments. AWA is required to use mark-to-market accounting as its fuel hedging instruments do not meet the requirements for hedge accounting as

established by Statement of Financial Accounting Standards No. 133, "Accounting for Derivative Instruments and Hedging Activities." If these instruments

had qualified for hedge accounting treatment, any unrealized gains or losses, including the $4 million discussed above, would be deferred in other

comprehensive income, a subset of stockholders' equity, until the jet fuel is purchased and the underlying fuel hedging instrument is settled. Given the market

volatility of jet fuel, the fair value of these fuel hedging instruments is expected to change until settled.

The 2005 results include $121 million of special charges including $28 million of merger related transition expenses, a $27 million loss on the sale and

leaseback of six 737-300 aircraft and two 757 aircraft, $7 million of power by the hour program penalties associated with the return of certain leased aircraft

and a $50 million charge related to the amended Airbus purchase agreement, along with $7 million in capitalized interest. The restructuring fee was paid by

means of set-off against existing equipment purchase deposits held by Airbus. The 2005 results also included nonoperating expenses of $8 million related to

the write-off of the unamortized value of the ATSB warrants upon their repurchase in October 2005 and an aggregate $2 million write-off of debt issue costs

associated with the exchange of the 54