US Airways 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

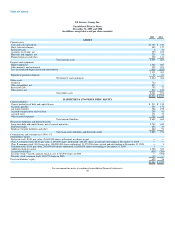

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

maintain a weekly minimum unrestricted cash balance which decreased periodically during the term of the extension.

On July 22, 2005, US Airways Group and America West Holdings announced that the ATSB approved the proposed merger. Under the negotiated new

loan terms, the US Airways ATSB Loan is guaranteed by US Airways Group (including all domestic subsidiaries, with certain limited exceptions) and is

secured by substantially all of the present and future assets of US Airways Group not otherwise encumbered, other than certain specified assets, including

assets which are subject to other financing agreements. The AWA ATSB Loan is also guaranteed by US Airways Group (including all domestic subsidiaries,

with certain limited exceptions) and is secured by a second lien in the same collateral. The loans continue to have separate repayment schedules and interest

rates; however, the loans are subject to similar repayments and mandatory amortization in the event of additional debt issuances, with certain limited

exceptions.

On October 19, 2005, $777 million in the aggregate of the US Airways ATSB Loan and the AWA ATSB Loan, of which $752 million was guaranteed by

the ATSB, was sold by the lender by order of the ATSB to 13 fixed income investors. The sale of the debt removed the ATSB guaranty and the ATSB has no

interest in any of the Company's debt. Terms associated with the loans remain unchanged. As a result of the sale of the loan, the US Airways ATSB Loan is

now referred to as the US Airways Citibank Loan and the AWA ATSB Loan is now referred to as the AWA Citibank Loan. The two loans had outstanding

balances of $551 million and $250 million, respectively, at December 31, 2005. See Note 9 for additional information related to the Citibank Loans.

New Convertible Notes — On September 30, 2005, US Airways Group issued $144 million aggregate principal amount of 7% Senior Convertible Notes

due 2020 (the "7% Senior Convertible Notes") for proceeds, net of expenses, of approximately $139 million. The 7% Senior Convertible Notes are

US Airways Group's senior unsecured obligations and rank equally in right of payment to its other senior unsecured and unsubordinated indebtedness and are

effectively subordinated to its secured indebtedness to the extent of the value of assets securing such indebtedness. The 7% Senior Convertible Notes are fully

and unconditionally guaranteed, jointly and severally and on a senior unsecured basis, by US Airways Group's two major operating subsidiaries, US Airways

and AWA. The guarantees are the guarantors' unsecured obligations and rank equally in right of payment to the other senior unsecured and unsubordinated

indebtedness of the guarantors and are effectively subordinated to the guarantors' secured indebtedness to the extent of the value of assets securing such

indebtedness.

Restructuring of Affinity Credit Card Partner Agreement — In connection with the merger, AWA, US Airways Group and Juniper Bank, a subsidiary of

Barclays PLC ("Juniper"), entered into an agreement on August 8, 2005 amending AWA's co-branded credit card agreement with Juniper, dated January 25,

2005. Pursuant to the amended credit card agreement, Juniper agreed to offer and market an airline mileage award credit card program to the general public to

participate in US Airways Group's Dividend Miles program through the use of a co-branded credit card.

US Airways Group's credit card program is currently administered by Bank of America, N.A. (USA). On December 28, 2005, US Airways issued a notice

of termination under its agreement with Bank of America and that notice will become effective on December 28, 2007. Pending termination of the Bank of

America agreement, both Juniper and Bank of America will run separate credit card programs for US Airways Group. The amended credit card agreement is

the subject of pending litigation filed by Bank of America against US Airways Group, US Airways and AWA. (See also Note 12(d)).

The amended credit card agreement took effect at the effective time of the merger. The credit card services provided by Juniper under the amended credit

card agreement began in January 2006, and will 103