US Airways 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

international services has been started and/or announced by U.S. carriers. New international capacity is being added in transoceanic markets, as well as to

points in Latin America and the Caribbean.

Regional jets continue to play a large and growing role within the U.S. airline industry. The more recent trend, however, is toward larger 70- and 90-plus

seat regional jets rather than the 50-seat and smaller jets that had dominated the marketplace in prior years. As carriers use the bankruptcy laws to restructure

and reduce their mainline fleets, replacement aircraft frequently are larger regional aircraft.

Fares remained at or near historically low levels, although the rising cost of fuel did lead to increased fares toward the latter part of 2005. Whether demand

can remain at historically high levels in the face of rising fares is unclear, but as domestic capacity continues to rationalize through fleet reductions and the

redeployment of aircraft to international markets, the likelihood of further fare restructurings such as Delta Air Lines' Simplifare program, a pricing scheme

introduced in January 2005 that generally lowered fares significantly and reduced restrictions on discount fares, seems to be diminishing.

Finally, the differences between low-cost carriers and traditional legacy carriers is blurring. Traditional carriers are restructuring with lower cost

structures, greater labor flexibility, and new and innovative products and thinking much like low-cost carriers, while still maintaining vast route networks,

alliances, and generous frequent flyer benefits. Low-cost carriers are adding amenities to their offerings, including state-of-the-art inflight entertainment, co-

branded credit cards, international service and more generous frequent flyer programs that were traditionally the exclusive province of the legacy carriers.

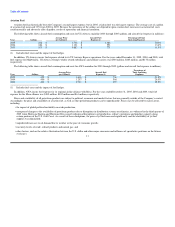

Airline Operations

Prior to the merger, AWA operated its route system through a hub-and-spoke network centered in its Phoenix and Las Vegas hubs. US Airways' major

connecting hubs prior to the merger were at airports in Charlotte and Philadelphia. US Airways also had substantial operations at Logan International Airport

("Logan Airport"), LaGuardia, Pittsburgh International Airport, and Reagan National. Following the merger, the combined company has primary hubs in

Charlotte, Philadelphia and Phoenix and secondary hubs/focus cities in Pittsburgh, Las Vegas, New York, Washington, D.C. and Boston. In 2005, both AWA

and US Airways made significant strides in right-sizing their respective fleets for the overall benefit of the combined airline. Despite the return of 55 aircraft

in 2005, both carriers were able to increase service in certain markets. In 2005, AWA launched Phoenix-Honolulu and Phoenix-Maui service with extended

over-water equipped Boeing 757 Aircraft. Additional Hawaii service is planned from Phoenix and Las Vegas in 2006. AWA also started new service from

Phoenix to Oklahoma City. The largest service expansion by AWA was from Las Vegas, where service to seven new markets was started in 2005.

US Airways added new seasonal transatlantic service to Barcelona and Venice in May 2005, and revamped its Philadelphia hub operations to improve

connectivity. US Airways also added 15 70-seat regional jets to its operation. After the merger, the combined airline began redeploying certain regional jet

capacity from the western United States to Charlotte to take advantage of market opportunities. For 2006, further fleet efficiencies are being realized and

implemented. In February 2006, US Airways announced new service from Philadelphia to Stockholm, Sweden, Milan, Italy and Lisbon, Portugal. These

services were made possible by the acquisition of additional Boeing 757 aircraft.

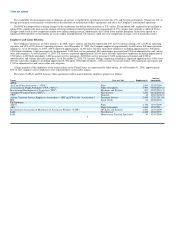

Express Operations

US Airways Express Network

Certain air carriers have code share arrangements with US Airways to operate under the trade name "US Airways Express." Typically, under a code share

arrangement, one air carrier places its designator code and sells tickets on the flights of another air carrier, which is referred to generically as its code share

partner. US Airways Express carriers are an integral component of US Airways Group's operating network. US Airways relies heavily on feeder traffic from

its US Airways Express partners, who carry passengers from low-density markets that are uneconomical for US Airways to serve with large jets to

US Airways' hubs. As of December 2005, the US Airways Express network served 130 airports in the continental

3