US Airways 2005 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323

|

|

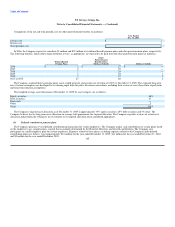

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

bear interest at a rate per annum equal to LIBOR plus 840 basis points increasing by 5 basis points on January 18 of each year, beginning January 18,

2006 through the end of the loan term, payable on a quarterly basis. All other terms associated with this loan remain unchanged. As a result of the sale

of the loan, the AWA ATSB Loan is now referred to as the AWA Citibank Loan, and had an outstanding balance of $250 million at December 31,

2005.

The AWA Citibank Loan is now secured debt. It requires certain prepayments from the proceeds of specified asset sales by US Airways Group and the

other loan parties, and US Airways Group is required to maintain consolidated unrestricted cash and cash equivalents, less: (a) the amount of all

outstanding advances by credit card processors and clearing houses in excess of 20% of the air traffic liabilities; (b) $250 million presumed necessary to

fund a subsequent tax trust (to the extent not otherwise funded by US Airways Group); (c) $35 million presumed necessary to post collateral to clearing

houses (to the extent not posted); and (d) any unrestricted cash or cash equivalents held in unperfected accounts; in an amount (subject to partial

reduction under certain circumstances upon mandatory prepayments made with the net proceeds of future borrowings and issuances of capital stock) not

less than:

• $525 million from September 27, 2005 through March 2006;

• $500 million through September 2006;

• $475 million through March 2007;

• $450 million through September 2007;

• $400 million through March 2008;

• $350 million through September 2008; and

• $300 million through September 2010.

(b) On September 10, 2004, AWA entered into a term loan financing with GECC providing for loans in an aggregate amount of $111 million. AWA used

approximately $77 million of the proceeds from this financing to repay in full its term loan with Mizuho Corporate Bank, Ltd. and certain other lenders

and to pay certain costs associated with this transaction. AWA used the remaining proceeds for general corporate purposes. The new term loan

financing consists of two secured term loan facilities: a $76 million term loan facility secured primarily by spare parts, rotables and appliances (the

"Spare Parts Facility"); and a $35 million term loan facility secured primarily by aircraft engines and parts installed in such engines (the "Engine

Facility").

The facilities are cross-collateralized on a subordinated basis, and the collateral securing the facilities also secures on a subordinated basis certain of

AWA's other existing debt and lease obligations to GECC and its affiliates.

The loans under the Spare Parts Facility are payable in full at maturity on September 10, 2010. The loans under the Engine Facility are payable in equal

quarterly installments of approximately $1 million beginning on March 10, 2006 through June 10, 2010, with the remaining loan amount of $12 million

payable at maturity on September 10, 2010. The loans under each facility may be prepaid in an amount not less than $5 million at any time after the

30th monthly anniversary of the funding date under such facility. If AWA fails to maintain a certain ratio of rotables to loans under the Spare Parts

Facility, it may be required to pledge additional rotables or cash as collateral, provide a letter of credit or prepay some or all of the loans under the Spare

Parts Facility. In addition, the loans under the Engine Facility are subject to mandatory prepayment upon the occurrence of certain events of loss

applicable to, or certain dispositions of, aircraft engines securing the facility. Principal amounts outstanding under the loans bear interest at a rate per

annum based on three-month LIBOR plus a 125